Incorporated in 1958, Foseco India Limited is a leading manufacturer specializing in products for the metallurgical industry. The company produces additives and consumables that enhance the physical properties and performance of castings, serving critical roles in foundry operations and metal casting quality improvements.

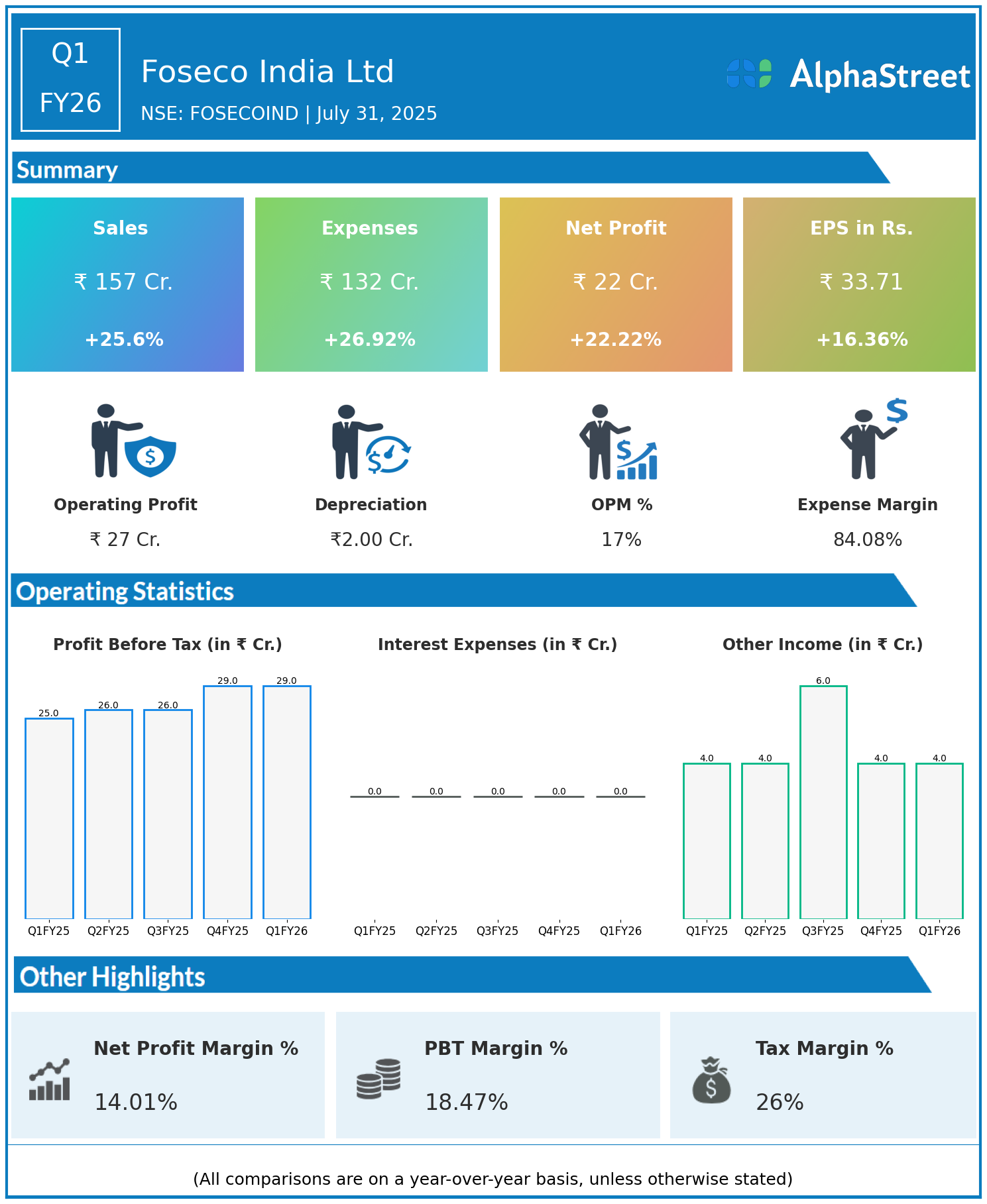

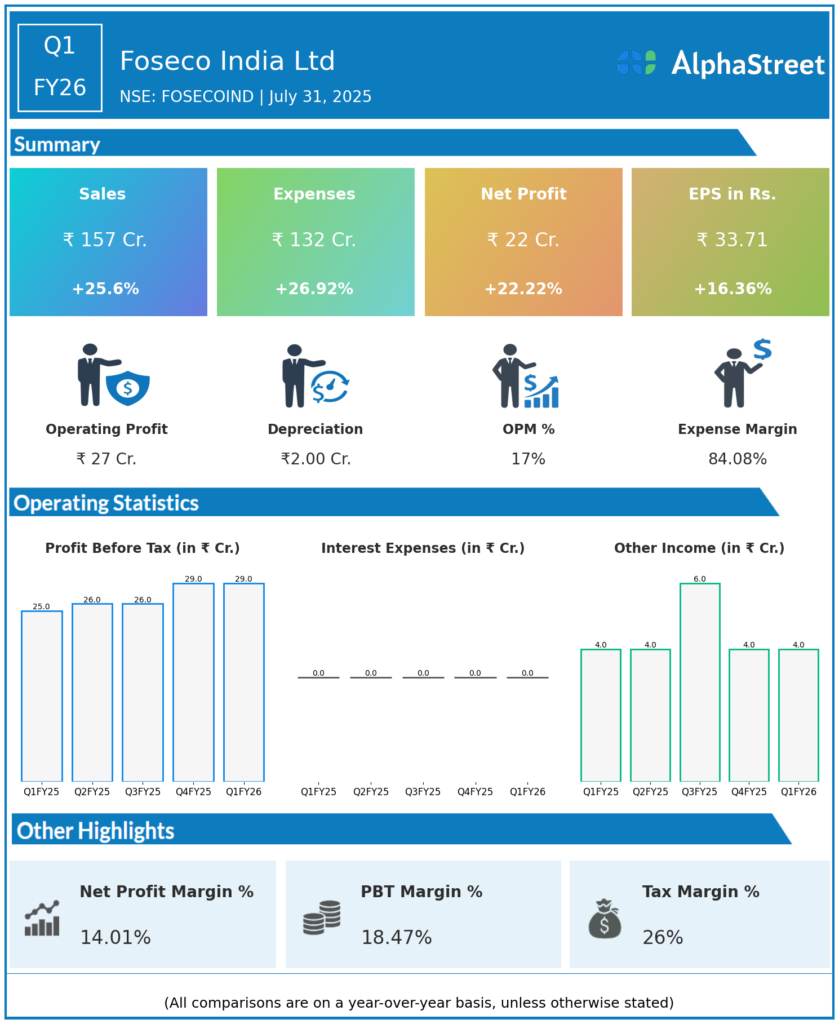

Q1 FY26 Earnings Summary (Apr–Jun 2025)

- Revenue: ₹157 crore, up 25.6% year-on-year (YoY) from ₹125 crore in Q1 FY25.

- Total Expenses: ₹132 crore, up 26.92% YoY from ₹104 crore.

- Consolidated Net Profit (PAT): ₹22 crore, up 22.22% from ₹18 crore in the same quarter last year.

- Earnings Per Share (EPS): ₹33.71, up 16.36% from ₹28.97 YoY.

Operational & Strategic Update

- Strong Revenue Growth: The significant increase in revenue was driven by higher demand across metallurgical segments, reflecting industrial recovery and increased focus on casting quality and performance enhancement products.

- Expense Growth: Total expenses rose slightly faster than revenue, impacted by higher raw material costs and operational scaling to meet increased demand.

- Profitability: Despite cost pressures, net profit increased solidly, indicating effective margin management and operational efficiencies. The EPS growth indicates enhanced shareholder returns.

- Product & Market Focus: Foseco India continues to innovate and supply critical foundry chemicals and consumables, supporting customers in automotive, engineering, and heavy industries.

- Technological Edge: Ongoing investments in R&D and adoption of new metallurgical technologies support superior product performance and customer satisfaction.

- Sustainability Commitment: The company emphasizes eco-friendly manufacturing processes and sustainable product formulations to meet evolving regulatory and environmental standards.

Corporate Developments

Q1 FY26 reflects a robust quarter for Foseco India Limited with healthy top-line growth and solid profitability improvement. The company’s focused approach in value-added metallurgical products and operational discipline underpin competitive strength in a specialized market.

Looking Ahead

Foseco India is well-positioned to capitalize on industrial growth trends and technological advancements in metallurgy. Continued investment in innovation, market expansion, and operational excellence will be key to sustaining growth momentum and enhancing shareholder value through FY26 and beyond.