Fortis Healthcare Limited (FHL), incorporated in 1996, is a leading integrated healthcare service provider in India with 36 facilities and approximately 4,000 operational beds across India, Nepal, Dubai, and Sri Lanka. The company’s core verticals include hospitals, diagnostics, and day care specialty facilities. Presenting below are its Q1 FY26 Earnings Results.

Q1 FY26 Earnings Results

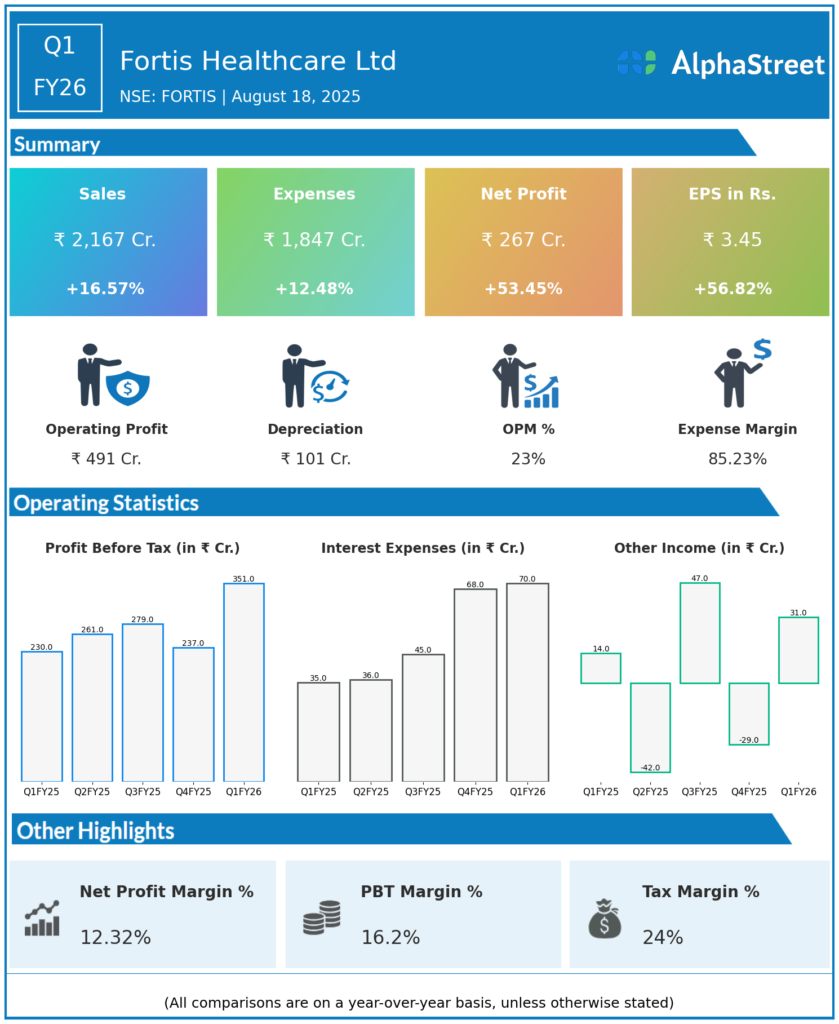

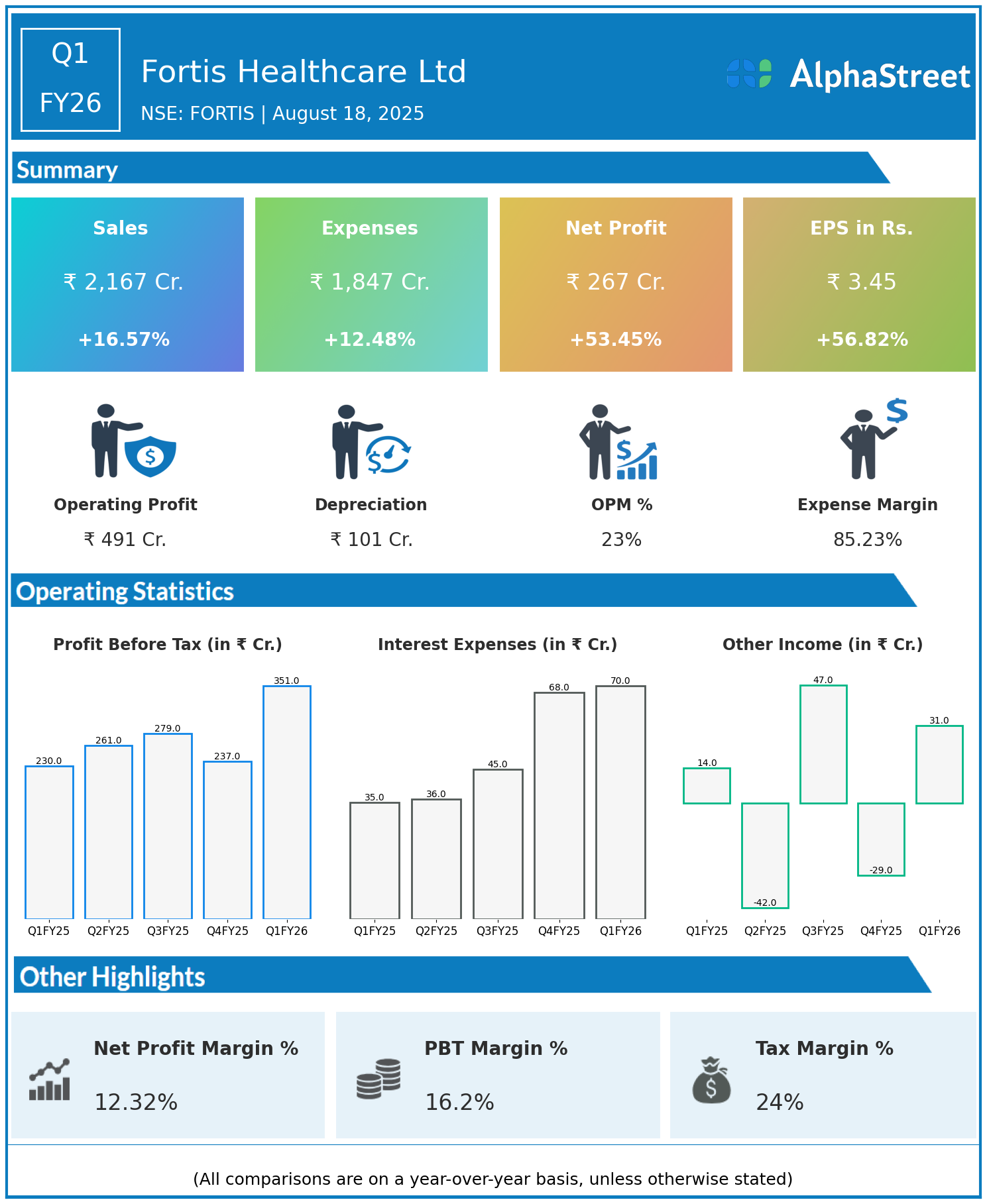

- Revenue: ₹2,167 crore, up 16.57% year-on-year (YoY) from ₹1,859 crore in Q1 FY25.

- Total Expenses: ₹1,847 crore, up 12.48% YoY from ₹1,642 crore.

- Consolidated Net Profit (PAT): ₹267 crore, up 53.45% from ₹174 crore in the same quarter last year.

- Earnings Per Share (EPS): ₹3.45, up 56.82% from ₹2.20 YoY.

Operational & Strategic Update

- Strong Revenue Growth: Double-digit increase in revenues driven by higher occupancy rates, increased operational capacity, and robust performance across hospitals and diagnostics.

- Controlled Expense Growth: Expenses rose at a slower pace than revenues, reflecting operational efficiencies and disciplined cost management.

- Significant Profit Expansion: Net profit and EPS surged over 53% and 56%, respectively, due to improved operating margins and a favorable business mix.

- Integrated Service Model: Fortis leverages a wide network of healthcare facilities and quality diagnostics, supporting leadership in both domestic and select international markets.

- Market Position: The company’s focus on specialty care, expansion of day care and diagnostic services, and investments in infrastructure have strengthened its positioning in India’s fast-growing healthcare sector.

Corporate Developments in Q1 FY26 Earnings

Q1 FY26 results reflect Fortis Healthcare’s continued operational momentum, driven by efficiency gains, service expansion, and market leadership in integrated healthcare delivery.

Looking Ahead

Fortis Healthcare Ltd aims to capitalize on healthcare demand through operational scale-up, expanding its specialty and diagnostics network, and further investments in technology and infrastructure. The focus remains on driving growth, improving margins, and enhancing shareholder value through FY26 and beyond.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel.