Gujarat Narmada Valley Fertilizers & Chemicals Limited (GNFC), a joint sector enterprise promoted by the Gujarat State Investments Limited and Gujarat State Fertilizers & Chemicals Ltd., operates primarily in industrial chemicals and fertilizers, with a small presence in IT services. The company has a diversified product portfolio that includes key bulk chemicals used in specialty chemical manufacturing. Below are its Q1 FY26 Earnings Results.

Q1 FY26 Earnings Results

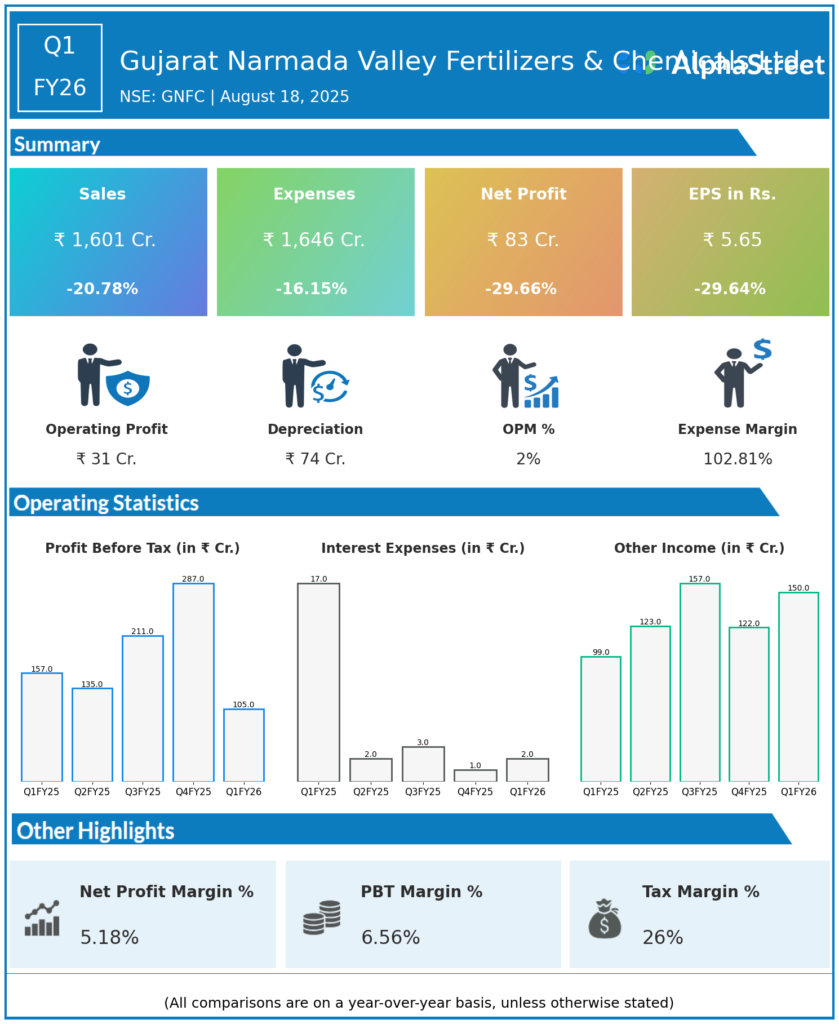

- Revenue: ₹1,601 crore, down 20.78% year-on-year (YoY) from ₹2,021 crore in Q1 FY25.

- Total Expenses: ₹1,646 crore, down 16.15% YoY from ₹1,963 crore.

- Consolidated Net Profit (PAT): ₹83 crore, down 29.66% from ₹118 crore in the same quarter last year.

- Earnings Per Share (EPS): ₹5.65, down 29.64% from ₹8.03 YoY.

Operational & Strategic Update

- Significant Revenue Decline: Revenue fell over 20%, impacted heavily by the annual maintenance shutdown at the Bharuch plant which constrained production volumes and disrupted sales.

- Expense Reduction: Total expenses decreased but at a slower pace compared to revenue, reflecting fixed costs and increased repair and maintenance expenses due to the shutdown.

- Profitability Pressure: Net profit fell nearly 30%, affected by lower revenues, unproductive costs during the shutdown, and margin contraction partly due to higher energy and raw material costs.

- Segment Challenges: Both fertilizer and chemical segments faced volume declines; the chemical segment was further impacted by weak market demand and price pressures for products such as Aniline and Toluene Diisocyanate (TDI).

- Strategic Initiatives: The company has appointed a strategic consultant to focus on cost reductions and growth planning; expects no further plant shutdowns in the year and anticipates operational improvements in the chemical segment.

Corporate Developments in Q1 FY26 Earnings

GNFC’s Q1 FY26 results reflect a challenging quarter marked by production shutdowns and difficult market conditions. Management is pursuing structural changes to improve cost efficiency and stabilize operations.

Looking Ahead

Gujarat Narmada Valley Fertilizers & Chemicals Ltd aims to improve margins and operational stability through cost optimization and enhanced production efficiency. With no further planned shutdowns and strategic initiatives underway, the company expects gradual recovery and value creation in the coming quarters.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel.