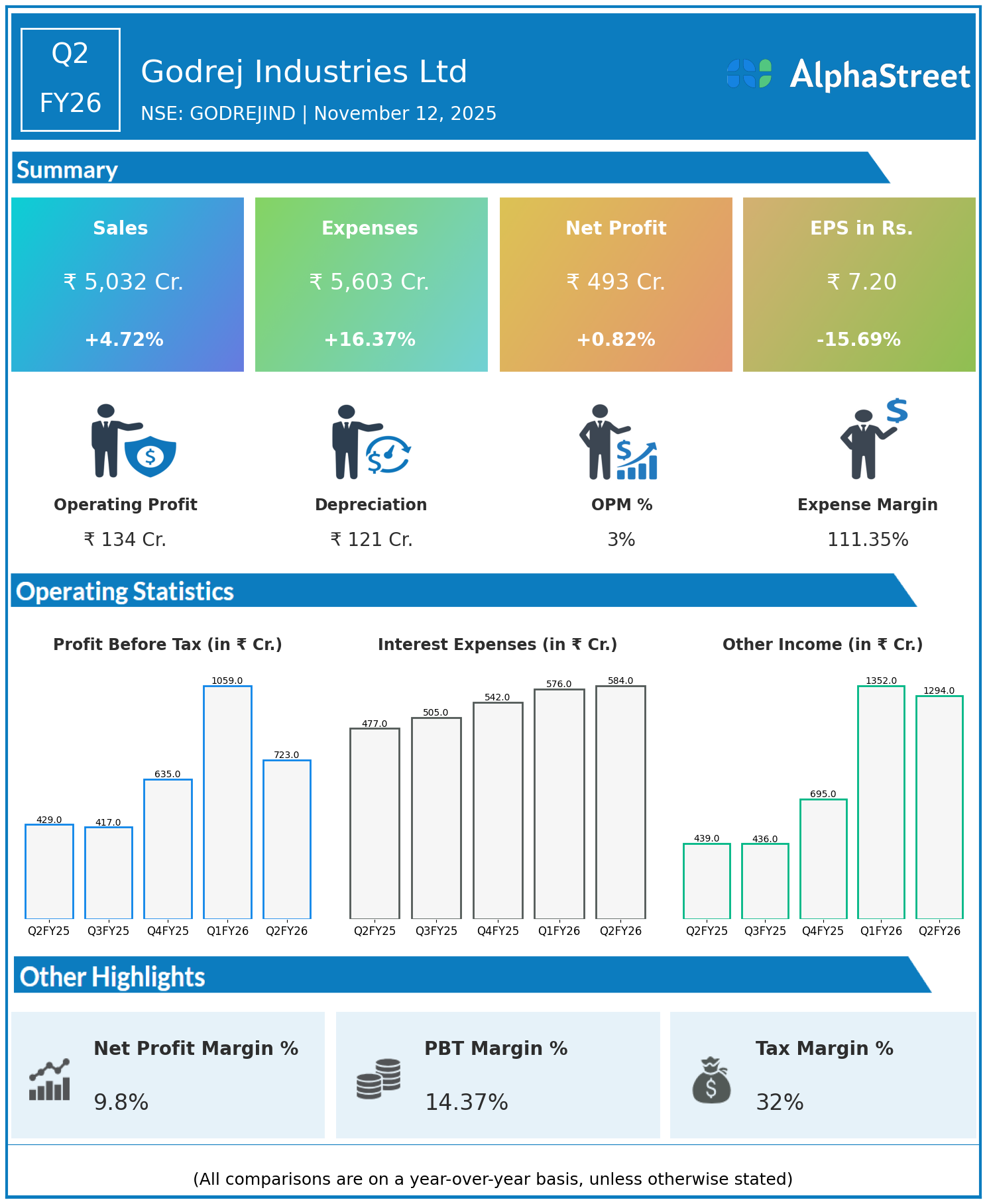

Godrej Industries Ltd, a key holding company of Godrej Group and a leading manufacturer of oleochemicals, reported mixed financial results for Q2FY26.

Financial Highlights:

- Revenues increased 4.72% year-on-year to ₹5,032 crore from ₹4,805 crore.

- Total expenses grew significantly by 16.37% to ₹5,603 crore from ₹4,815 crore.

- Consolidated net profit edged up slightly 0.82% to ₹493 crore from ₹489 crore.

- Earnings per share declined 15.69% to ₹7.20 from ₹8.54.

The modest profit growth was tempered by a sharp rise in expenses, reflecting higher input costs and operational challenges. The decline in earnings per share is attributed to increased share capital or other financial factors.

Outlook:

Godrej Industries is focusing on cost controls, operational efficiencies, and product portfolio optimization to improve profitability in a competitive market environment. Strategic initiatives are aimed at sustaining growth and shareholder returns.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel.