“We remain confident of complying with our cardinal principles that govern our business growth which are volume growth of 6% to 8% EBITDA growth being higher than volume growth and PAT growth being higher than EBITDA growth with return on capital employed in the 22% zone. The structural framework that has enabled our growth over decades remains the same and the volumes are an integral part of it. Therefore while we specifically would refrain from giving out an EBITDA per metric tons guidance for FY2024 it is safe to assume that your company will aspire to grow in terms of volumes as well as EBITDA for the coming year.”

– Unnathan Shekhar, Promoter & Managing Director

Stock Data

| Ticker | GALAXYSURF |

| Exchange | NSE & BSE |

| Industry | Specialty Chemicals |

Share Price

| Last 1 Month | 5.3% |

| Last 6 Months | -12.7% |

| Last 12 Months | -15.7% |

Business Basics

Galaxy Surfactants Limited is a leading manufacturer of specialty chemicals for the personal care and home care industries. The company offers a wide range of products that cater to various applications such as shampoos, soaps, detergents, and other personal care products. Galaxy Surfactants has a diverse portfolio of products, which enables it to serve a broad customer base and provide customized solutions to meet their specific needs.

The company operates through three main business segments: performance surfactants, specialty care products, and oleochemicals. The performance surfactants segment is the largest contributor to the company’s revenue, offering a range of products such as sulfonates, sulfates, and ether sulfates that are used in personal care, home care, and industrial applications. The specialty care products segment offers a range of products such as amphoteric surfactants, cationic surfactants, and fatty alkanolamides that are used in premium personal care and home care products. The oleochemicals segment offers natural fatty alcohols, fatty acids, and glycerine, which are used as raw materials in the manufacturing of surfactants and other products.

Galaxy Surfactants has a strong presence in India and also has manufacturing facilities in Egypt and the United States. The company has a global customer base and is known for its high-quality products, reliable supply chain, and customer-centric approach. The company’s commitment to sustainability has also helped it to build a reputation as a responsible corporate citizen. The company has a robust research and development program, and its state-of-the-art research and development center is equipped with advanced technology and equipment. This allows the company to develop innovative products and stay ahead of the competition. Galaxy Surfactants also has a strong focus on cost optimization, and its efficient manufacturing processes ensure that it can offer competitive prices to its customers.

Q3 FY23 Financial Performance

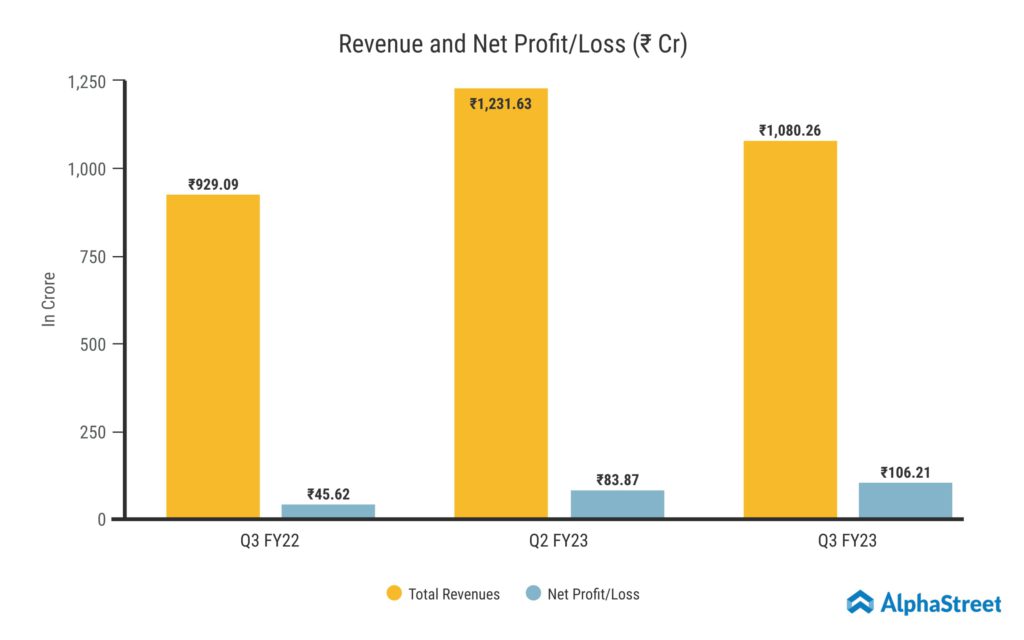

Galaxy Surfactants Limited reported Revenue from Operations for Q3 FY23 of ₹1,080.26 Crore up from ₹929.09 Crore year on year, a growth of 16.2%. The consolidated Net Profit of ₹106.21 Crore, up 132.8% from ₹45.62 Crore in the same quarter of the previous year. The Earnings per Share is ₹29.96 for this quarter.

Galaxy Surfactants’ Performance In Different Regions

In India, the volumes have grown 12% in Q3 and 7.7% for the nine months till December. The company is in course to cross the 100000 metric ton sales number for India. Africa, Middle East, and Turkey region have been a point of concern while volumes have declined 14.8% till December and 6% for the quarter due to the macroeconomic volatility. Nearly 10% of the volume decline on an aggregate level has been contributed by the AMET markets which have in turn been recouped by the growing India market thus ensuring to remain flat on an aggregate level. This quarter has seen AMET grow at 11% sequentially with the bulk of the growth coming from the local Egypt market. Volume momentum in AMET should make a comeback and the management remain optimistic about FY2024.

As per the management, “While in FY2020 and 2021 our volumes got impacted due to the pandemic. FY2022 supply chain issues further compounded in situation. As supply side factors started improving the contraction of demand in Europe and China this year adversely impacted our performance, while the challenges continue, we do see our performance improving significantly in FY2024. The optimism is based on consumption making a strong come back in Europe and developed markets warding of recession.”

Analysis Of India’s Speciality Chemicals Industry

The Indian chemical industry provides numerous opportunities for the development of at-scale businesses in a variety of specialty, inorganic, and petrochemical segments. The market for specialty chemicals in India is expected to reach $25 billion in 2021 due to the industry’s rapid growth. A report by KPMG India claims that the specialty chemicals market in India is expanding rapidly. From 2020 to 2025, the industry in India is anticipated to expand at a CAGR of more than 12%. Both domestic and foreign businesses have plenty of opportunities in this industry.

The growth of the industry is also fueled by increasing investments in R&D and technological advancements, leading to the development of new and innovative products. Moreover, the shift towards sustainability and the growing demand for eco-friendly products are expected to provide new growth opportunities for the industry.

The future potential of the specialty chemical industry in India is promising, as the demand for specialty chemicals is increasing in various end-use industries, such as pharmaceuticals, agrochemicals, and personal care products. Furthermore, the government’s initiatives to promote the domestic production of chemicals and reduce dependence on imports are expected to boost the growth of the industry.