Executive Summary

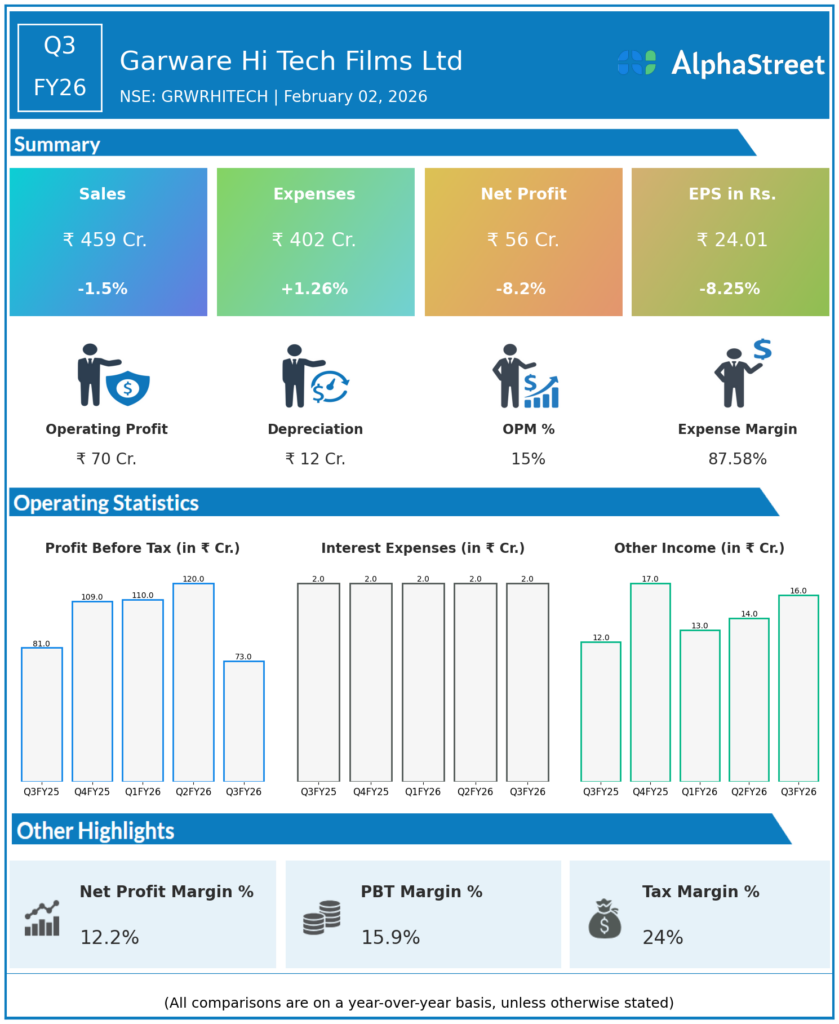

Garware Hi-Tech Films Ltd reported Q3FY26 revenues of ₹459 crore, down 1.5% YoY, with consolidated net profit declining 8.2% to ₹56 crore amid modest expense rise. Global trade pressures and seasonal factors impacted surface protection films, though strategic UAE expansion and D2C launches signal growth focus.

Revenue & Growth

Revenues contracted slightly to ₹459.00 crore in Q3FY26 from ₹466.00 crore YoY, reflecting 1.5% decline due to international market headwinds. Total expenses edged up 1.26% YoY to ₹402.00 crore, squeezing operating leverage in polyester films.

Profitability & Margins

Consolidated net profit fell 8.2% YoY to ₹56.00 crore from ₹61.00 crore, with EBITDA at ₹86.7 crore (down 7.4% YoY) and margins at 18.9%. Basic EPS declined 8.25% to ₹24.01 from ₹26.17; 9M FY26 PAT down 9.2% to ₹230 crore.

Balance-Sheet Highlights

The dataset lacks detailed balance sheet items such as assets, liabilities, equity, net debt, or current ratio for Q3FY26.

Cash Flow / Liquidity

Operating cash flow, free cash flow, and liquidity metrics are not specified in the Q3FY26 dataset.

Key Ratios / Metrics

EBITDA margin stable at 18.9% despite revenue softness; 9M revenue down 2.4% YoY to ₹1,523 crore. New UAE subsidiary and Garware Home Solutions D2C launch enhance MENA exports and domestic architectural films.