Gandhar Oil Refinery (India) Limited (NSE:GANDHAR), a leading manufacturer of specialty oils and petroleum products, has announced its unaudited standalone and consolidated financial results for the quarter and nine months ended December 31, 2025.

The board meeting, held on January 23, 2026, highlighted significant revenue growth, strategic land acquisitions for expansion, and the declaration of an interim dividend for shareholders.

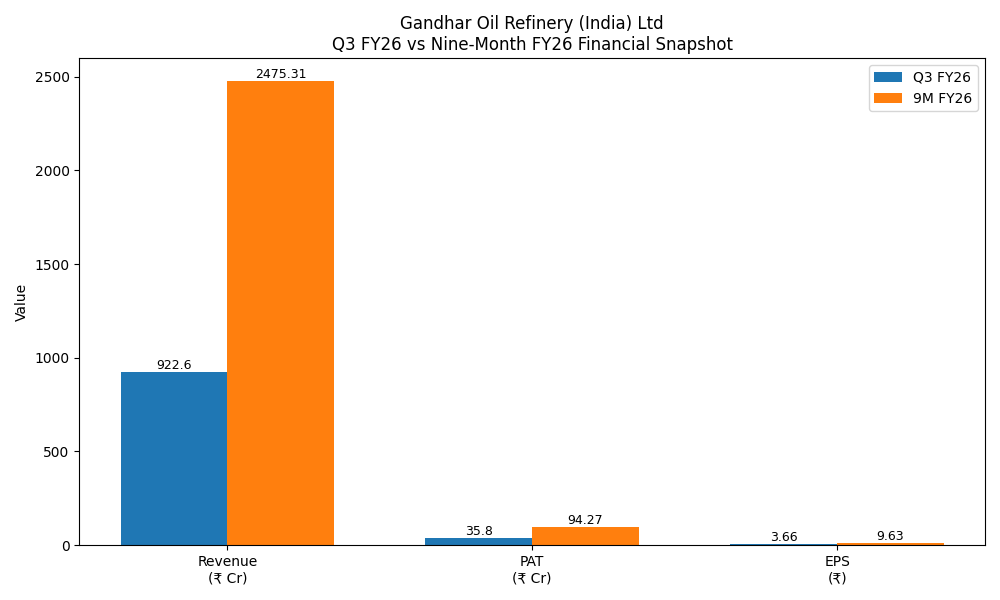

Key Financial Metrics (Consolidated)

The company demonstrated robust year-on-year performance across primary financial indicators.

- Revenue from Operations: Consolidated revenue for the nine months ended December 31, 2025, reached ₹3,129.93 crore, up from ₹2,935.20 crore in the same period last year. For the quarter ended December 31, 2025, revenue stood at ₹1,167.06 crore.

- Profit After Tax (PAT): Net profit for the nine-month period surged to ₹100.21 crore, compared to ₹71.22 crore in the corresponding period of 2024. Quarterly PAT was reported at ₹34.33 crore.

- Earnings Per Share (EPS): The basic and diluted EPS for the nine-month period increased to ₹9.68, up from ₹6.98 in the previous year.

- Interim Dividend: The Board declared an interim dividend of ₹0.75 per equity share (37.5% of the face value of ₹2 each) for FY 2025-26, with a record date set for January 30, 2026.

Business Updates and Strategic Moves

Gandhar Oil is actively pursuing its long-term expansion strategy to strengthen operational capabilities.

- Land Acquisition: The Board approved the purchase of a land parcel admeasuring 453.55 decimals adjoining its existing factory location. This acquisition, from Narmada Creations, is intended to support the company’s expansion goals.

- Asset Disposal: In a parallel move to optimize its portfolio, the company approved the sale of immovable property located in Mohali, Punjab. The transaction, expected to be completed by March 31, 2026, will yield a consideration of no less than ₹1.60 crores.

- IPO Proceeds Utilization: As of December 31, 2025, the company has fully utilized the net proceeds from its fresh issue (₹317.44 crore). Key allocations included funding working capital (₹185.01 crore), capital expenditure for Silvassa plant expansion (₹27.73 crore), and investment in its subsidiary, Texol Lubritech FZC (₹22.71 crore).

Market Perspective and Outlook

The company remains focused on its core segment of petroleum products and specialty oils. Its subsidiary, Texol Lubritech FZC, continues to be a significant contributor, reporting revenues of ₹661.95 crore and a net profit of ₹11.02 crore for the nine-month period. The strategic land purchase near its current factory indicates a clear focus on scaling production capacity to meet growing market demand. By cleaning up non-core assets and reinvesting in operational infrastructure, Gandhar Oil is positioning itself for sustained growth in the specialty chemicals and lubricant sector.