Go Digit General Insurance Ltd (GODIGIT, NSE/BSE) shares closed at ₹324.70 on January 22, 2026, with a market capitalization of ₹30,016 crore. The stock declined 0.15% from the previous close as the market digested the company’s Q3 FY26 results, released today, which revealed significant profitability acceleration despite moderating revenue growth.

Q3 FY26 Financial Performance

Go Digit reported a net profit of ₹119 crore in the quarter ended December 31, 2025, representing a 176% increase year-over-year from ₹43 crore in Q3 FY25. This marked the strongest quarterly earnings in the company’s reporting history. Total income rose 7.11% year-over-year to ₹2,372 crore, while profit before tax climbed 53% to ₹163 crore. Gross written premium grew 10.24% to ₹2,677 crore, compared to ₹2,428 crore in the same quarter last year.

The combined ratio – a key underwriting metric – improved to 108.1% in Q3 FY26 from 110.3% in Q3 FY25, signaling better cost management and claim handling efficiency. Premium retention ratio stood at 83.8%, down slightly from 87.8% year-over-year, as the company continued disciplined premium selection.

Full-Year FY25 Context

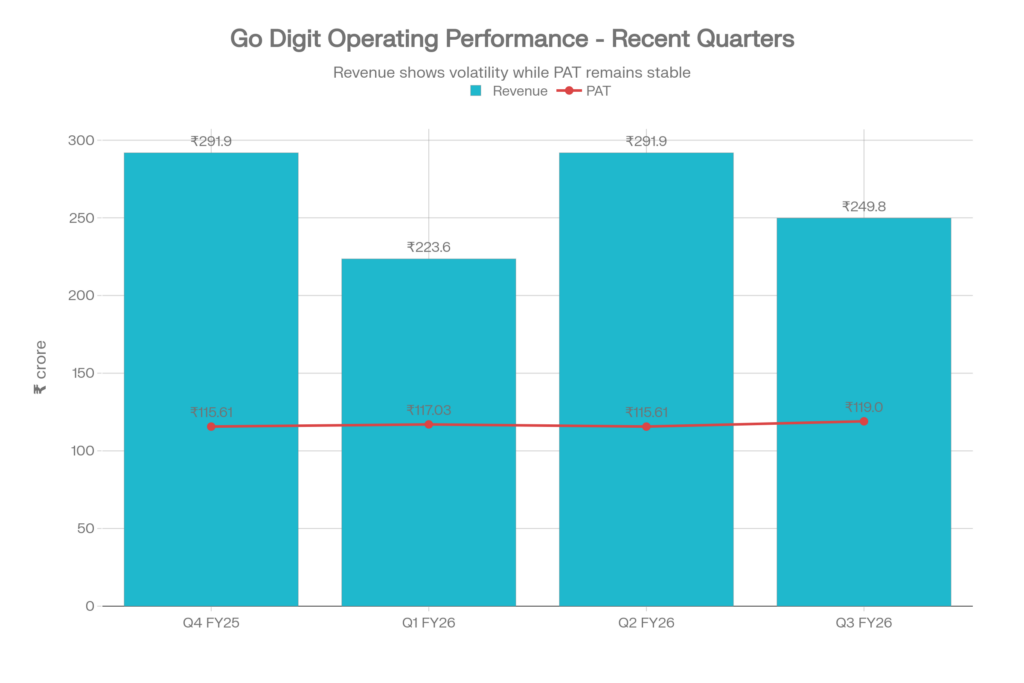

Go Digit’s quarterly revenue and net profit over the last four quarters through Q3 FY26, demonstrating consistent profitability amid steady revenue growth

For the nine-month period ending December 31, 2025, Go Digit reported net profit of ₹309 crore, up 170% from ₹114 crore in the corresponding nine-month period of FY25. Full-year FY25 (ended March 31, 2025) revenues totaled ₹9,696 crore with net profit of ₹425 crore, representing 133% year-over-year growth from FY24’s ₹182 crore profit on revenues of ₹8,615 crore.

Operating Performance

Go Digit’s quarterly revenue and net profit over the last four quarters through Q3 FY26, demonstrating consistent profitability amid steady revenue growth

Stock Price Trend

Go Digit’s stock price movement over 12 months, showing a peak of ₹407 in September 2024 and recent consolidation near ₹325 as of January 22, 2026

Business & Operations Update

The insurer deepened its market presence in January 2026 by launching three new health insurance plans: Digit Double Wallet Plan, Digit Infinity Wallet Plan, and Digit Worldwide Plan. These offerings target shifting consumer health insurance preferences post-pandemic, providing multiple sum insured options, worldwide coverage, and comprehensive cashless hospitalization access across 10,500+ network hospitals nationwide. The product expansion reinforces Go Digit’s focus on the high-growth health segment, which contributed ₹40.7 crore in net premium earned in Q3 FY26.

Motor insurance remained the revenue backbone, generating ₹151.2 crore in net premium earned during Q3, while the miscellaneous and crop segments contributed ₹5.2 crore and ₹19.2 crore respectively. Fire insurance earned ₹3.6 crore in net premiums.

Strategic Restructuring

On December 29, 2025, Go Digit’s board approved a landmark merger of its unlisted holding company, Go Digit Infoworks Services, with the listed insurer – the first such consolidation under recent insurance law changes permitting parent-subsidiary mergers. This restructuring aims to create a leaner operational structure with direct alignment to promoter ownership while maintaining the company’s robust solvency position of 2.30, well above regulatory minimums. The move requires regulatory approval but carries minimal impact on promoter shareholding concentration.

Financial Ratios & Outlook

Go Digit’s underwriting expense ratio improved to 36.8% in the nine-month period from 39.1% in the prior year, reflecting operational leverage as the company scales. The solvency ratio of 2.30 indicates substantial capital adequacy for future growth investments. Management’s gross written premium guidance for FY25 was ₹10,419 crore, achieving 15.6% full-year growth, positioning the company in the upper quartile of India’s general insurance sector for premium expansion.

The company’s assets under management reached ₹18,939 crore as of December 31, 2025, compared to ₹14,909 crore a year earlier, supporting investment income and balance-sheet strength during volatile market conditions.

Market Position & Closing

Go Digit’s Q3 profitability surge reflects disciplined underwriting, enhanced claims management, and growing operational efficiency in India’s competitive general insurance market. The company’s combined ratio of 108.1% in Q3, whilst elevated, remained better than the 110.3% recorded in the prior year quarter. The new health insurance products and pending merger approval position Go Digit for sustained operational evolution in 2026. Investors will monitor the holding company merger execution and full-year FY26 guidance for strategic validation of the expanded product suite.