Kajaria Ceramics Limited (KAJARIACER.NS), India’s largest ceramic and vitrified tile manufacturer, has a market capitalization of approximately ₹140 billion. The company operates a total tile production capacity of 87.80 million square meters (MSM) across nine plants in India and Nepal. Key manufacturing hubs include Gailpur (35.95 MSM), Sikandrabad (8.80 MSM), and Morbi, where several subsidiaries operate at full capacity. Kajaria serves both domestic and select international markets through subsidiaries, although recent overseas showroom operations under Kajaria International DMCC were closed due to profitability challenges.

Shares of Kajaria were trading near ₹900 on Friday, up 0.5% intraday, below its 52-week high of ₹1,320 but above its 52-week low of ₹760, reflecting investor caution amid muted demand and sector-wide pricing pressure.

Financial Performance Overview

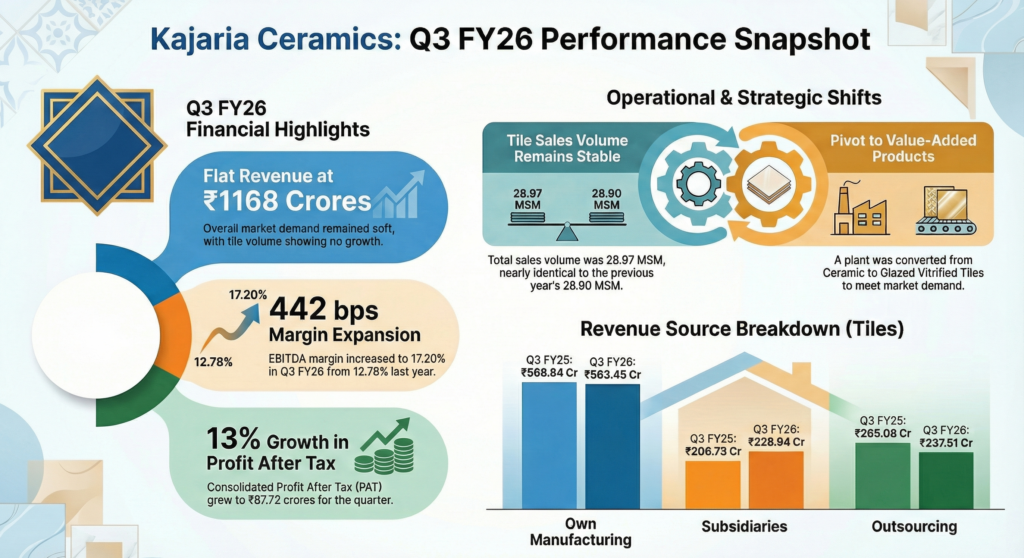

For the third quarter ended December 31, 2025 (Q3 FY26), the company reported consolidated revenue of ₹1,168.26 crore, broadly flat year-on-year from ₹1,163.71 crore in Q3 FY25. The stagnation was primarily due to flat tile volumes and the closure of the plywood division, which had previously contributed marginal revenue.

Despite flat top-line growth, EBITDA rose 35% to ₹200.90 crore, driven by cost management and a higher share of premium glazed vitrified products. The EBITDA margin improved to 17.20%, up from 12.78% in the prior year, although it declined slightly from Q2 FY26 by 74 basis points due to discounts offered to reduce stock-keeping units (SKUs).

Net profit was impacted by exceptional items, resulting in a consolidated bottom-line decline after accounting for ₹39.64 crore in charges, which included labor provisions, a financial fraud incident, and loan impairments related to international ventures.

Exceptional Items Impacting Profitability

- Labor Code Provisions: ₹18.30 crore provision for gratuity and compensated leave liabilities following consolidation of labor laws.

- Financial Fraud: Net loss of ₹19.36 crore due to embezzlement of ₹20.20 crore by the ex-CFO of Kajaria Bathware Private Limited at Kerovit Global Private Limited, partially offset by recoveries.

- Impairment Losses: ₹1.98 crore recorded on loans extended to Kajaria International DMCC, currently under liquidation.

These exceptional items suppressed net profit growth despite EBITDA margin expansion.

Nine-Month and Year-on-Year Context

For 9M FY26, Kajaria reported moderate revenue growth and improved profitability compared with the same period last year, largely driven by operational efficiencies and premium product focus rather than volume expansion.

In FY25, the company experienced limited revenue growth and margin pressure, reflecting high input costs and competitive pricing in the Indian tiles industry. FY26 has seen stabilizing margins but soft top-line growth, highlighting the cautious demand environment in residential and commercial construction.

Strategic Restructuring and Consolidation

Kajaria has undertaken multiple strategic initiatives to consolidate operations and improve subsidiary control:

- Wholly-Owned Subsidiaries: Acquisition of remaining shares in Kajaria Adhesive Private Limited (KAPL) for ₹25,000 and Kajaria Surfaces Private Limited for up to ₹1.20 crore.

- Plant Conversion: Gailpur plant converted from ceramic floor tiles to glazed vitrified tiles, aligning production with higher-value market demand (capacity: 9.10 MSM per annum).

- International Operations: Closure of showroom operations under Kajaria International DMCC due to high costs and low profitability.

- Discontinued Operations: Plywood business through Kajaria Plywood Private Limited was discontinued, with a net loss of ₹0.29 crore for Q3 FY26.

Operational Performance

Kajaria’s manufacturing units produced 15.66 MSM in Q3 FY26, broadly flat compared to the previous year. Production stability was supported by operational optimization across major plants, including subsidiaries in Morbi and Gailpur.

Leadership and Governance

Kajaria announced key management changes effective FY26-FY27:

- Mr. Ram Chandra Rawat, COO (A&T), Company Secretary, and Compliance Officer, will superannuate on March 31, 2026.

- Mr. Vinit Kumar, who has been with the company since 2016, will assume the roles of General Counsel, Company Secretary, and Compliance Officer from April 1, 2026.

As of December 31, 2025, the shareholding pattern remained stable: Promoters 47.69%, DIIs 26.30%, and FIIs 11.66%.

Sector and Competitive Environment

The Indian tiles and building materials sector remains under pressure from muted residential construction demand, cautious distributor inventory, and competition from Morbi-based manufacturers. While input costs such as fuel and logistics have eased, pricing power remains limited.

Kajaria maintains a scale and distribution advantage over competitors like Somany Ceramics and Orient Bell, with a diversified product portfolio and broad brand presence. However, flat volumes, margin pressure, and competitive intensity continue to challenge near-term profitability.

Market Outlook

Kajaria’s shares reflect investor caution on demand recovery, with recent margin improvements providing limited upside. Strategic initiatives, including plant conversion, subsidiary consolidation, and premium product focus, are expected to support sustainable EBITDA margins, but revenue growth remains contingent on sectoral recovery.