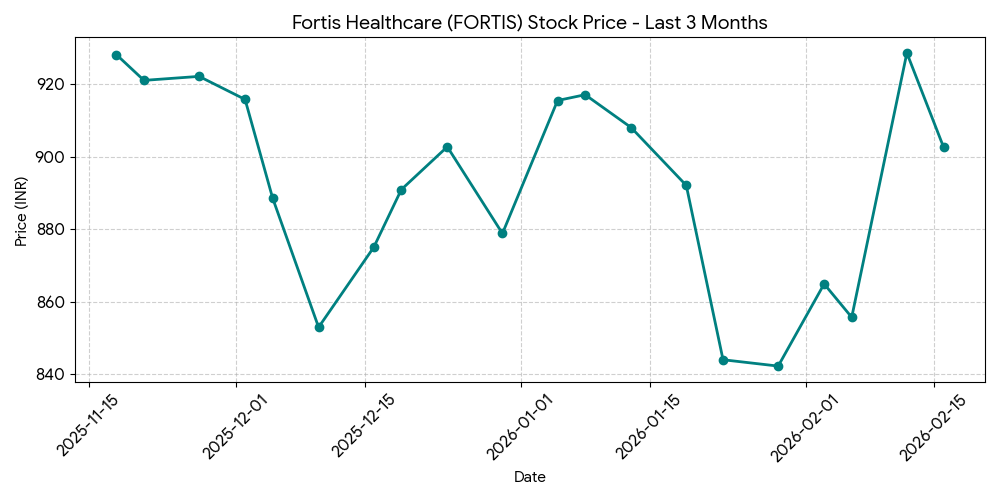

Fortis Healthcare Ltd (FORTIS) shares ended lower on the National Stock Exchange and Bombay Stock Exchange on Monday, February 16, 2026, following the disclosure of its third-quarter financial results. The stock closed at ₹916.75 on the NSE, representing an intraday decline of 1.23%. Trading volume for the session reached approximately 1.22 million shares as investors reacted to the interplay between operational growth and one-time statutory expenses.

Market Capitalization

As of the market close on February 16, 2026, the market capitalization of Fortis Healthcare Ltd stood at ₹69,236.89 crore (approximately $8.35 billion).

Latest Quarterly Results

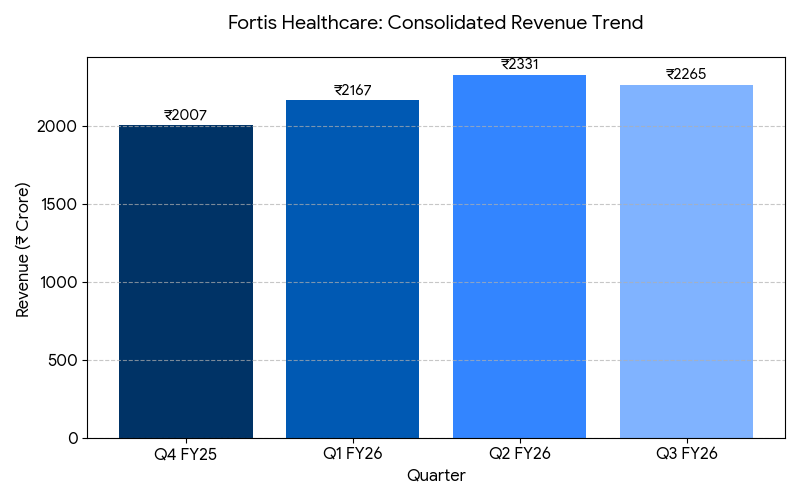

For the quarter ended December 31, 2025 (Q3 FY2026), Fortis Healthcare reported consolidated revenue from operations of ₹2,265 crore, a 17.5% increase compared to ₹1,928 crore in the corresponding quarter of the previous fiscal year. Consolidated net profit for the period was ₹197 crore, down 22% from ₹254 crore in Q3 FY2025. This bottom-line contraction was primarily attributed to an exceptional loss of ₹55.2 crore related to the implementation of new labor codes, partially offset by a ₹9.4 crore impairment reversal.

Segment Performance Highlights:

- Healthcare (Hospitals): Revenue grew 19.4% to ₹1,938 crore. Operating EBITDA for the segment rose 28.9% to ₹420 crore, with margins expanding to 21.7% from 20.0% year-over-year.

- Diagnostics (Agilus): Gross revenue increased 8.3% to ₹371 crore. The segment’s operating EBITDA surged 73.5% to ₹86 crore, resulting in a margin of 23.1%.

FINANCIAL TRENDS

Nine-Month Overview

For the nine-month period ended December 31, 2025, consolidated revenue reached ₹6,763 crore, a 17.1% increase from ₹5,776 crore in the previous year. Operating EBITDA for the same period rose 34.7% to ₹1,553 crore, with margins improving to 23.0% from 20.0%. Financial data for the period reflects a consistent upward trend in operational scale and margin expansion across both core business verticals.

Business & Operations Update

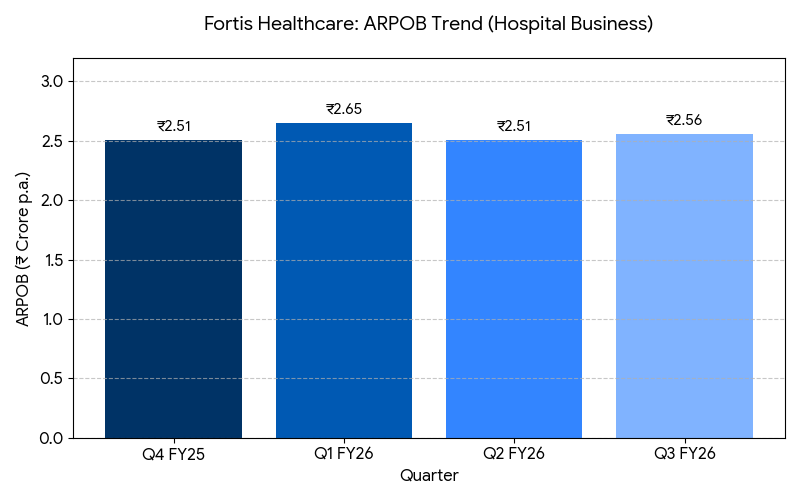

Fortis Healthcare expanded its operational footprint through the acquisition of the 125-bedded People Tree Hospital in Bengaluru for ₹430 crore in January 2026. This facility, located in Yeshwanthpur, includes adjacent land providing potential to scale to 300 beds. Additionally, the company launched ‘Adayu’, a 36-bedded specialized mental health facility in Gurugram, in November 2025. Hospital occupancy remained stable at 67%, while the Average Revenue Per Occupied Bed (ARPOB) increased 4.5% to ₹2.56 crore per annum.

M&A and Strategic Moves

The company completed the acquisition of a stake in Agilus Diagnostics and the purchase of Shrimann Hospital in Jalandhar. These investments contributed to an increase in net debt, which stood at ₹2,547 crore as of December 31, 2025, resulting in a net debt-to-EBITDA ratio of 1.24x, compared to 0.41x in the previous year.

Earnings Call Discussion

During the Q&A session with analysts, management addressed the impact of the new labor codes on employee benefit expenses and the timeline for brownfield expansions. Discussion points focused on the 27% growth in Renal Sciences and 20% growth in Orthopedics. Executives clarified that the Bengaluru acquisition is part of a cluster-led strategy to increase regional bed capacity to 1,500. Questions also pertained to the recovery of margins in the diagnostics business and the performance of the international patient segment, which saw a 26% revenue increase in the preceding quarter.

Guidance & Outlook

Management indicated a focus on brownfield expansion and the evaluation of inorganic opportunities in existing clusters. Key factors to watch include the progressive improvement of diagnostics margins and the integration of newly acquired facilities in Bengaluru and Jalandhar. The company is also navigating ongoing regulatory investigations by the Serious Fraud Investigation Office (SFIO) related to historical transactions.

Performance Summary

Fortis Healthcare stock closed 1.23% lower at ₹916.75 following its Q3 results. While consolidated revenue rose 17.5%, net profit declined 22% due to exceptional statutory costs. The hospital segment drove growth with a 19.4% revenue increase, supported by higher ARPOB and stable occupancy.