Globus Spirits Limited, established in 1992, is a prominent player in the alcoholic beverages industry, engaged in the manufacture and sale of Indian Made Indian Liquor (IMIL), Indian Made Foreign Liquor (IMFL), bulk alcohol, hand sanitizers, and franchise bottling. The company operates a comprehensive 360° business model covering the entire alcohol value chain. Notably, it was the first in India to set up a grain distillery and launch branded DDGS (Distillers Dried Grains with Solubles), reflecting its innovative approach within the sector. Presenting below are its Q1 FY26 Earnings Results.

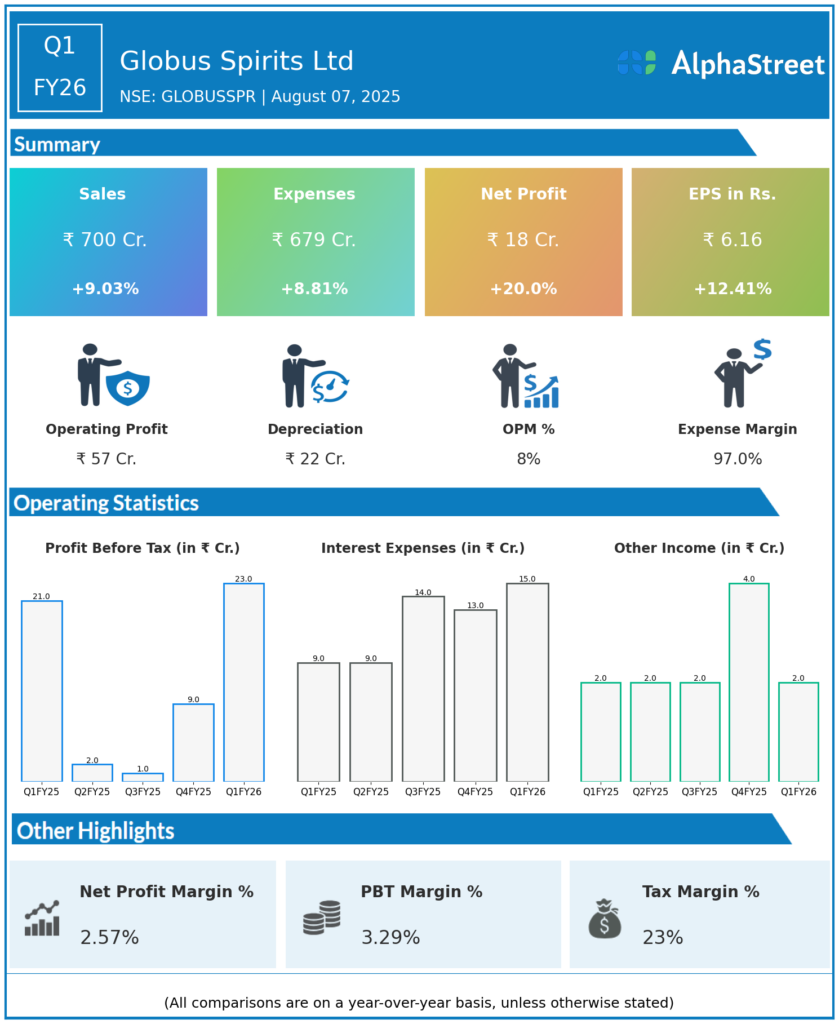

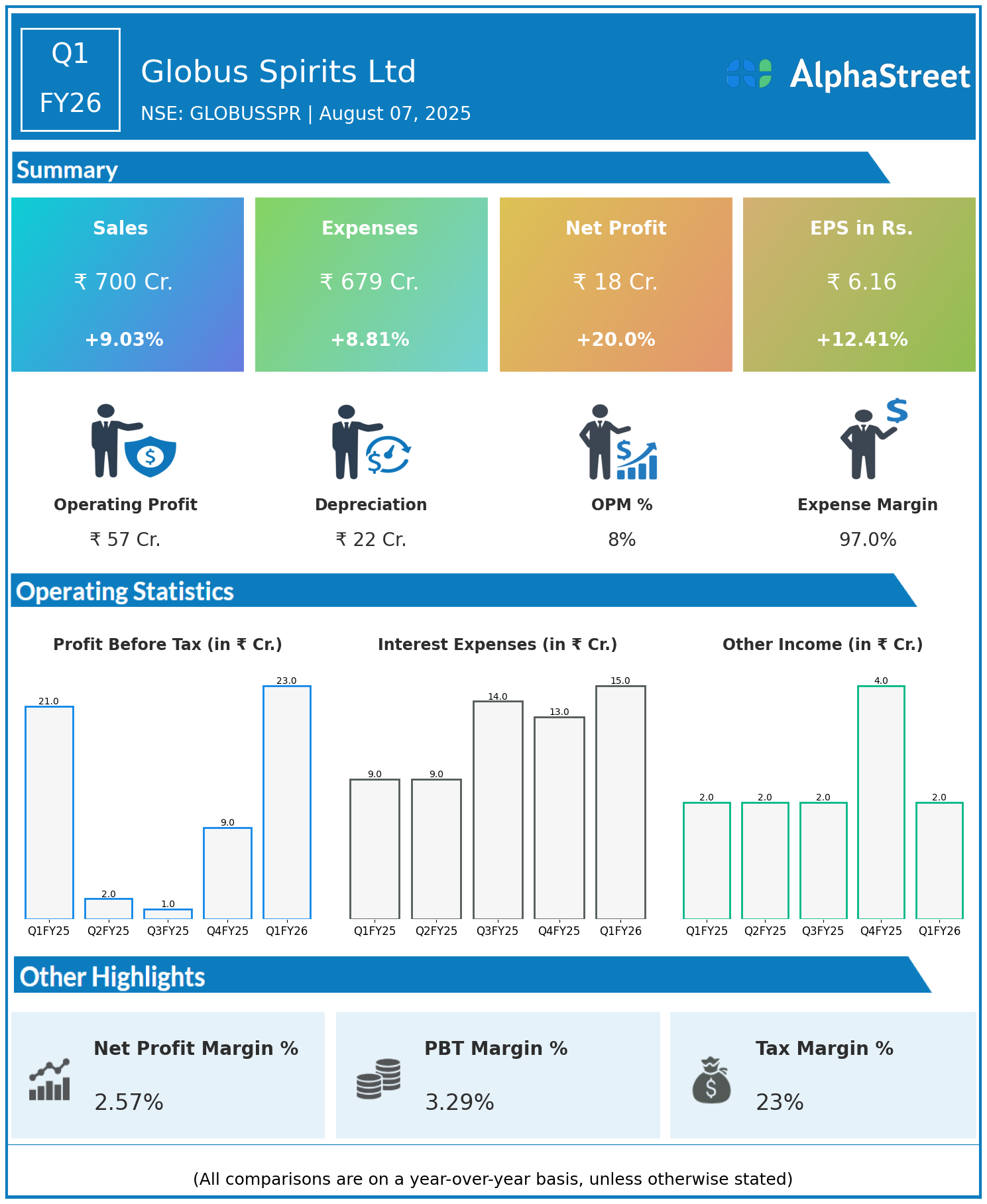

Q1 FY26 Earnings Results

- Revenue: ₹700 crore, up 9.03% year-on-year (YoY) from ₹642 crore in Q1 FY25.

- Total Expenses: ₹679 crore, up 8.81% YoY from ₹624 crore.

- Consolidated Net Profit (PAT): ₹18 crore, up 20.0% from ₹15 crore in the same quarter last year.

- Earnings Per Share (EPS): ₹6.16, up 12.41% from ₹5.48 YoY.

Operational & Strategic Update

- Revenue Growth: The company posted healthy revenue growth driven by increased sales volumes and improved realizations across its IMIL, IMFL, and bulk alcohol segments, supported by resilient demand and market penetration.

- Cost Management: Total expenses rose slightly but were effectively controlled relative to revenue growth, indicating efficient management of input costs and operational expenses.

- Profitability Improvement: Net profit and EPS recorded double-digit growth, outpacing revenue gains, reflecting margin expansion aided by improved operating efficiencies and product mix enhancements.

- Innovative Practices: Globus Spirits’ unique 360° model, along with pioneering initiatives such as branded DDGS and grain distillery operations, provides strategic advantages, enabling better cost control and value addition.

- Market & Product Focus: The company continues to strengthen its presence in both traditional and emerging segments of the alcoholic beverages market while expanding franchise bottling and sanitizer business verticals to diversify revenue streams.

Corporate Developments in Q1 FY26 Earnings

Q1 FY26 performance highlights Globus Spirits Ltd’ ability to sustain profitable growth amid a competitive and evolving industry landscape. The company’s integrated value chain model and innovation-driven initiatives remain key drivers of its financial resilience and market positioning.

Looking Ahead

Globus Spirits Ltd is well-positioned to capitalize on growing demand for alcoholic beverages and allied products in India. With continued focus on operational efficiency, portfolio expansion, new product development, and market diversification, the company aims to sustain revenue growth, margin improvement, and shareholder value creation throughout FY26 and beyond.

To view GLOBUSSPR’s previous results: Click Here