Finkurve Financial Services Limited (NSE: FINKURVE), which operates under the brand Arvog, reported a total income of 52.47 crore for the third quarter ended Dec. 31, 2025. This represents a 31.19% increase compared to the 40.00 crore reported in the same period of the previous fiscal year.

Profit before tax for the quarter reached 9.95 crore, up 27.25% from 7.82 crore in the corresponding quarter of the prior year. Net profit after tax for Q3 FY26 was approximately 6.98 crore after accounting for 2.97 crore in tax expenses.

Segment Highlights and Operational Metrics

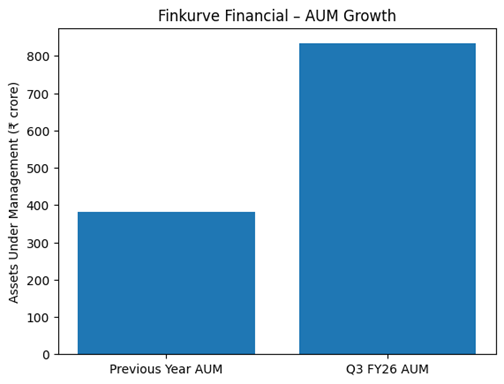

The company reported a shift in its lending focus, with retail gold loans accounting for 93% of the total loan book as of Q3 FY26. This is an increase from 89% in FY25 and 39% in FY23. Consolidated assets under management (AUM) rose to 833.15 crore, a 119% increase from 381.08 crore a year earlier.

Gold holdings under management increased 57% year-over-year to 970.57 kilograms. The company expanded its physical presence to 98 branches by the end of the quarter, compared to 72 branches in Q3 FY25. The average ticket size for gold loans stood at 1.52 lakh.

Total disbursements for the quarter were 1,374 crore, representing a 38% increase over the 995 crore disbursed in Q3 FY25. The active customer base grew 66% to 25,415 individuals.

Full-Year Context and Directional Trends

For the full fiscal year ended March 31, 2025, Finkurve reported a total income of 141.06 crore, compared to 90.27 crore in FY24. Annual profit before tax for FY25 was 23.62 crore, an increase from 21.22 crore in the previous year. Financial data indicates directional growth in total revenue and profitability over the last two fiscal years.

Business Update and Strategic Moves

Operational developments include the implementation of a proprietary loan origination and management system with built-in regulatory controls. The company also launched a lab-grown diamond (LGD) platform to address evolving market demand.

Strategic moves include a partnership with RBL Bank for the co-lending of gold loans. Finkurve previously divested from Arvog Forex to focus on its core retail lending segments. In the debt capital markets, the company executed a maiden raise of 49 crore through Non-Convertible Debentures (NCDs). Additionally, 111.5 crore was raised through a preferential issue of equity shares and warrants to promoters and non-promoters.

Outlook and Asset Quality

Developments to watch include the company’s cluster-led expansion strategy targeting Tier-2 and Tier-3 markets with high household gold holdings. The company is also maintaining a focus on underbanked locations to formalize credit through organized gold lending.

Asset quality metrics showed a decrease in Net Non-Performing Assets (NNPA) to 0.54% in Q3 FY26, down from 1.84% in Q3 FY25. The capital adequacy ratio stood at 39.3% as of the end of the quarter.

Performance Summary

Finkurve reported a 119% year-over-year increase in AUM to 833.15 crore. Retail gold loans now constitute 93% of the product mix. Total income for Q3 FY26 rose 31.19%. Net non-performing assets decreased to 0.54%. The company currently operates 98 branches across India.

I have created an infographic featuring charts that visualize Finkurve Financial’s AUM growth, the shift in its product mix toward gold loans, and the improvement in its Net Non-Performing Assets (NNPA) ratio. You can view and download this artifact in the Studio tab.