Executive Summary

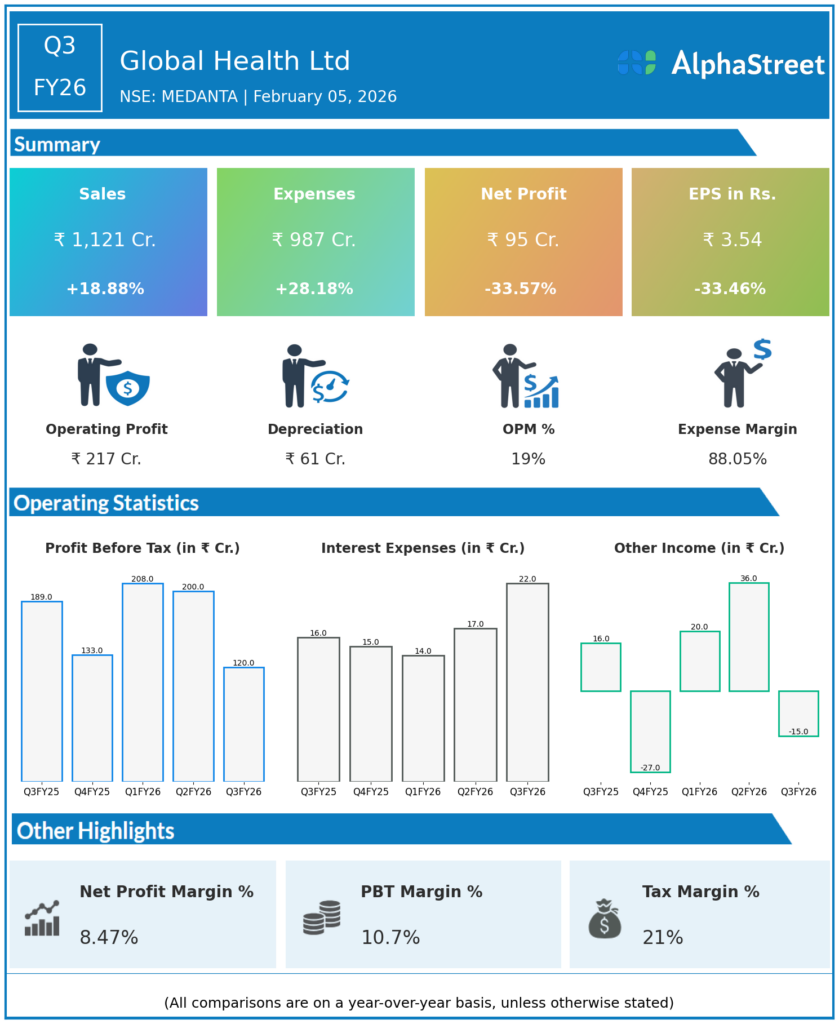

Global Health Ltd reported Q3FY26 revenues of ₹1,121 crore, up 18.88% YoY, but consolidated net profit declined 33.57% to ₹95 crore primarily due to ₹36.6 crore exceptional Labour Code charges. Strong patient volumes and ARPOB growth were offset by regulatory implementation costs across Medanta hospitals.

Revenue & Growth

Revenues expanded to ₹1,121 crore from ₹943 crore YoY, driven by 6.8% rise in average occupied bed days and improved ARPOB across cardiology, neurosciences, and oncology specialties. Total expenses surged 28.18% YoY to ₹987 crore, exceeding revenue growth due to one-time provisions and operational scaling.

Profitability & Margins

Consolidated net profit fell 33.57% YoY to ₹95 crore from ₹143 crore; profit before exceptional items declined 17.5% to ₹156 crore. Basic EPS dropped 33.46% to ₹3.54 from ₹5.32 as ₹36.6 crore Labour Code gratuity/leave provisions impacted results.

Balance-Sheet Highlights

The dataset lacks detailed balance sheet items such as assets, liabilities, equity, net debt, or current ratio for Q3FY26. 3.5 acres land possession received from Assam Industrial Development Corporation supports regional expansion.

Cash Flow / Liquidity

Operating cash flow, free cash flow, and liquidity metrics are not specified in the Q3FY26 dataset.

Key Ratios / Metrics

9M revenues reached ₹3,251 crore (+17.8% YoY) with PAT at ₹412 crore; occupancy sustained at 59%. Stock options granted to 605,500 employees signal continued talent investment amid capacity additions.