Gem Aromatics Limited (GEMAROMA.NS) shares fell in early trade on Tuesday after the specialty ingredients manufacturer reported a quarterly loss and a sharp drop in nine-month profit, weighed down by higher depreciation charges and subdued demand.

The stock was issued at ₹325 per share at its National Stock Exchange and BSE listing on Aug. 26, 2025. It has since traded well below its offer price and remains far from its 52-week high of ₹349.60, compared with a low of ₹133.00. The company’s market capitalization stood at about ₹7.9 billion, according to market data.

Earnings Pressure From Depreciation

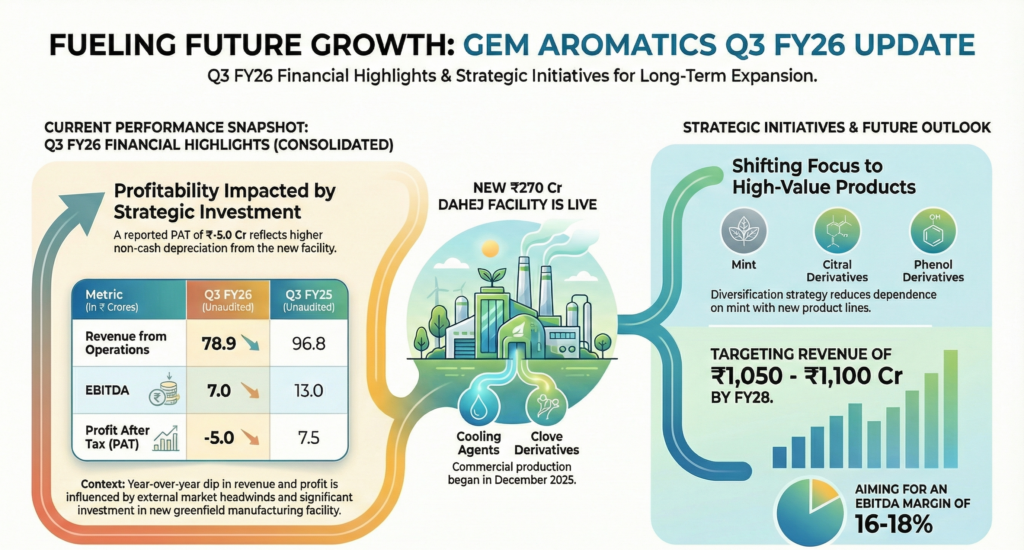

For the quarter ended Dec. 31, 2025, Gem Aromatics reported consolidated revenue from operations of ₹789.03 million, down from ₹968.44 million a year earlier. The company posted a consolidated net loss of ₹49.94 million, versus a profit of ₹74.57 million in the year-ago quarter.

On a standalone basis, the company remained profitable with net profit of ₹42.08 million, though earnings declined year on year.

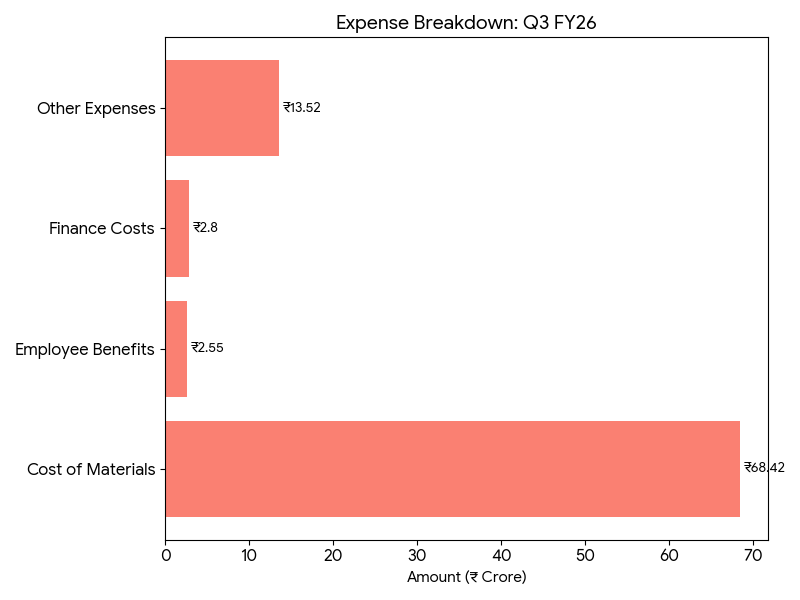

The consolidated loss was largely driven by a non-cash depreciation charge of ₹87.1 million, following the capitalization of around ₹2,500 million in capital expenditure related to its new Dahej greenfield facility.

Margins Contract Amid Weak Volumes

Profitability weakened during the quarter. EBITDA margin contracted to 8.9% from 13.5% a year earlier, while gross margin declined to 23.0% from 25.8%, reflecting lower volumes and pricing pressure.

For the nine months ended December 2025, consolidated revenue declined to ₹2,560.61 million from ₹3,017.38 million in the year-ago period. Nine-month consolidated profit fell to ₹4.11 million, compared with ₹257.79 million a year earlier.

Demand Headwinds Persist

The company said quarterly revenue was affected by tariff-related uncertainty and GST-related changes, prompting customers to defer procurement and draw down inventories. Management noted a gradual recovery in mint prices and improved customer inquiries toward the end of the quarter, though demand conditions remained cautious.

Product Mix & Competition

Gem Aromatics operates across mint, clove and synthetic aroma chemicals, offering more than 80 products and serving 225 domestic and 44 international customers across 18 countries, including Colgate-Palmolive, Symrise, Dabur and Patanjali.

The company is expanding into higher-value specialty chemistries, including citral and phenol derivatives, to reduce dependence on mint-linked pricing. Commercial production of WS-23 and WS-03 cooling agents began at the Dahej facility in December, with limited volumes in the quarter.

Outlook & Coverage

Gem Aromatics has outlined a long-term revenue target of ₹10,500–11,000 million by FY28, with expected EBITDA margins of 16–18%, driven by capacity ramp-up and product mix changes. There were no analyst upgrades, downgrades or price-target changes following the board meeting held on Jan. 27, 2026, which concluded at 4:05 p.m. local time.

Bottom Line

Gem Aromatics’ near-term earnings remain under pressure from weak demand and higher depreciation, leaving execution at its new Dahej facility key to restoring margins and growth.