Godfrey Phillips India Limited is a leading FMCG company in India and the flagship entity of the KK Modi Group. The company is renowned for its iconic cigarette brands such as Four Square, Red & White, and Cavanders. Additionally, it holds an exclusive sourcing and supply agreement with Philip Morris International to manufacture and distribute the globally recognized Marlboro brand within India. Presenting below are its Q1 FY26 Earnings Results.

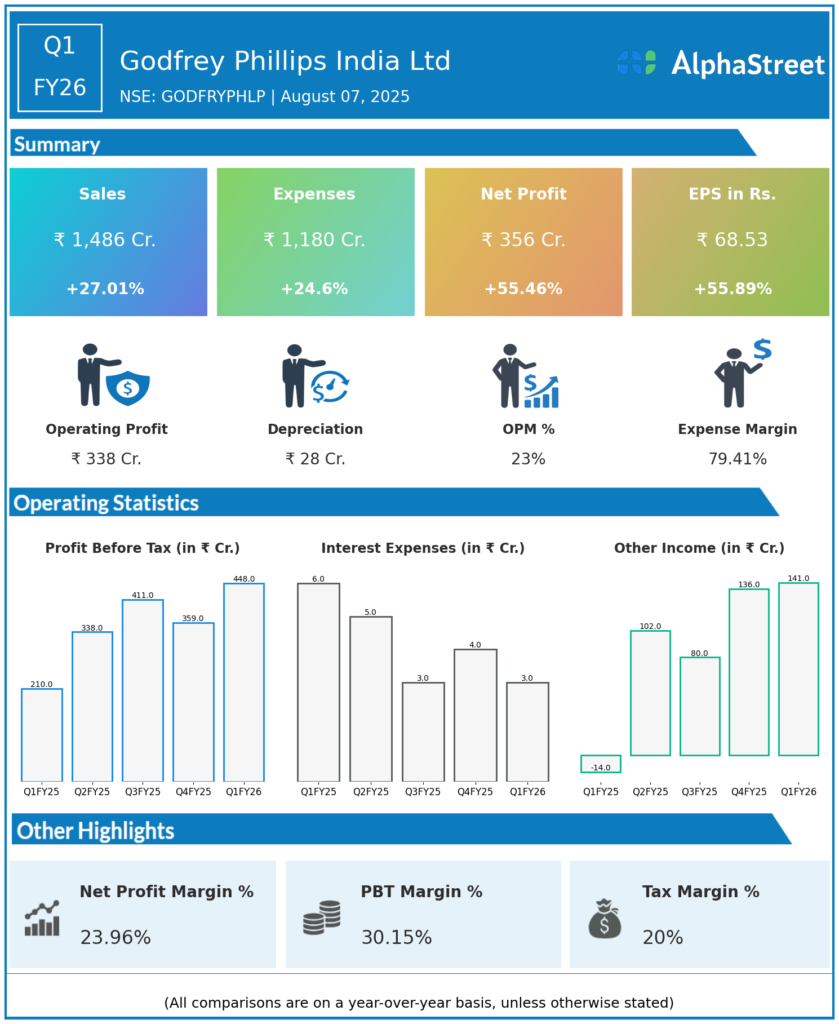

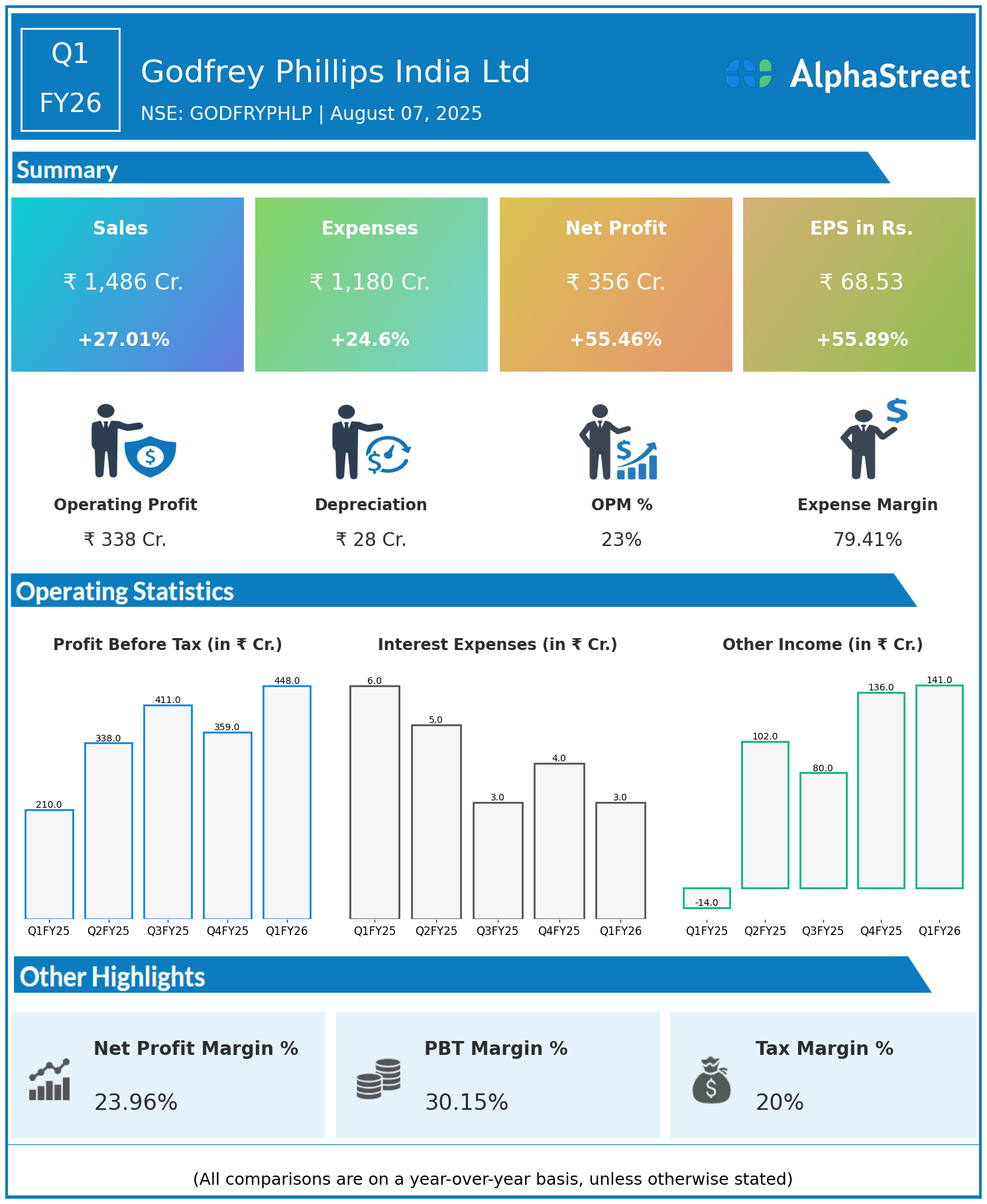

Q1 FY26 Earnings Results

- Revenue: ₹1,486 crore, up 27.01% year-on-year (YoY) from ₹1,170 crore in Q1 FY25.

- Total Expenses: ₹1,180 crore, up 24.6% YoY from ₹947 crore.

- Consolidated Net Profit (PAT): ₹356 crore, up 55.46% from ₹229 crore in the same quarter last year.

- Earnings Per Share (EPS): ₹68.53, up 55.89% from ₹43.96 YoY.

Operational & Strategic Update

- Strong Revenue Growth: The company’s impressive 27% revenue growth signifies robust demand and possible volume and value upticks across its cigarette portfolio, strengthened by the Marlboro brand partnership and market penetration.

- Controlled Expense Increase: Total expenses rose at a lower rate than revenues, indicating effective cost management and operational efficiencies amidst expanding business activities.

- Significant Profitability Improvement: Net profit and EPS surged by over 55%, reflecting strong margin expansion driven by revenue growth outpacing cost increases, improved product mix, and operational leverage.

- Brand and Market Positioning: Godfrey Phillips India continues to leverage its strength in legacy brands while benefiting from the strategic collaboration with Philip Morris International to enhance its premium segment presence.

- Strategic Focus: The company may be focusing on innovation in product offerings, marketing initiatives, and distribution enhancements to capitalize on growth opportunities in the Indian tobacco market.

Corporate Developments in Q1 FY26 Earnings

Q1 FY26 was a highly successful quarter for Godfrey Phillips India, marked by sharp improvements in both topline and profitability metrics. The company’s brand equity, exclusive partnerships, and cost discipline have collectively fueled this robust performance.

Looking Ahead

Godfrey Phillips India Ltd is positioned to sustain its growth momentum through continued market development, product innovation, and leveraging its alliance with international players. Continued focus on cost optimization and premiumization strategies is expected to drive further profitability and shareholder value through FY26 and beyond.

To view GODFRYPHLP’s previous results: Click Here