“Godrej Tyson recorded excellent all-round performance in Q1 with both the topline and profitability growth across categories. The branded business delivered 16% year-on-year volume growth led by Real Good Chicken. This coupled with lower raw material costs improved profitability. The live bird business also contributed to improved profitability on account of sustained efficiency improvement. Our joint venture in Bangladesh, ACI Godrej, recorded revenue growth of 15% year-on-year on a local currency basis in Q1 FY24. This was mainly driven by higher realization as compared to Q1 FY23.”

-Nadir Godrej, Chairman

Stock Data

| Ticker | GODREJAGRO |

| Industry | Agribusiness |

| Exchange | NSE |

Share Price

| Last 5 Days | 0.5% |

| Last 1 Month | -2.2% |

| Last 6 Months | 8% |

Business Basics

Godrej Agrovet Limited, a significant player in the agribusiness and animal feed sectors, operates with a commitment to sustainable agriculture, innovation, and rural development. With a rich legacy and a forward-looking approach, the company’s business fundamentals are grounded in quality, ethical practices, and responsible growth.

At the heart of Godrej Agrovet’s business strategy is its diversified portfolio, encompassing animal feed, crop protection, oil palm plantations, dairy, poultry, and processed foods. This wide array of offerings allows the company to address various facets of the agribusiness value chain, catering to the evolving needs of farmers, livestock producers, and consumers. Innovation is a cornerstone of Godrej Agrovet’s operations. The company places a strong emphasis on research and development, continuously striving to introduce advanced solutions that enhance agricultural productivity and animal nutrition. Collaborations with research institutions and experts in the field enable the company to stay at the forefront of technological advancements.

Sustainability and social responsibility are integral to Godrej Agrovet’s ethos. The company is dedicated to promoting sustainable farming practices, supporting rural livelihoods, and ensuring the well-being of animals. Initiatives such as dairy development programs, farmer training, and sustainable sourcing efforts underline the company’s commitment to making a positive impact on communities and the environment. Effective cost management, strategic investments in modernizing facilities, and an eye on market trends contribute to the company’s continued success.

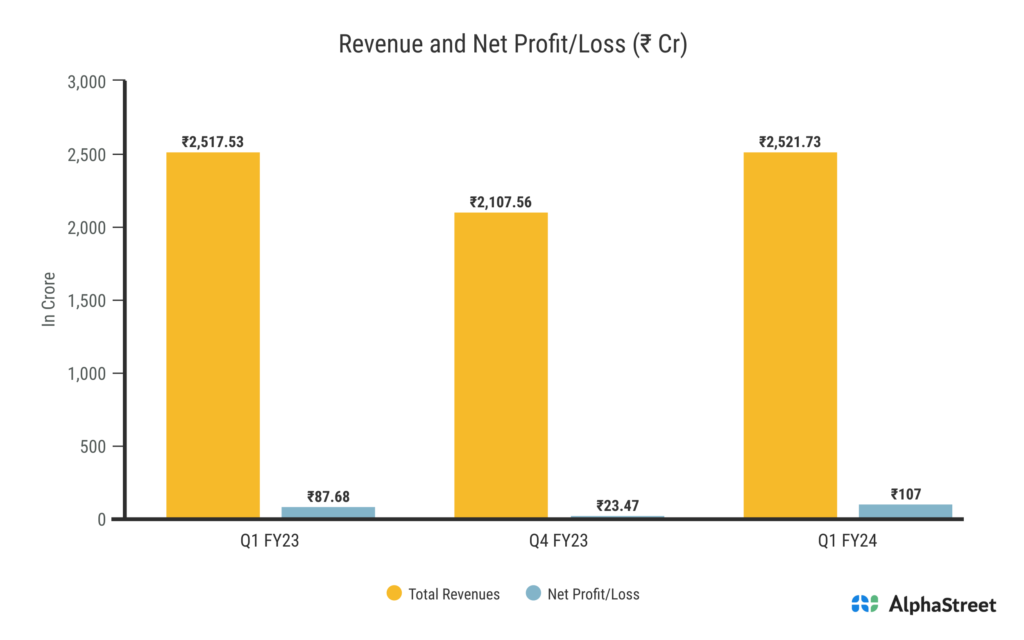

Q1 FY24 Financial Performance

Godrej Agrovet Ltd reported Revenues for Q1FY24 of ₹2,510.00 Crores same from ₹2,510.00 Crore year on year. Consolidated Net Profit of ₹107.00 Crores up 21.59% from ₹88.00 Crores in the same quarter of the previous year. The Earnings per Share is ₹5.48, up 27.44% from ₹4.30 in the same quarter of the previous year.

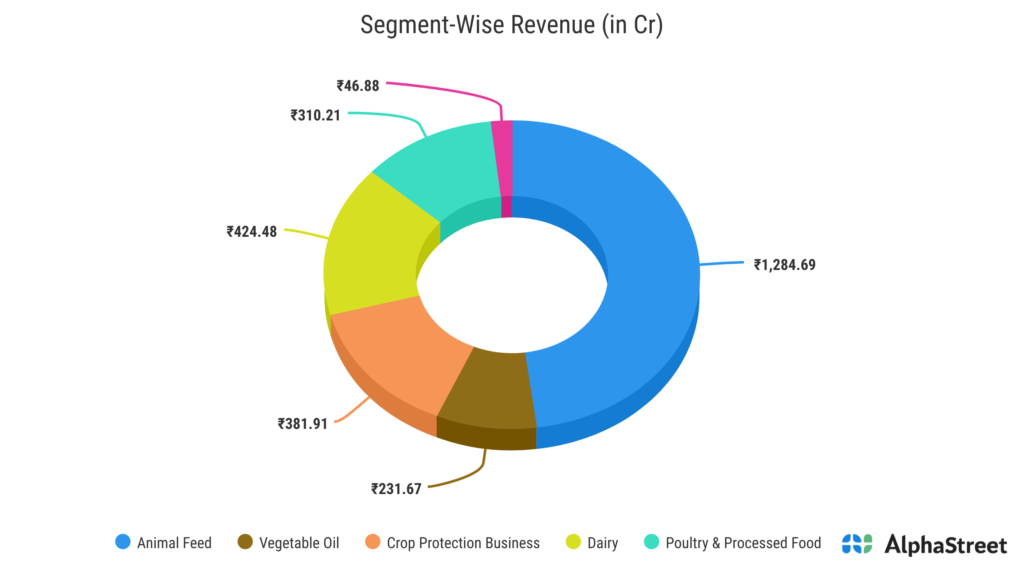

Godrej Agrovet’s Business Segments

Godrej Agrovet Limited operates across a diverse spectrum of business segments, each contributing to its holistic approach to agribusiness, sustainable agriculture, and rural development.

Animal Feed: Godrej Agrovet’s Animal Feed segment is dedicated to providing high-quality nutrition solutions to enhance the productivity and health of livestock. With a focus on optimizing animal nutrition, the company offers a wide range of balanced and customized feed products for poultry, cattle, aquaculture, and other livestock. Through research-driven formulations and innovative products, this segment plays a crucial role in supporting farmers and improving livestock yields.

Vegetable Oil: The Vegetable Oil segment is involved in the cultivation of oil palm plantations, which yield crude palm oil. With a focus on sustainable practices, this segment not only contributes to the production of cooking oil but also promotes responsible land use, biodiversity conservation, and community engagement. Godrej Agrovet’s commitment to sustainable sourcing and processing methods ensures the delivery of high-quality and eco-friendly vegetable oil products.

Crop Protection Business: Godrej Agrovet’s Crop Protection Business focuses on providing effective solutions to safeguard crops against pests, diseases, and other challenges. By developing and offering a range of agrochemical products, this segment aids farmers in maintaining crop health and optimizing yields. The company’s emphasis on research and innovation ensures that farmers have access to advanced and environmentally responsible crop protection solutions.

Dairy: The Dairy segment of Godrej Agrovet is engaged in the production and distribution of a variety of dairy products. Leveraging modern technology and sustainable practices, the company procures milk from farmers, processes it, and delivers an array of dairy products, including milk, curd, cheese, and more. Through backward integration and quality assurance, this segment supports rural livelihoods and ensures the availability of nutritious dairy products to consumers.

Poultry & Processed Food: This segment encompasses both poultry farming and the production of processed food items. Godrej Agrovet’s poultry operations involve the rearing and production of chicken and eggs, contributing to protein-rich diets for consumers. Additionally, the company’s processed food offerings include ready-to-eat and ready-to-cook products, catering to the evolving preferences of urban consumers for convenient and healthy food options.

Update In Godrej Agrovet’s Business

In Q1 FY24, the Animal Feed business increased its market share in the cattle-feed category while also increasing overall volume. Year on year, cattle feed volumes increased by 19%. Sustained volume growth in cattle feed and aqua feed was accompanied by margin recovery across the board. The Dairy business generated positive EBITDA in the first quarter, thanks to strong margin performance across categories and consistent volume growth in value-added products. Revenue from value-added products increased by 20% year on year, and its importance increased to 42% of total sales from 38% a year ago.

In Vegetable Oil segment, volume growth in fresh fruit bunch arrival was offset by significantly lower end product prices from the last year’s high base. Crude palm oil and palm kernel oil prices fell by 42% and 50%, respectively, year on year. The difficult market conditions had a negative impact on it. Furthermore, it had a significant impact on Astec Lifesciences’ revenue and profitability. However, contract manufacturing revenues increased threefold year on year, owing to new product development, and profitability improved.