Incorporated in 2004 and headquartered in Jaipur, Rajasthan, Global Surfaces Ltd. is an established player in the natural and engineered stone industry, specializing in the mining, production, and export of granite, marble, and engineered quartz. Over more than two decades, the company has evolved from a local provider to an internationally recognized brand, with a significant emphasis on exports. Approximately more than 45% of Global Surfaces’ operational revenue is derived from export sales (as of Q1FY25), highlighting the company’s successful penetration into competitive global markets such as the United States and the Middle East.

Global Surfaces’ extensive product offerings include customized slabs and countertops used in flooring, wall cladding, countertops, vanity tops, staircases, and various interior applications, making it a versatile choice for commercial and residential projects. The company’s diverse product line caters to both aesthetic and structural requirements, with customizable options available in various shapes, sizes, colors, and finishes.

Historical Growth and Financials:

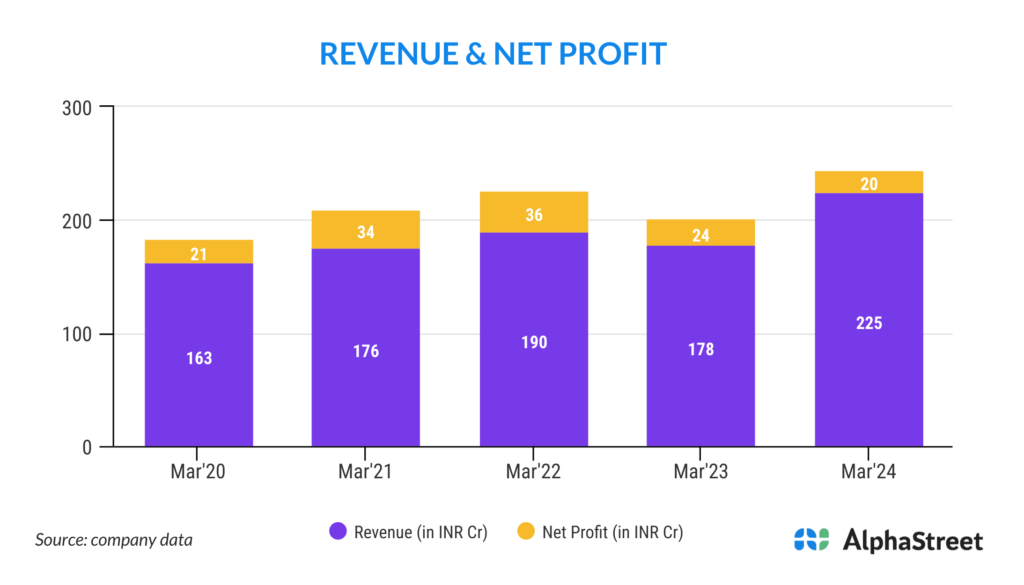

Over the past 13 years, Global Surfaces has achieved a compound annual growth rate (CAGR) of 20.8%, with revenue from operations rising from ₹23 crore in FY 2011 to ₹225 crore in FY 2024. This growth is primarily attributed to increasing international demand for engineered quartz products, which accounted for approximately more than 75% of the company’s revenue in FY 2023-24.

Business Model and Operations

Global Surfaces operates with a dual-facility setup in Jaipur, Rajasthan, which allows it to efficiently manufacture and process both natural stones and engineered quartz:

Unit I :–

The first facility, spread over 20,488 square meters in the RIICO Industrial Area, focuses on processing natural stones like marble, granite, and quartzite. Its strategic location in proximity to key raw material sources allows the company to reduce logistics costs and maintain a stable supply of high-quality stones.

Unit II :–

The second unit, located in the Mahindra World City SEZ, spans 24,139 square meters and is dedicated to the production of engineered quartz. This facility is equipped with a research and development center, allowing the company to innovate and test new designs, colors, and patterns. The focus on R&D enables Global Surfaces to respond swiftly to market trends, helping it maintain a competitive edge in an industry where aesthetic preferences shift frequently.

Product Segmentation:

- Natural Stones:

Global Surfaces produces a variety of natural stones, including marble, granite, quartzite, and others, each unique in its aesthetic appeal, texture, and color. These products are favored for their one-of-a-kind look, adding a sense of luxury and exclusivity to spaces. - Engineered Quartz:

Engineered quartz products cater to markets requiring durable, low-maintenance, and visually appealing options for countertops, flooring, and wall cladding. Unlike natural stones, engineered quartz is fabricated using crushed quartz bonded with resin, providing a more consistent appearance while retaining the strength and resilience of natural stone.

Strategic Growth Initiatives

Global Surfaces has a three-tiered strategy for sustained growth, focused on increasing its international footprint, expanding production capabilities, and enhancing product innovation.

- Geographic Expansion:

The North American market remains the primary focus, but the company is aggressively exploring opportunities to expand in other regions, including Australia and the Middle East. This expansion strategy involves establishing local connections and understanding market demands to deliver products that cater to region-specific needs. By reinforcing its brand presence in these regions, Global Surfaces aims to gain a greater market share and secure long-term partnerships with key customers. - Dubai Manufacturing Facility:

To support its growth ambitions, Global Surfaces is constructing a new manufacturing facility in the Jebel Ali Free Zone, Dubai, UAE, through its wholly-owned subsidiary, Global Surfaces FZE. This facility, spanning 39,657 square meters, is scheduled to begin production in FY 2023-24, with an estimated installed capacity of 622,896 square meters annually. Located in a free-trade zone, the Dubai facility will benefit from income tax exemptions and favorable trade privileges, which will enhance cost efficiencies and strengthen the company’s position in Middle Eastern and European markets. - Product Innovation and Diversification:

Global Surfaces invests significantly in R&D to introduce new patterns, colors, and finishes in both natural stone and engineered quartz. This dedication to innovation allows the company to stay ahead of design trends, attracting a broader customer base. The emphasis on customization and design flexibility also strengthens relationships with existing customers and facilitates entry into untapped segments. - Technology Integration and Process Automation:

To improve operational efficiency and quality, Global Surfaces integrates advanced technology into its manufacturing processes. The company has adopted SAP software for streamlined record-keeping, and automation technologies help optimize production, reduce waste, and ensure consistent product quality. This commitment to technological advancement positions Global Surfaces to scale operations as demand grows, maintaining a reputation for quality and efficiency.

Core Strengths

- Revenue Growth:

Over the last decade, Global Surfaces’ revenue has grown at a CAGR of 20.8%, reaching ₹225 crore in FY 2024, underscoring robust demand for its products. The company’s consistent growth trajectory demonstrates its capacity to adapt to market challenges, including the impact of the COVID-19 pandemic. - Product Portfolio Diversification:

From its origins as a natural stone producer, Global Surfaces has successfully diversified into engineered quartz. This shift allows the company to capture a wider customer base and compete in multiple categories, providing an extensive array of products that appeal to both residential and commercial clients. - Established Market Presence in the U.S.:

The United States is a key market for Global Surfaces, with exports to the region constituting a significant portion of revenue. This established presence in North America gives the company access to one of the largest and most lucrative markets for premium interior materials. - Experienced Management Team:

The leadership team, led by Managing Director Mayank Shah, brings a blend of industry knowledge, operational expertise, and innovative vision, which has been instrumental in transforming Global Surfaces from a local company to an international competitor. The management team’s strategic focus on quality and market adaptation supports Global Surfaces’ competitive position.

Investment Rationale

- Growing Demand for Engineered Quartz:

Engineered quartz is gaining popularity due to its durability, low maintenance, and wide range of design options, making it a preferred choice for both residential and commercial spaces. The global engineered quartz market is projected to grow significantly, driven by urbanization and increased spending on home renovations and commercial interiors. - Strategic Dubai Facility:

The Dubai facility will enable Global Surfaces to serve customers more efficiently across the Middle East and Europe. The tax and logistical advantages of operating within a free-trade zone will allow the company to improve its cost structure, boosting profitability and creating a platform for further international expansion. - Focus on Product Innovation:

Global Surfaces’ investment in R&D underscores its commitment to meeting evolving customer demands. By introducing new designs and finishes, the company can appeal to a wider range of customers and adapt to trends that emphasize aesthetics and durability. - Technological Advancements in Operations:

Advanced manufacturing technologies, combined with SAP integration, enable Global Surfaces to maintain high operational standards. This technology-driven approach supports efficient production and positions the company to scale its operations in response to increasing demand.

Key Risks

- Customer Concentration:

A significant portion of revenue is derived from a small number of key customers, making the company vulnerable to changes in their purchasing behavior. In FY 2023, the top three clients accounted for over ~57% of revenue. Any reduction in orders from these customers could negatively impact revenue and profitability. - Supply Chain Dependence:

The company does not have long-term contracts with suppliers for raw materials, making it susceptible to fluctuations in material availability and costs. This dependence could affect production timelines and margins, particularly if there are shortages or price increases in key raw materials. - Challenges in New Market Expansion:

While the company is expanding into new regions, a lack of experience in certain markets could hinder its ability to establish a solid customer base. Success in these new territories will be critical to achieving the expected growth.

Financial Performance:

In the fiscal period from March 2022 to June 2024, Global Surfaces Ltd. demonstrated impressive growth and resilience in its financial performance, reflecting its robust position in the natural and engineered stone industry.

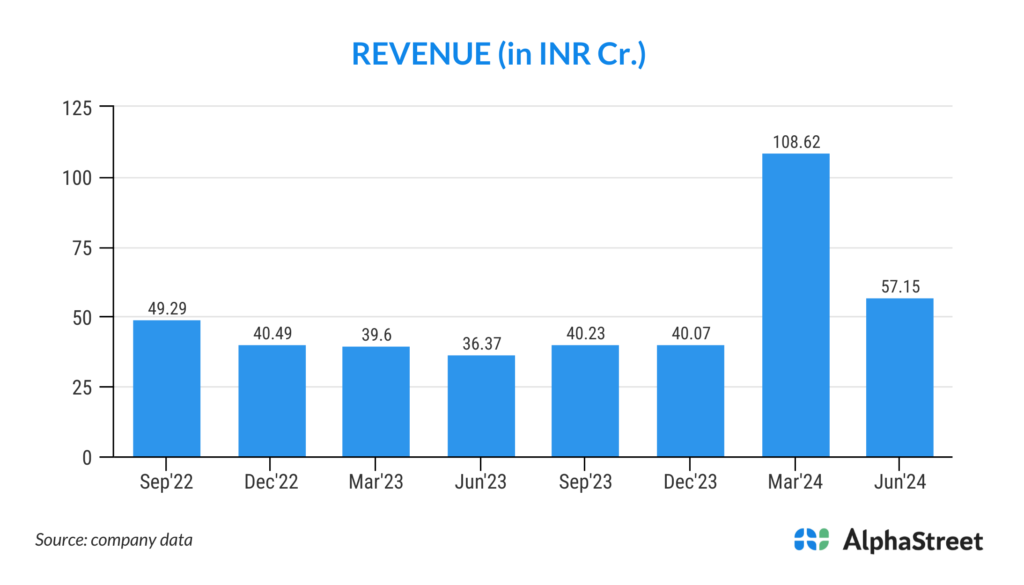

Quarterly Financial Highlights:

Sales and Expenses:

Global Surfaces has shown strong sales momentum, with quarterly sales peaking at ₹108.62 crore in March 2024, reflecting robust demand in international markets. Although quarterly expenses followed a similar trend, the company effectively managed costs to support this growth. Even with minor fluctuations, sales maintained a healthy upward trajectory over the period.

Operating Profit and OPM:

Operating profit and margins showcased the company’s ability to adapt in a dynamic market. The Operating Profit Margin (OPM) reached a notable 23.88% in September 2022, while operating profits peaked at ₹16.20 crore in March 2024, a testament to efficient cost management and strong product positioning. These figures highlight Global Surfaces’ resilience and ability to sustain profitability even as it expands.

Profit Before Tax and Net Profit:

Profit before tax reached its highest at ₹11.49 crore in March 2024, underscoring the company’s growth potential. Although there was some variability in quarterly net profit, Global Surfaces consistently generated positive results, with its strategic decisions positioning the company well for long-term stability.

Annual Performance Highlights

Sales Growth and Margins:

Annual sales demonstrated solid growth, advancing from ₹163 crore in March 2020 to ₹225 crore by March 2024, with a remarkable peak of ₹246 crore in the TTM. This growth trajectory reflects the success of Global Surfaces’ expansion in international markets, particularly in high-demand regions like the United States and Canada. Although operating margins shifted due to growth expenses, they remained strong at 16% in March 2024, showcasing the company’s balanced approach to expansion.

Net Profit and EPS:

Net profit reached its highest in March 2022 at ₹36 crore and maintained a positive trajectory despite expansion-related costs. Earnings per Share (EPS) has displayed resilience, supporting shareholder value through Global Surfaces’ proactive approach to international market penetration and consistent profitability.

Efficiency and Liquidity Metrics

Working Capital and Cash Conversion Cycle:

While working capital days have extended to 243 in March 2024, this reflects the company’s growth and higher inventory to meet rising demand. The cash conversion cycle lengthened to 295 days, primarily due to strategic increases in inventory, supporting sales growth and ensuring product availability to meet customer needs.

Debtor and Inventory Days:

With inventory days expanding to 236 by March 2024, Global Surfaces is well-positioned to capitalize on rising demand. The increase in debtor days, now at 178, highlights the company’s commitment to supporting its client relationships, fostering trust and long-term growth.

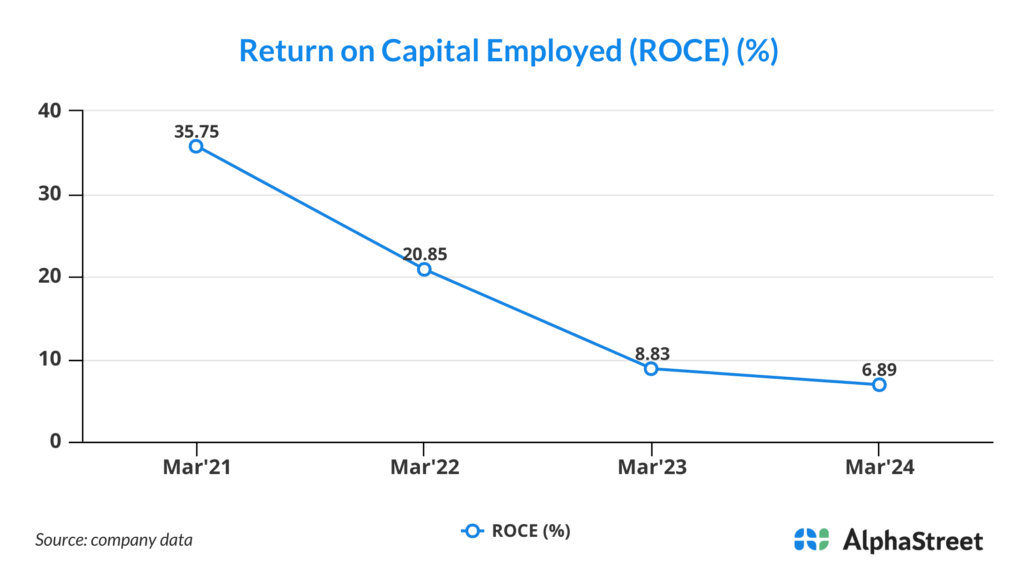

Return on Capital Employed (ROCE):

Global Surfaces’ ROCE, while adjusting for growth-related investments, remains solid, reflecting the company’s dedication to creating long-term shareholder value. The current ROCE at 7% illustrates prudent capital investment aimed at fostering expansion and strengthening its operational capacity.

Industry Outlook

The global engineered quartz market is forecasted to grow at a CAGR of 8-9% through 2027, driven by rising urbanization, demand for aesthetic interior designs, and a growing preference for sustainable, low-maintenance materials. Natural stones and engineered quartz are increasingly favored for their durability, design flexibility, and resistance to wear, which makes them suitable for high-traffic areas and long-term installations.

Conclusion:

Global Surfaces Ltd. is well-positioned to capitalize on these industry trends. The company’s expansion initiatives, along with its commitment to R&D, provide a solid foundation for future growth, making it a strong candidate for investors seeking long-term value creation in the natural and engineered stone sector.