GMR Power & Urban Infra Limited (GPUIL) is a significant player in India’s energy and urban infrastructure space, with a footprint spanning power generation and transmission, urban utilities, and metro and transportation projects. Leveraging these diversified segments, GMR aims to support India’s growth in energy access, urban mobility, and smart infrastructure.

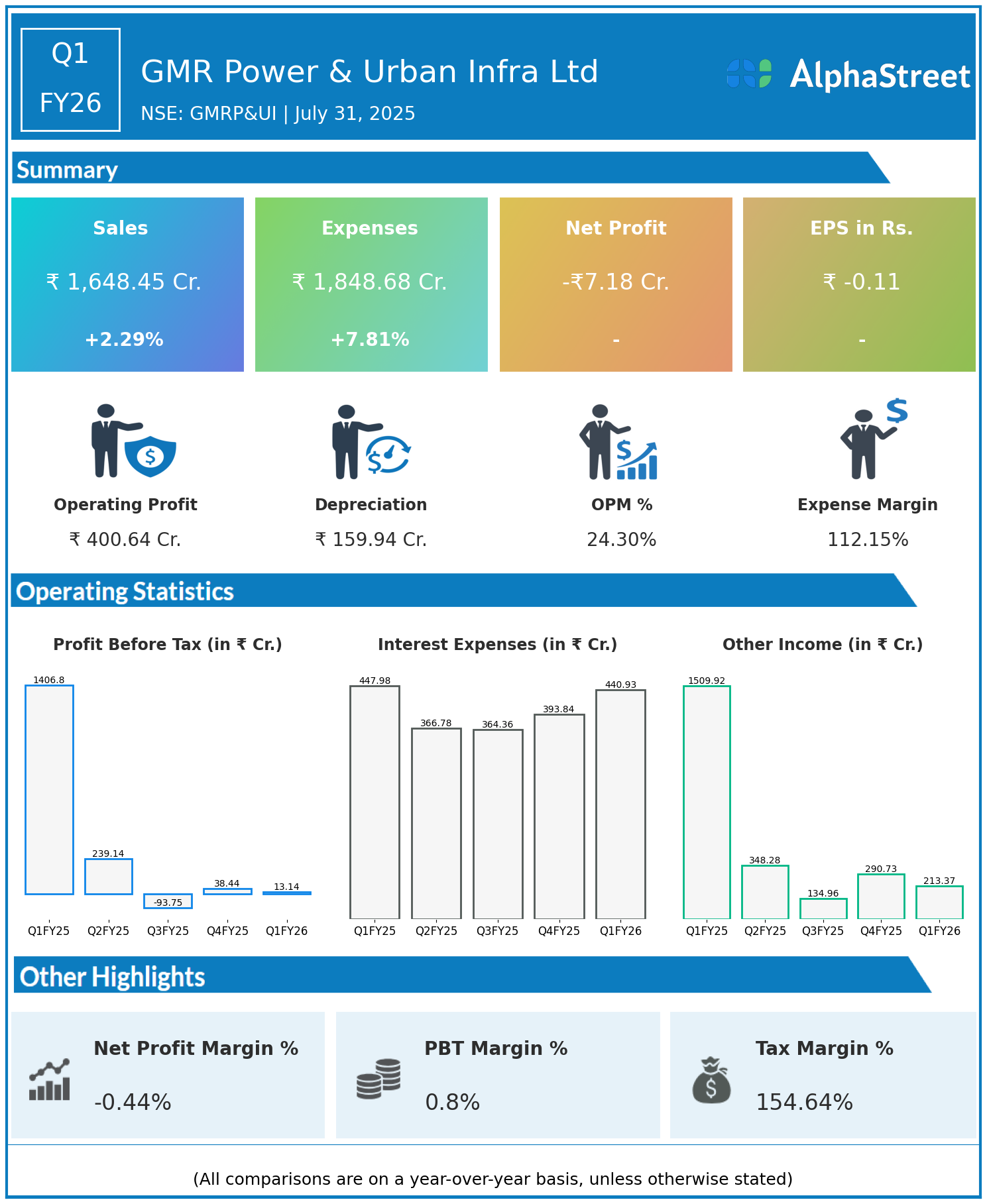

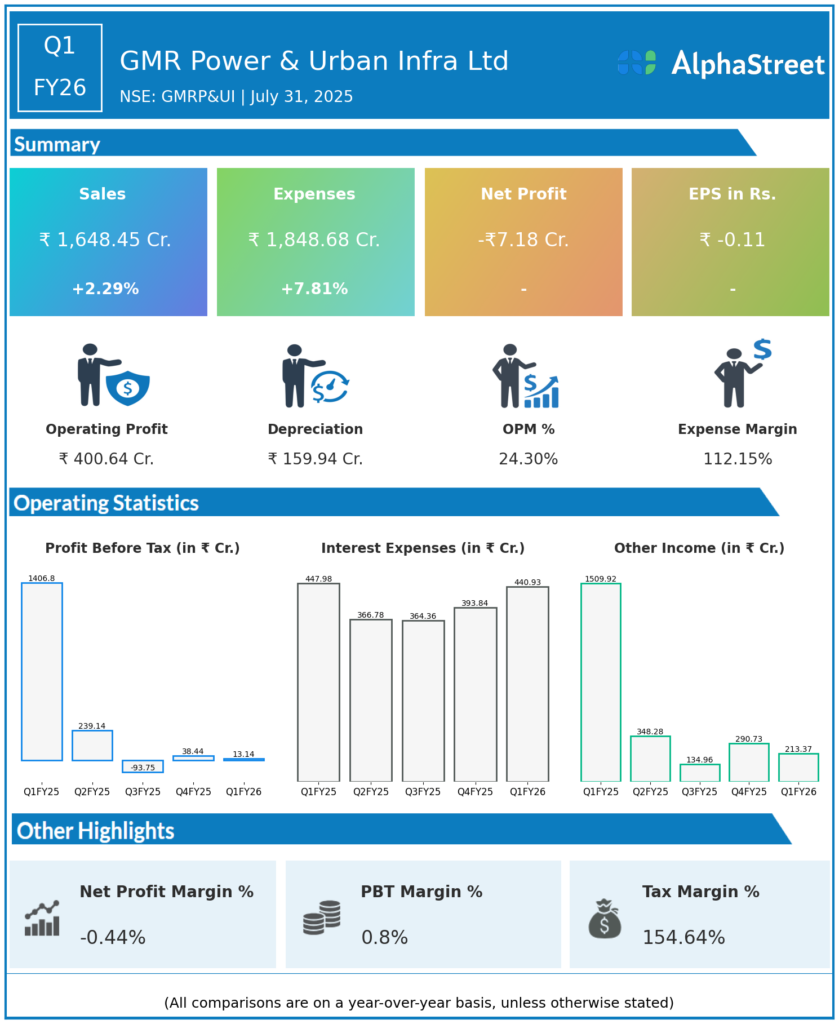

Q1 FY26 Earnings Summary (Apr–Jun 2025)

- Revenue: ₹1,648.45 crore, up 2.29% year-on-year (YoY) from ₹1,611.58 crore in Q1 FY25.

- Total Expenses: ₹1,848.68 crore, up 7.81% YoY from ₹1,714.70 crore.

- Consolidated Net Profit (PAT): -₹7.18 crore, in contrast to a profit of ₹1,362.10 crore in Q1 FY25 (the previous year included a large one-off/extraordinary income).

- Earnings Per Share (EPS): -₹0.11, down from ₹20.30 YoY.

Operational & Strategic Update

- Modest Revenue Growth: A slight revenue increase was driven by stable contributions from energy assets and gradual growth in urban infrastructure and metro segments.

- Rising Expenses: Total expenses grew more than revenues, primarily due to higher operating, project, and input costs associated with long-cycle infrastructure projects.

- Profitability Pressure: The company moved to a small net loss this quarter, compared to a substantial profit last year, as last year’s base was boosted by extraordinary income and this quarter saw margin compression due to cost inflation.

- Energy & Infra Operations: The energy segment continues as the primary revenue generator. Urban utility and metro rail projects remain key for long-term growth but require sustained investment and have long payback timelines.

- Project Pipeline: Ongoing focus on expanding and executing urban mobility (metro), smart city utility, and waste management projects, with an emphasis on timely delivery and cost efficiency.

- Strategic Priorities: The management aims for tighter cost management, asset monetization, and cash flow discipline to restore and improve profitability.

Corporate Developments

Q1 FY26 was a challenging quarter for GMR Power & Urban Infra Ltd, with revenue holding steady but profitability affected by higher costs and the absence of one-off gains. The company remains firmly positioned in the urban infra and energy sectors, with a diversified operations base that supports long-term potential, especially as India invests further in clean energy and smart cities.

Looking Ahead

GMR Power & Urban Infra Ltd’s future growth will depend on cost containment, asset monetization, and timely execution of its urban mobility and energy projects. As policy tailwinds in urbanization and sustainable infrastructure continue, the company will focus on margin stabilization and capital discipline to unlock value for stakeholders through FY26 and beyond.