Executive Summary

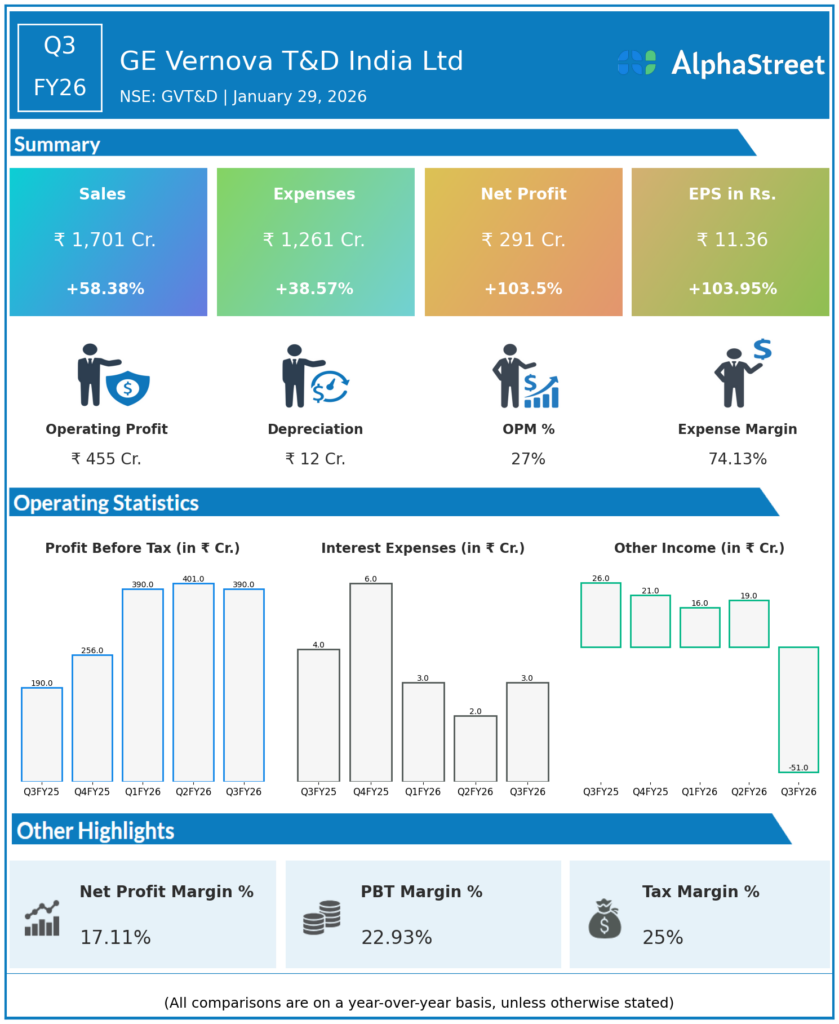

GE Vernova T&D India Ltd reported Q3FY26 revenues of ₹1,701 crore, up 58.38% YoY, with consolidated net profit surging 103.5% to ₹291 crore. Total expenses rose 38.57% YoY to ₹1,261 crore, reflecting exceptional operating leverage in transmission equipment.

Revenue & Growth

Revenues jumped to ₹1,701.00 crore in Q3FY26 from ₹1,074.00 crore YoY, marking 58.38% growth. Total expenses increased 38.57% YoY to ₹1,261.00 crore, significantly trailing revenue expansion.

Profitability & Margins

Consolidated net profit more than doubled, up 103.5% YoY to ₹291.00 crore from ₹143.00 crore. Basic EPS rose 103.95% to ₹11.36 from ₹5.57.

Balance-Sheet Highlights

The dataset lacks detailed balance sheet items such as assets, liabilities, equity, net debt, or current ratio for Q3FY26.

Cash Flow / Liquidity

Operating cash flow, free cash flow, and liquidity metrics are not specified in the Q3FY26 dataset.

Key Ratios / Metrics

Gross, EBITDA, and PAT margins are unavailable. Net debt/EBITDA cannot be computed without debt and EBITDA figures. QoQ changes for revenue, EBITDA, and PAT are not provided.