Gland Pharma Limited, established in Hyderabad, India in 1978, has evolved from being a contract manufacturer of small-volume liquid parenteral products to becoming one of the largest and fastest-growing injectable-focused companies in the world. With a presence in over 60 countries—including the United States, Europe, Canada, Australia, and India—the company operates primarily under a B2B model, boasting a strong track record in developing, manufacturing, and marketing complex injectables. It is promoted by Shanghai Fosun Pharma, a global pharmaceutical major. Presenting below are its Q1 FY26 Earnings Results.

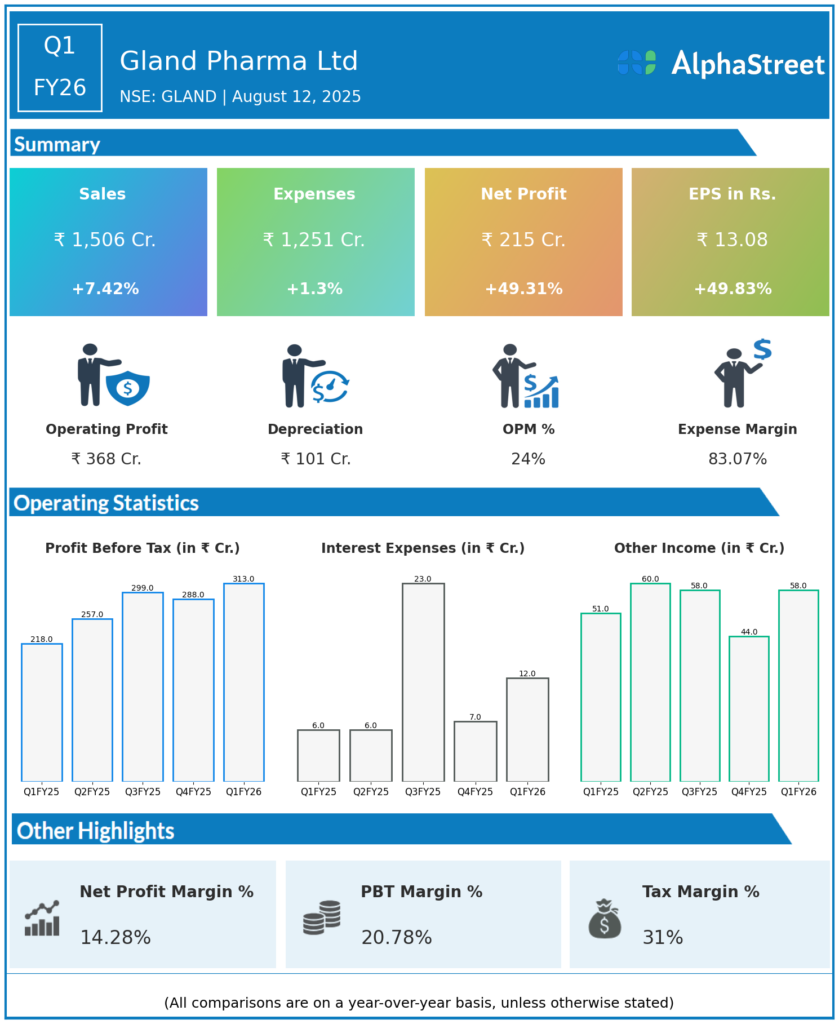

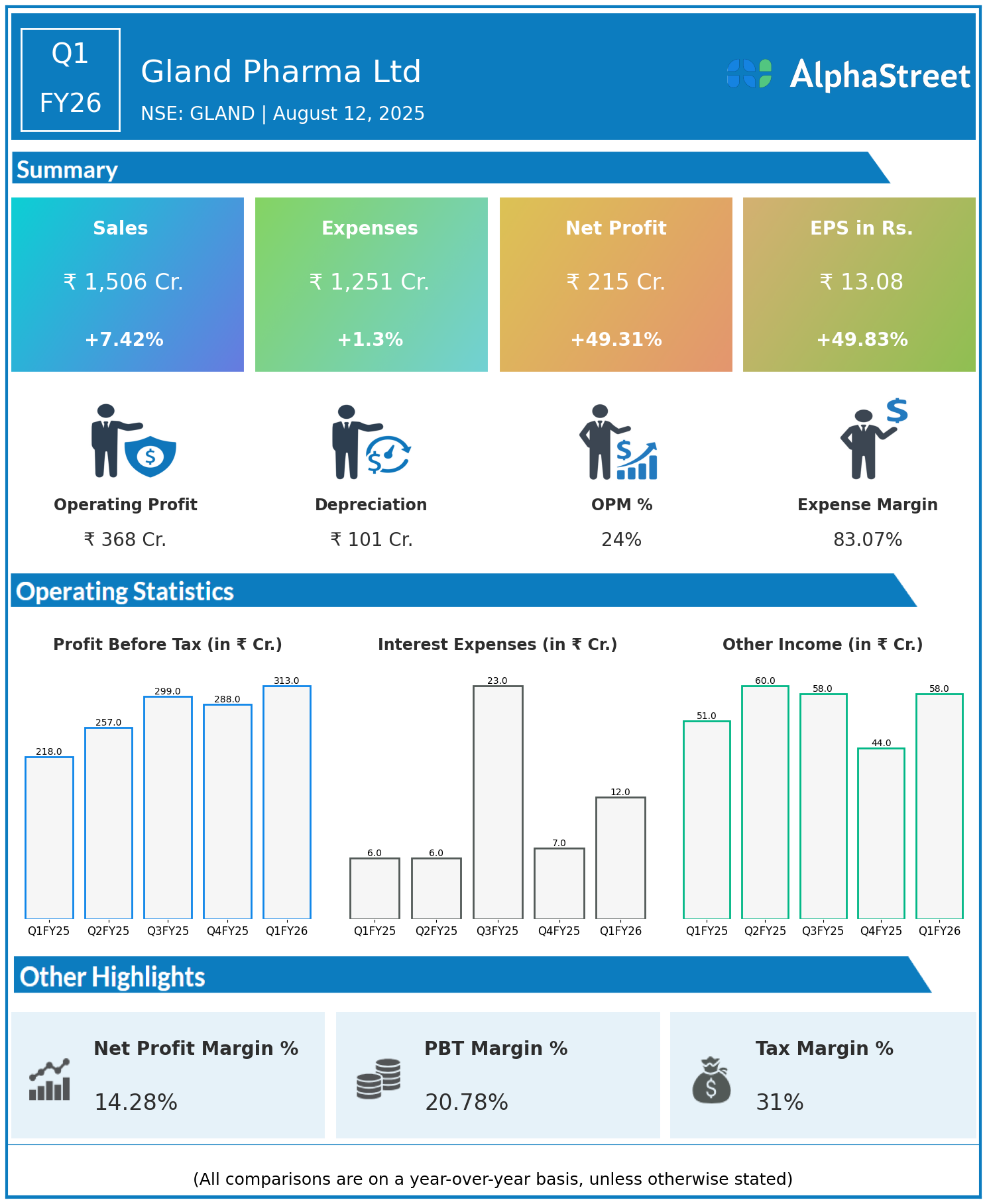

Q1 FY26 Earnings Results

- Revenue: ₹1,506 crore, up 7.42% year-on-year (YoY) from ₹1,402 crore in Q1 FY25.

- Total Expenses: ₹1,251 crore, up 1.3% YoY from ₹1,235 crore.

- Consolidated Net Profit (PAT): ₹215 crore, up 49.31% from ₹144 crore in the same quarter last year.

- Earnings Per Share (EPS): ₹13.08, up 49.83% from ₹8.73 YoY.

Operational & Strategic Update

- Revenue Growth: The 7% increase in revenue was driven by steady demand across regulated and emerging markets, buoyed by product launches and deeper penetration in key geographies.

- Controlled Cost Growth: Expenses grew by just 1.3%, significantly lower than revenue growth, reflecting strong operational efficiencies, supply chain optimization, and effective cost control measures.

- Strong Profitability Expansion: Net profit and EPS surged nearly 50%, supported by higher gross margins, favorable product mix, and improved manufacturing leverage.

- Global Market Focus: Gland Pharma continues to strengthen its injectable portfolio and deepen its market presence in the US, Europe, and emerging economies, capitalizing on its expertise in complex molecules and technologies.

- Innovation & Integration: The company is investing in R&D for niche sterile injectables and leveraging synergies with Fosun Pharma’s global network for new product development and market access.

Corporate Developments in Q1 FY26 Earnings

Q1 FY26 results highlight Gland Pharma’s ability to deliver robust profit growth despite moderate revenue expansion. Strategic efficiency measures and a focus on high-value products have significantly boosted profitability.

Looking Ahead

Gland Pharma Ltd aims to sustain growth by expanding its injectable portfolio, accelerating new product filings in regulated markets, and enhancing manufacturing capacities. The company’s strong pipeline, operational discipline, and global market reach are expected to drive continued margin expansion and shareholder value through FY26 and beyond.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel.