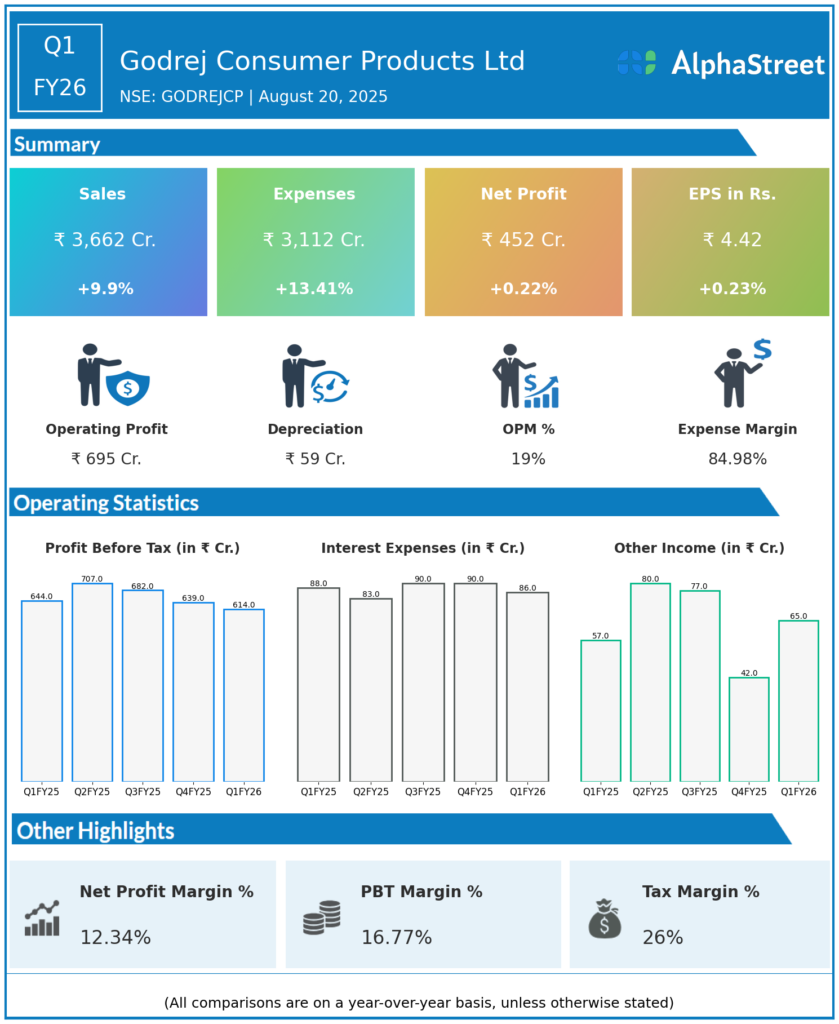

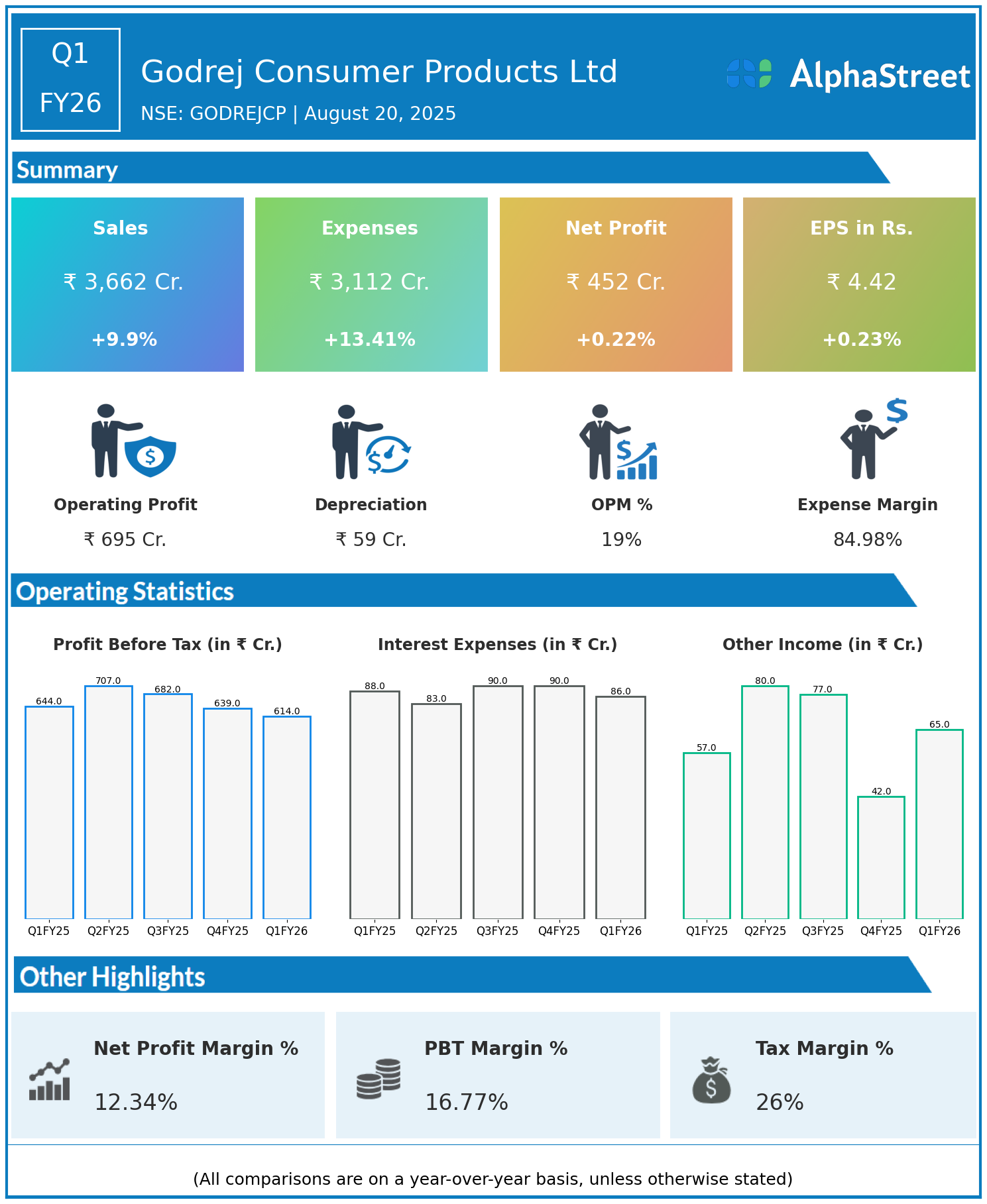

Godrej Consumer Products Limited is a fast-moving consumer goods (FMCG) company specializing in manufacturing and marketing household and personal care products. Presenting below are its Q1 FY26 Earnings Results

Q1 FY26 Earnings Results

- Revenue: ₹3,662 crore, up 9.9% year-on-year (YoY) from ₹3,332 crore in Q1 FY25.

- Total Expenses: ₹3,112 crore, up 13.41% YoY from ₹2,744 crore.

- Consolidated Net Profit (PAT): ₹452 crore, up 0.22% from ₹451 crore in the same quarter last year.

- Earnings Per Share (EPS): ₹4.42, up 0.23% from ₹4.41 YoY.

Operational & Strategic Update

- Revenue Growth: Revenues rose nearly 10%, supported by strong growth in household and personal care segments across domestic and international markets.

- Rising Expenses: Expenses increased by over 13%, outpacing revenue growth and exerting pressure on margins.

- Flat Profitability: Net profit and EPS were nearly flat year-on-year, reflecting margin compression due to cost increases in raw materials, marketing, and distribution.

- Market Position: Godrej Consumer Products maintains a strong leadership position with a diversified portfolio and well-established brands in key product categories.

- Strategic Focus: The company continues to invest in brand building, innovation, and market expansion to drive sustainable growth and margin improvement.

Corporate Developments in Q1 FY26 Earnings

Q1 FY26 results indicate steady topline growth for Godrej Consumer Products Ltd, while profitability remains subdued due to cost pressures in a competitive FMCG environment.

Looking Ahead

Godrej Consumer Products Ltd aims to enhance profitability through operational efficiencies, premiumization, and digital marketing initiatives. Continued focus on new product launches and geographical expansion is expected to support long-term value creation through FY26 and beyond.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel.