GAIL (India) Ltd (NSE: GAIL) company reported a consolidated net profit of ₹1,729.13 crore for the quarter ended December 31, 2025. The Board of Directors simultaneously approved an interim dividend payment to shareholders, reflecting its current capital strength and commitment to shareholder value.

As of the closing date for the period ending December 31, 2025, the share price of GAIL (India) Limited [NSE, BSE] was ₹172. The company’s market capitalization stood at ₹113,125 crore.

Latest Quarterly Results and Highlights

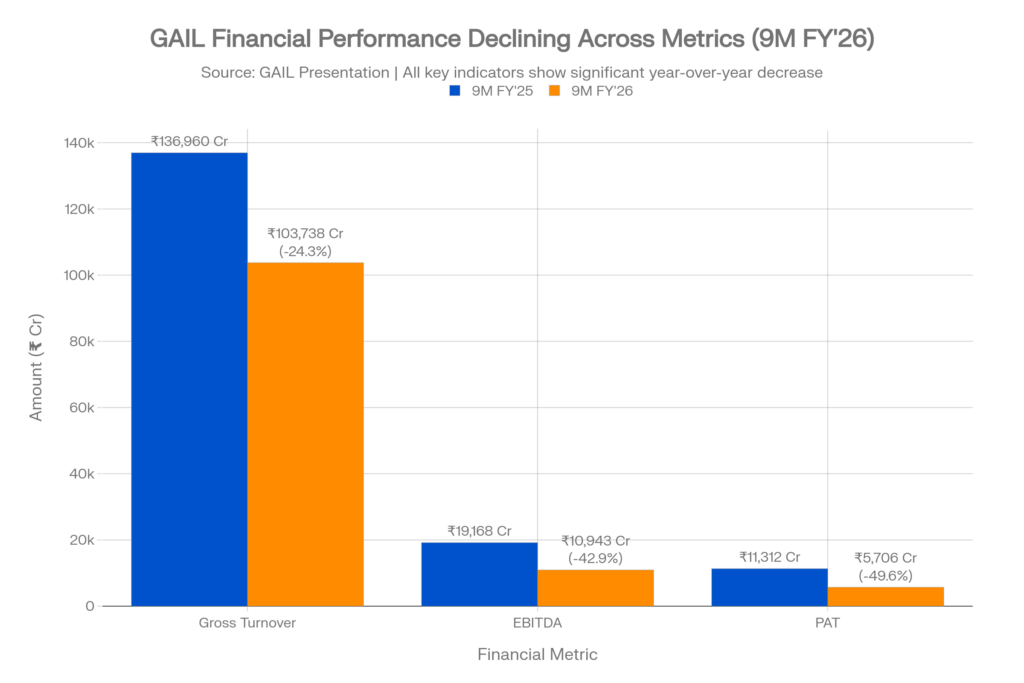

For the third quarter (Q3) of the 2025-26 fiscal year, GAIL reported a consolidated revenue from operations of ₹35,302.76 crore. This represents a decrease compared to the ₹36,937.05 crore reported in the corresponding quarter of the previous year. Consolidated Profit After Tax (PAT) for Q3 FY26 was ₹1,729.13 crore, down from ₹4,084.24 crore in Q3 FY25. On a standalone basis, the net profit for the quarter was ₹1,602.57 crore.

Interim Dividend and Shareholder Value

The Board of Directors declared an interim dividend of ₹5.00 per equity share on January 31, 2026. The total dividend payout amounts to ₹3,287.55 crore. The record date for this payment is fixed for February 5, 2026.

Company Profile and Business Model

GAIL (India) Limited is a Government of India Undertaking and a Maharatna Company. The company’s business model is integrated across the natural gas value chain. It operates through several business verticals, including natural gas transmission, natural gas marketing, petrochemicals, LPG, and liquid hydrocarbons. The company also holds interests in city gas distribution (CGD), exploration and production (E&P), and renewables.

Performance by Business Vertical

• Natural Gas Transmission: The segment achieved an average throughput of 125.45 MMSCMD in Q3 FY26. Segment revenue for this vertical was ₹2,760.81 crore.

• Natural Gas Marketing: This vertical remains the largest revenue contributor, generating ₹35,228.51 crore on a consolidated basis during the quarter.

• Petrochemicals: Segment revenue was ₹2,020.91 crore for Q3 FY26. The segment reported a loss before interest and tax of ₹482.64 crore for the quarter.

• LPG and Liquid Hydrocarbons: Revenue for this segment stood at ₹973.44 crore.

Operational Scale and Market Leadership

GAIL maintains a leading position in India’s energy infrastructure. It handles 72% of the natural gas transmission market share in India as of the nine-month period ending December 2025. The company’s natural gas marketing portfolio is diversified, with 50% of the gas sourced from RLNG/Spot markets and 35% from APM/NAPM sources.

Robust Capital Strength and Growth Trajectory

As of December 31, 2025, GAIL reported a net worth of ₹68,290 crore. The debt-equity ratio remained stable at 0.25. Total assets were valued at ₹1,19,551 crore.

Core Growth Strategies and Strategic Expansion

The company is executing a significant capital expenditure plan to expand its infrastructure. The estimated CAPEX for FY 2025-26 is ~₹10,700 crore. Key investment areas include:

• Petrochemicals: 28% of total CAPEX.

• Pipelines: 26% of total CAPEX.

• Operational CAPEX & Others: 18% of total CAPEX.

• Net Zero/Renewables: 11% of total CAPEX.

Regulatory Milestones and Management Commentary

GAIL is currently contesting two provisional tariff orders issued by the Petroleum and Natural Gas Regulatory Board (PNGRB) before the Appellate Tribunal for Electricity (APTEL). Furthermore, the company has filed an appeal in the Supreme Court regarding a Central Excise duty demand of ₹2,889 crore related to the classification of ‘Naphtha’. Management maintains a favorable outlook on these legal matters and has treated them as contingent liabilities.

Future Outlook and Broader Industry Trends

The company continues to align with broader industry trends focusing on the expansion of the National Gas Grid and city gas networks. GAIL aims for Net Zero carbon emissions through its renewable energy investments. Major demand for natural gas continues to be driven by the fertilizer and CGD sectors, which account for 34% and 28% of supply respectively.

52-Week Context and Recent Trend

The share price has experienced fluctuations over the past year, moving from ₹183 in FY25 to ₹172 by December 2025. The Return on Capital Employed (ROCE) was reported at 11% for the 9-month period of FY26, compared to 17% for the full 2024-25 fiscal year.

Where Does GAIL (India) Ltd Stand Today?

GAIL remains the dominant player in India’s natural gas transmission sector with a pipeline network contributing ₹8,301.58 crore in revenue for the nine-month period ended December 31, 2025. The company holds a total financial indebtedness of ₹13,158.88 crore as of the same date.