GMM Pfaudler Ltd manufactures corrosion-resistant glass-lined equipment and is a leading supplier of process equipment to the pharmaceutical and chemical industries. The company has diversified its offerings to include mixing systems, filtration & drying equipment, engineered systems, and heavy engineering equipment. Presenting below are its Q1 FY26 Earnings Results

Q1 FY26 Earnings Results

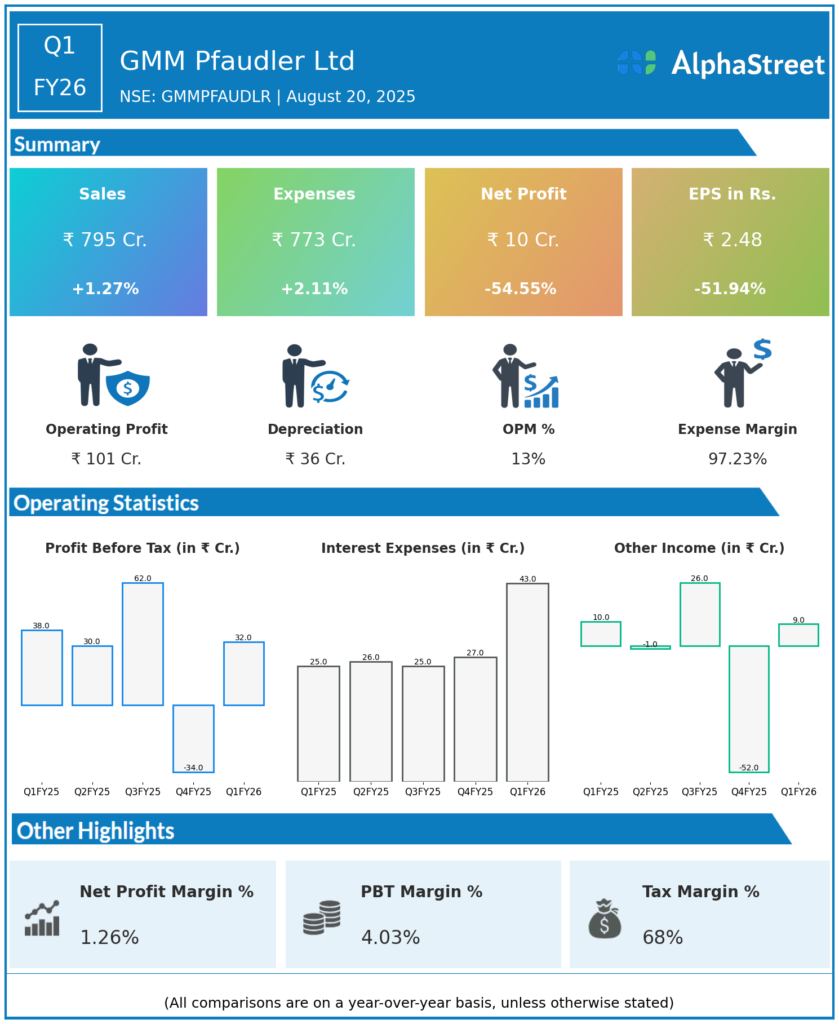

- Revenue: ₹795 crore, up 1.27% year-on-year (YoY) from ₹785 crore in Q1 FY25.

- Total Expenses: ₹773 crore, up 2.11% YoY from ₹757 crore.

- Consolidated Net Profit (PAT): ₹10 crore, down 54.55% from ₹22 crore in the same quarter last year.

- Earnings Per Share (EPS): ₹2.48, down 51.94% from ₹5.16 YoY.

Operational & Strategic Update

- Modest Revenue Growth: Revenues improved slightly by 1.27%, reflecting steady demand in core pharmaceutical and chemical industries.

- Cost Escalation: Expenses rose by 2.11%, outpacing revenue growth and resulting in margin compression.

- Sharp Profit Decline: Net profit and EPS fell significantly, by over 54%, largely due to higher operational costs and possibly softer product mix or pricing pressure.

- Market Position: GMM Pfaudler retains its leadership in glass-lined and process equipment, supported by a diversified and evolving portfolio tailored to critical process industries.

- Strategic Focus: The company is emphasizing operational efficiency, new product introductions, and expansion into engineering and heavy equipment to counter margin challenges.

Corporate Developments in Q1 FY26 Earnings

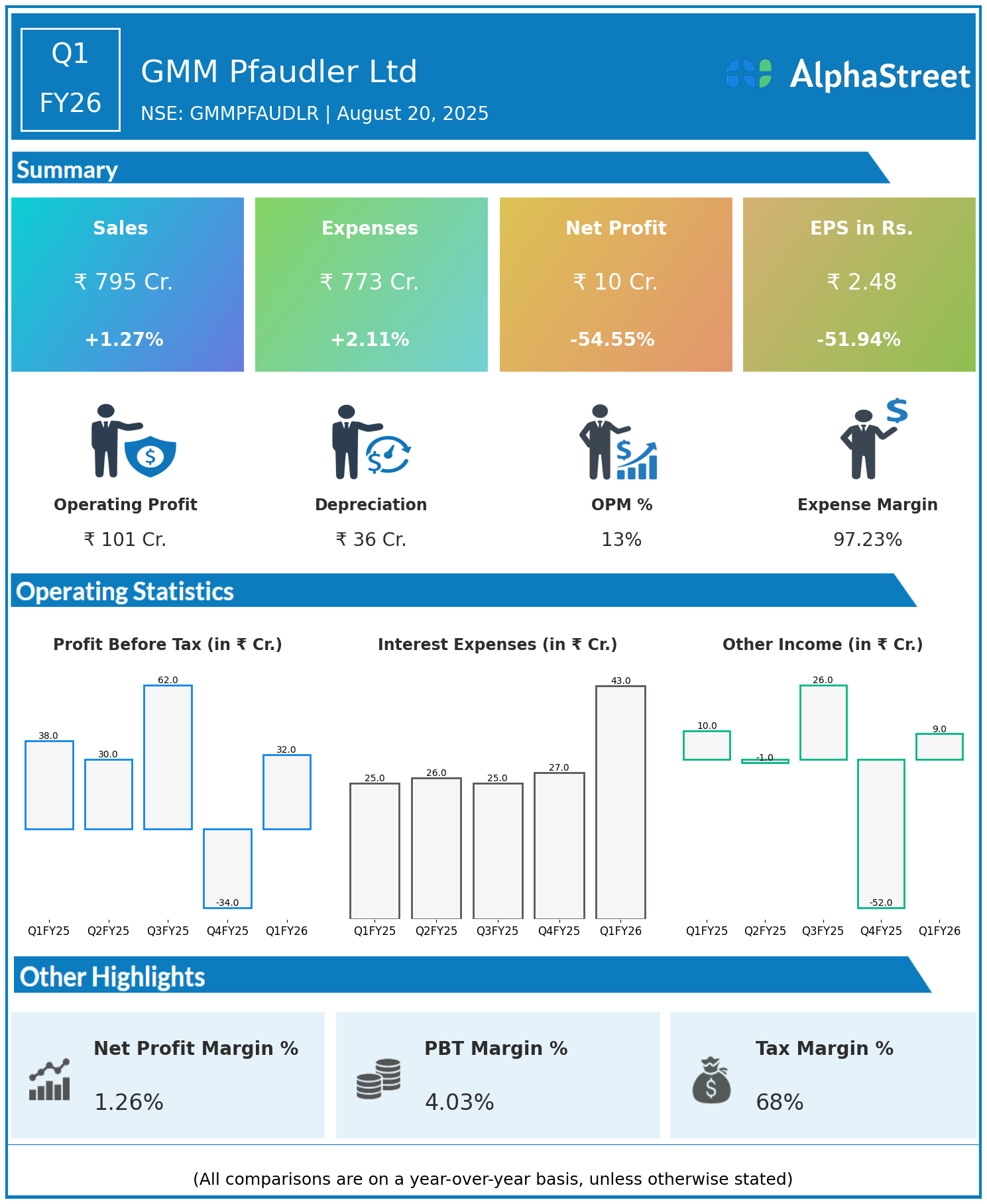

Q1 FY26 results point to a challenging quarter for GMM Pfaudler Ltd, with cost pressures and margin erosion despite stable revenue growth.

Looking Ahead

GMM Pfaudler aims to restore profitability by strengthening operational controls, diversifying its product base further, and deepening penetration in pharmaceutical and chemicals process markets. Innovation, efficiency gains, and strategic expansion are expected to drive recovery through FY26 and beyond.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel.