Stock Data:

| Ticker | NSE: GRWRHITECH |

| Exchange | NSE |

| Industry | COMMERCIAL SERVICES & SUPPLIES |

Price Performance:

| Last 5 Days | +18.83 % |

| YTD | +61.82 % |

| Last 12 Months | +36.82% |

Company Description:

Founded in Aurangabad, India, Garware Hi-Tech Films Limited has evolved from a diverse business portfolio to a focused specialist in specialty films. The company’s manufacturing facilities are equipped with state-of-the-art technology, allowing it to control its entire production process, from chips to films. This vertical integration grants GHFL a competitive edge in terms of quality control, customization, and cost efficiency. GHFL is renowned for its production of Solar Control Films (SCFs), Paint Protection Films (PPFs), and Shrink Films. GHFL has positioned itself as a market leader.

Segment Analysis:

Solar Control Films (SCFs): GHFL’s SCF division is gaining traction, especially in the domestic market. The re-introduction of the ‘Safety Glazing’ window film, known for its UV and heat rejection properties, has garnered substantial interest. Despite challenges in the European markets, the company’s proactive approach of investing in international markets has positioned it for growth and new customer acquisitions.

Paint Protection Films (PPFs): PPFs constitute one of GHFL’s standout segments, showcasing robust demand both domestically and globally. The company’s strategy of educating consumers about the benefits of PPFs has proven effective in driving growth. The rising popularity of electric vehicles (EVs) is anticipated to further boost demand for PPFs, as consumers seek to protect and enhance their EV investments.

Shrink Films: With dedicated production lines and capacity expansion, GHFL has established a strong foothold in the Shrink Film market. The commercialization of innovative products like ‘Pearl Float’ and ‘Solid White’ shrink films underscores the company’s adaptability and willingness to cater to evolving market needs. Additionally, GHFL’s transition to recyclable PET-based shrink films aligns with sustainability goals.

Critical Success Factors:

- Vertical Integration: Garware Hi-Tech Films benefits from a vertically integrated production process, enabling it to control the entire value chain from raw materials to finished products. This integration enhances quality control, reduces production costs, and ensures greater agility in responding to market demands.

- Market Leadership: The company holds a dominant position in the specialty films industry, backed by its strong global brand recognition and premium product offerings. This leadership status enables GHFL to command higher margins and customer loyalty.

- Innovative Product Portfolio: With a diverse range of products such as Solar Control Films (SCFs), Paint Protection Films (PPFs), and Shrink Films, GHFL caters to various industries and customer needs. This diversified portfolio minimizes revenue concentration risk and allows the company to tap into multiple revenue streams.

- Patented Technologies: GHFL’s portfolio of over 9 registered patents and pending patents underscores its commitment to innovation. These proprietary technologies provide the company with a competitive edge, setting its products apart in terms of performance, quality, and differentiation.

- Global Market Presence: The company’s international footprint extends to various markets, including the US, Europe, and emerging economies. This expansive global presence is facilitated by a robust distribution network and partnerships, enabling GHFL to tap into diverse customer bases.

- Strong Customer Relationships: GHFL has established enduring relationships with a wide range of customers, from automotive manufacturers to architects and distributors. These relationships are built on the foundation of quality products, reliability, and responsive customer service.

- Sustainability Focus: The company’s transition to eco-friendly products, such as recyclable PET-based Shrink Films, reflects its commitment to sustainability. This approach aligns with evolving consumer preferences and regulatory trends, enhancing GHFL’s market reputation.

- Research and Development: GHFL’s dedicated research and development efforts have led to product innovations and technological advancements. This emphasis on R&D ensures that the company remains at the forefront of industry trends, driving continuous growth and relevance.

- Quality Assurance: The company’s adherence to stringent quality control measures and its ISO 9001:2015 certification ensures the production of high-quality films. GHFL’s products are recognized for their durability, performance, and compliance with international standards.

- Strong Financial Performance: GHFL’s consistent financial performance, as evidenced by revenue growth and EBITDA margins, showcases its operational efficiency and ability to navigate industry challenges. The company’s strong balance sheet positions it well for capitalizing on growth opportunities.

Key Challenges:

- Market Volatility: GHFL operates in a dynamic market influenced by economic cycles and industry trends. Fluctuations in demand, changes in consumer preferences, and global economic conditions could impact the company’s revenues and profitability.

- Regulatory Challenges: The specialty films industry is subject to various regulatory standards and requirements, both domestically and internationally. Changes in regulations related to environmental standards, safety, or labeling could necessitate costly adjustments to GHFL’s operations and products.

- Intense Competition: The specialty films market is competitive, with numerous players vying for market share. The entry of new competitors, technological advancements, and pricing pressures could erode GHFL’s margins and market position.

- Dependence on Raw Materials: GHFL’s manufacturing process relies on raw materials such as polyester and other chemicals. Fluctuations in the cost and availability of these materials could impact the company’s production costs and profit margins.

- Geopolitical Factors: The company’s international operations expose it to geopolitical risks such as trade tensions, currency fluctuations, and political instability in key markets. These factors could disrupt supply chains, affect export volumes, and impact financial performance.

- Technological Disruption: Rapid technological advancements could render GHFL’s existing products or manufacturing processes obsolete. Failure to adapt to emerging technologies and market trends may hinder the company’s ability to remain competitive and relevant.

- Foreign Exchange Exposure: Given its global operations and exports, GHFL is exposed to foreign exchange risks. Fluctuations in exchange rates could impact the company’s revenues, expenses, and profitability when translated into its reporting currency.

- Customer Concentration: Dependence on a few key customers for a significant portion of revenues exposes GHFL to customer concentration risk. A loss of one or more major customers could have a substantial negative impact on the company’s financial performance.

- Supply Chain Disruptions: Disruptions in the supply chain, whether due to natural disasters, transportation issues, or supplier-related challenges, could lead to production delays, increased costs, and potential revenue losses.

- Environmental Impact: As a manufacturer, GHFL is subject to scrutiny regarding its environmental practices. Non-compliance with environmental regulations or reputational damage due to perceived environmental insensitivity could impact the company’s image and market perception.

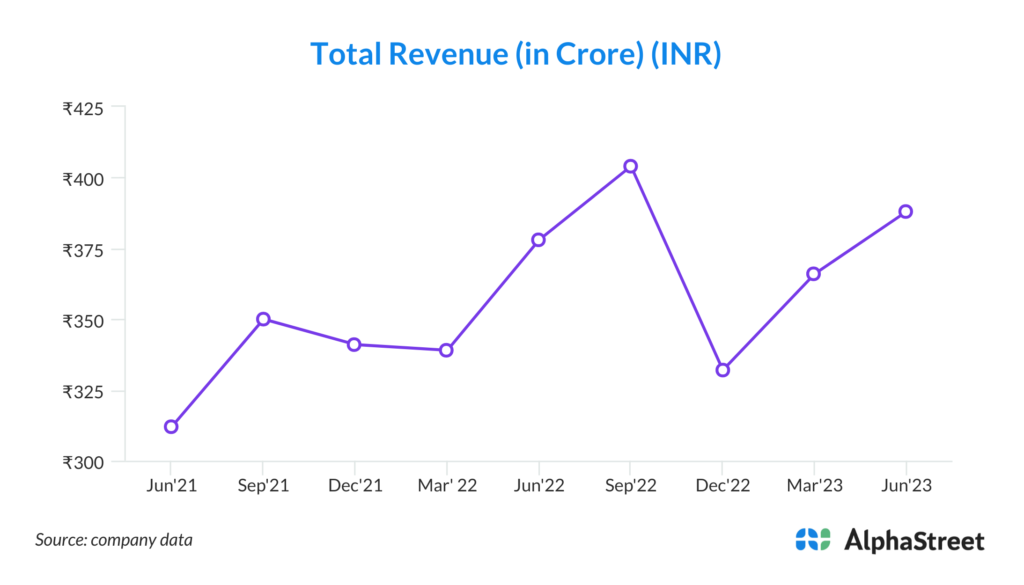

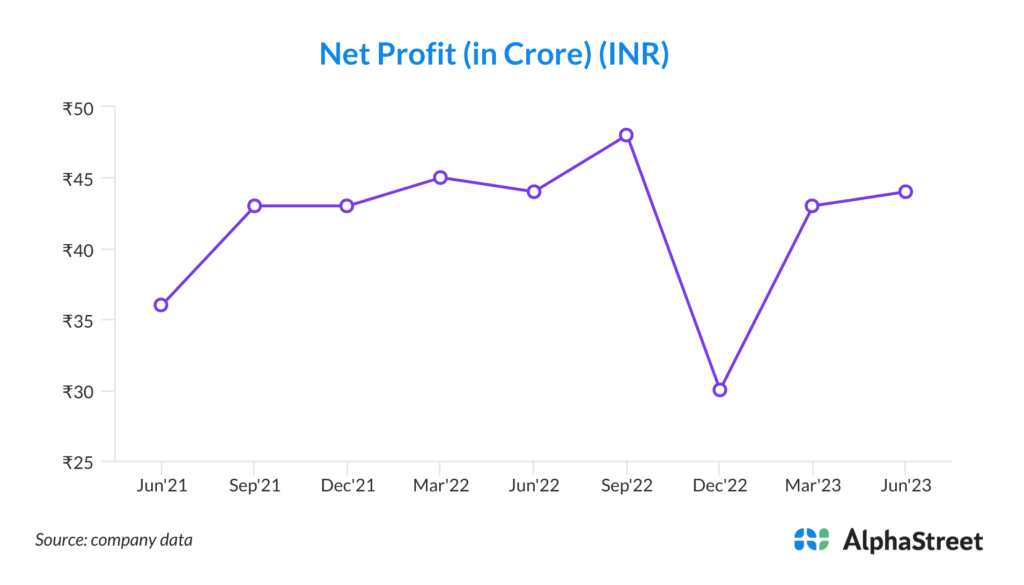

Financial Performance:

In Q1FY24, GHFL reported a revenue growth of 2.7% YoY, showcasing resilience amidst industry challenges. The specialty films segment’s prominence has shielded the company from the overcapacity concerns plaguing the broader poly film industry. EBITDA grew by 2.9% during the same period, reflecting prudent expense management and increased PPF volumes. The company’s strong financial position paves the way for future growth opportunities.

Conclusion:

Garware Hi-Tech Films Limited’s strategic transformation into a specialist in specialty films has positioned it for sustained success. The company’s performance across its business segments, robust financial position, and competitive advantages underscore its market leadership. As GHFL continues to expand its global footprint, introduce innovative products, and capitalize on emerging market trends, it remains poised for substantial growth. With its strategic vision and commitment to innovation, GHFL presents an attractive investment opportunity with significant potential for investors seeking exposure to the dynamic specialty films sector.