GlaxoSmithKline Pharmaceuticals Limited (GSK Pharma) is a leading pharmaceutical company focused on researching, manufacturing, and making available a broad range of medicines and vaccines that benefit people in India and globally. The company consistently delivers innovation and quality across its therapeutic portfolio.

(Source: Company Website)

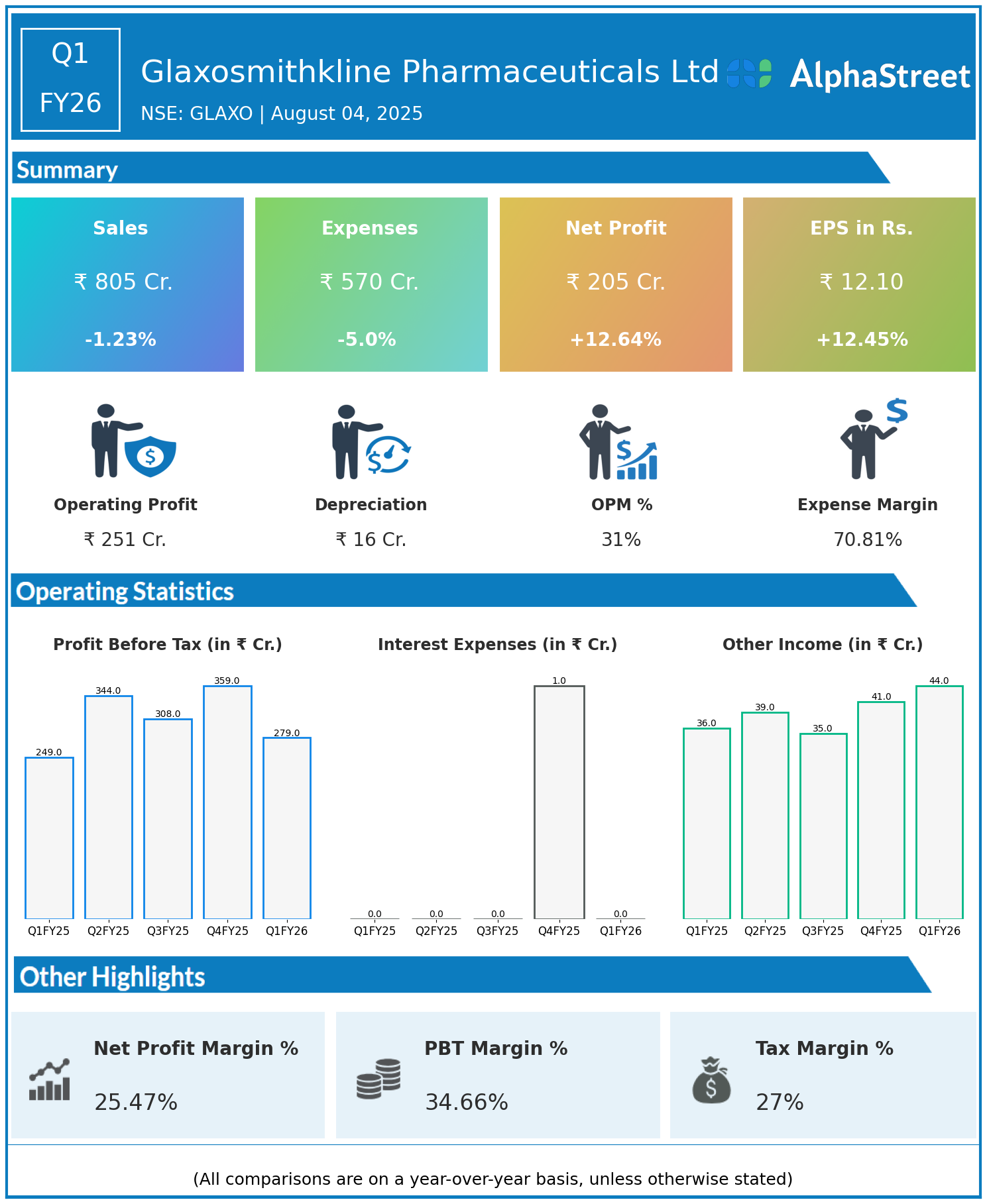

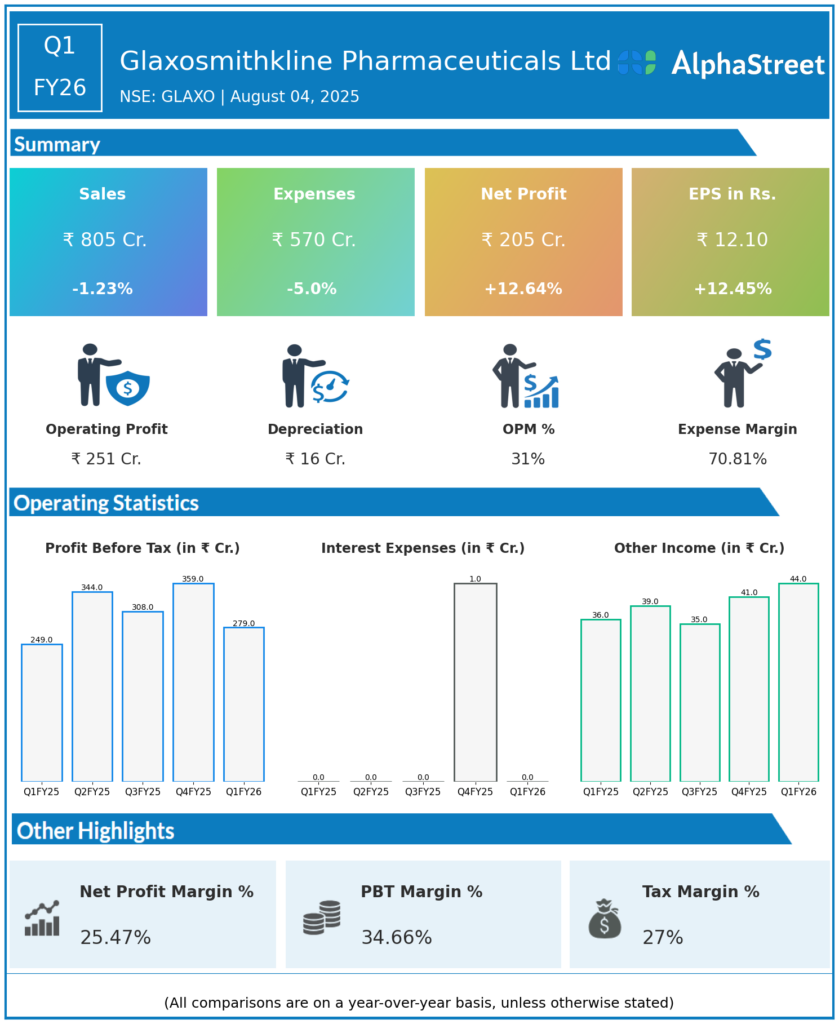

Q1 FY26 Earnings Summary (Apr–Jun 2025)

- Revenue: ₹805 crore, down 1.23% year-on-year (YoY) from ₹815 crore in Q1 FY25.

- Total Expenses: ₹570 crore, down 5.0% YoY from ₹600 crore.

- Consolidated Net Profit (PAT): ₹205 crore, up 12.64% from ₹182 crore in the same quarter last year.

- Earnings Per Share (EPS): ₹12.10, up 12.45% from ₹10.76 YoY.

Operational & Strategic Update

- Revenue Performance: Marginal decline in revenue reflects a stable demand base, with product mix and portfolio optimization balancing out market pressures.

- Expense Management: Robust 5% reduction in expenses demonstrates strong cost discipline, improved operational efficiencies, and strategic prioritization—enabling margin expansion.

- Profitability Growth: Solid increase in net profit and EPS despite steady revenues underscores efficient expense control, favorable mix of high-margin products, and a focus on operational improvement.

- Product Portfolio: GSK Pharma continues to focus on core therapy areas, strengthening both prescription brands and vaccines, leveraging trusted legacy products and introducing new launches.

- Innovation & Quality: Ongoing investment in research and global collaboration helps sustain the pipeline of innovative therapies and supports regulatory compliance.

- Strategic Initiatives: Expanded digital outreach, improved supply chain, and focus on customer engagement have contributed positively to performance.

Corporate Developments

Q1 FY26 demonstrates GlaxoSmithKline Pharmaceuticals’ resilience, with profitable growth driven by operational efficiencies and prudent cost management—even as revenue moderated. The company’s focus on its core therapeutic strengths and patient-centric approach underpins its continued market leadership.

Looking Ahead

GlaxoSmithKline Pharmaceuticals Ltd is well-positioned to sustain profitability through new product launches, further cost optimization, and by deepening engagement in the Indian healthcare space. Continued innovation and expansion in vaccines and specialty medicines will be critical for future growth and stakeholder value creation through FY26 and beyond.