Everest Industries Limited (NSE: EVERESTIND), a forerunner in new-age building products, provides a comprehensive range of roofing, ceiling, wall, flooring, and cladding products. The product line includes a variety of roofing, flooring, and ceiling solutions in addition to steel building products like pre-engineered steel structures. The company has capacity to produce 9,50,000 metric tonnes of building products and 72,000 metric tonnes of steel building products each year. These products are distributed through a large network that includes 33 Sales Depots and 7000 Dealer Outlets that serve over 600 cities and 100,000 villages. Everest Industries is one of India’s top suppliers of building solutions due to its extensive manufacturing and distribution operations. Additionally, for every project, they offer thorough technical support in the form of designs, drawings, and implementation.

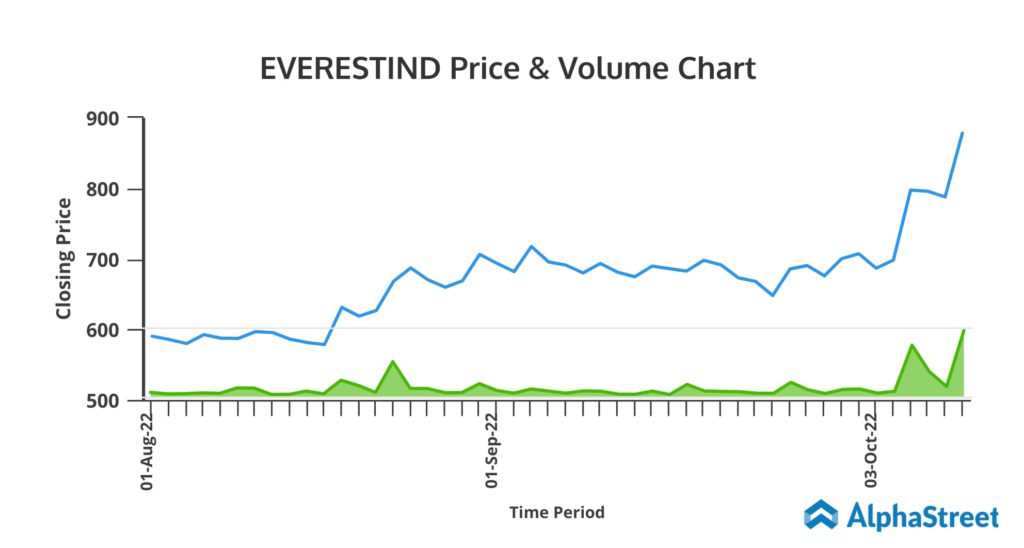

Recent Share Price Trend

- As of October 12, 2022, Everest Industries’ share price is ₹877, which is at its all time high.

Notably, the company’s share price jumped by 55% over the past year, while it recorded 10% negative returns over the past 6 months. - Notably, the company’s share price jumped by almost double over the past year, while it recorded 33% returns over the past 6 months.

Steel Building Segment yet to Surpass Pre-covid Level

The company operates through two business segments: Steel Buildings and Building Products. During the Covid period, the company’s business was affected. This resulted in a decrease in overall revenue.

For the most recent quarter, the overall Revenue from Operations was ₹452.57 Crore. Revenue for this quarter jumped by 4.7% over the pre-covid level (Q1FY20) of ₹432.18. Additionally, the Building Products segment increased by 11.2% over pre-COVID levels. Revenue of this segment grew up to ₹353.38 Crore from ₹317.75 Crore in the same period. The Steel Building segment, however, has not yet fully recovered. The segment’s revenue fell to ₹99.19 crore from ₹114.43 crore in the corresponding quarter of FY20.

Recent Financial Highlights

In Q1FY23, Everest Industries improved its consolidated revenue from operations by 20.9% year on year to Rs 452.57 crore from Rs 374.33 crore. Steel buildings segment primarily drove growth . This segment increased to ₹99.19 crore from ₹64.16 crore, a growth of 54% year over year. Additionally, the Building Product segment rose to ₹353.38 Crore from ₹310.17 Crore. Consolidated PAT for the first quarter was ₹21.2 crore, with a margin of 4.7%. The business had a meagre margin of 1.6% in previous year due to increased expenses.

Recent Highlights

The 134th State Level Single Window Clearance Committee (SLSWCC) meeting, held at the Karnataka Udyog Mitra office, approved 53 investment proposals totaling ₹2,750.55 crore. This also includes the ₹187 Crore investment proposal from Everest Industries.

Industries Minister Murugesh Nirani said, “Today’s clearance will further boost investments in the state in the run-up to the Global Investors’ Meet scheduled on November 2, 3 and 4.”

Industry Challenges & Analysis

The impact of the pandemic on the construction and building materials industries were most severe in 2020. The years 2021–2022 saw a significant recovery for the sector. Notably, building materials are currently estimated to be a $225 billion industry in India.

As newer economic sectors like hospitality, retail, entertainment, and education have emerged, the construction industry in India has expanded dramatically. The market has seen the introduction of numerous new building materials in addition to the expansion of the construction industry. However, the industry was under pressure from inflation at the start of this fiscal year, which was largely attributed to rising raw material prices. Globally, the short-term outlook for growth is poor, and higher inflation is anticipated. Conclude in a positive way.

Our View:

Due to the expansion of the Building Products segment, Total Revenue increased above its pre-Covid levels. The steel building segment, however, has not yet reached its pre-COVID growth level. The demand for construction materials will increase significantly over the long term. If Everest Industries is able to meet this demand, the Steel Building segment should expand, which will boost the company’s top line. However, investors should be cautious before investing as the company’s price looks overvalued.