Exide Industries Ltd (NSE: EXIDEIND) current market price is Rs. 362.2 as of December 31, 2025. The stock performance reflects a market capitalization of Rs. 30,787 crore. Equity analysis of the third quarter indicates revenue recovery following a second-quarter slowdown.

The company achieved record quarterly revenues in automotive segments following GST 2.0 reforms. Management maintains a debt-free balance sheet while advancing its multi-gigawatt lithium-ion cell manufacturing project in Bengaluru.

Financial Overview

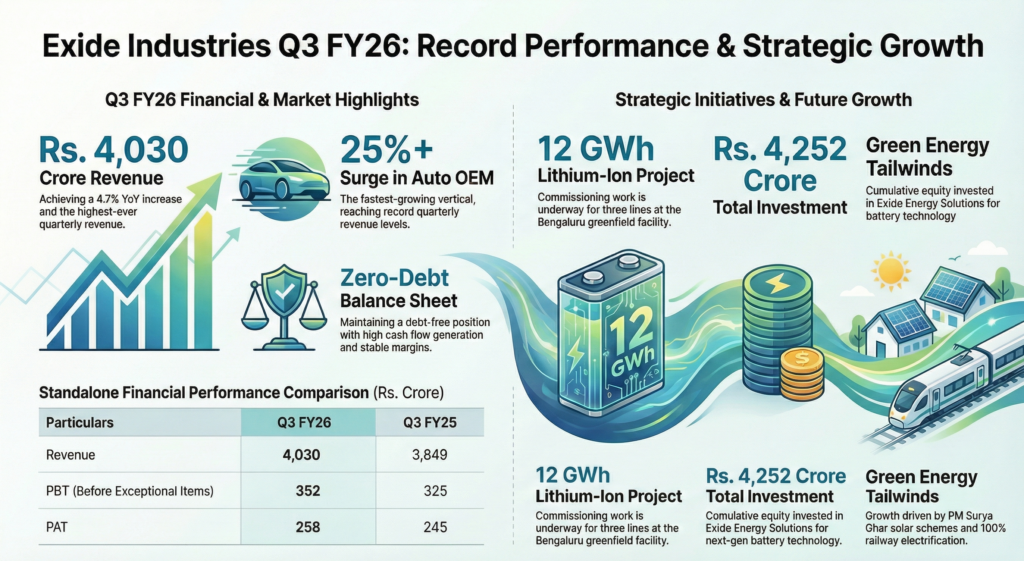

Exide Industries Limited reported standalone revenue of Rs. 4,030 crore for the quarter ended December 31, 2025, representing a 4.7% year-over-year increase. The growth was primarily driven by the automotive Original Equipment Manufacturer (OEM) and replacement markets. The company maintained an EBITDA margin of 11.7% despite rising raw material costs.

Company Profile

Exide Industries has a legacy of over 75 years in India. It manufactures lead-acid storage batteries ranging from 2.5Ah to 20,200Ah. The company operates 13 manufacturing plants and 3 lead recycling facilities. It maintains a presence in more than 60 countries. The firm has remained debt-free and profitable since its inception.

Latest Quarterly Results and Highlights

Standalone Profit Before Tax (PBT) before exceptional items grew 8.3% to Rs. 352 crore in Q3 FY26. Net Profit After Tax (PAT) for the quarter was Rs. 258 crore, up from Rs. 245 crore in the previous year. The 2W and 4W replacement business achieved its highest ever quarterly revenue. The Auto OEM vertical was the fastest-growing segment with over 25% year-over-year growth.

Guidance and Future Outlook

Management expects strong growth momentum to continue into the fourth quarter for both OEM and replacement segments. The outlook for the Inverters and Solar business is positive ahead of the peak season. The company is focusing on process automation to enhance operational efficiency and quality.

Regulatory Milestones and Segment Updates

GST 2.0 reforms provided a boost to the battery industry during the quarter. Automotive battery GST rates shifted from 28% to 18%, while solar power rates moved from 12% to 5%. An exceptional item of Rs. 9.04 crore was recorded to account for the incremental impact of new national Labour Codes. The Industrial Infrastructure segment, excluding telecom, showed double-digit growth due to railway electrification and data center demand.

Market Capitalization and Management Commentary

The company’s market capitalization stands at over Rs. 30,000 crore. Management indicates that macroeconomic conditions in India remain favorable with low inflation and positive consumer sentiment. However, high prices for metals like copper, silver, and tin are creating cost pressures. The corporate priority remains managing profitable growth and preserving cash.

Broader Industry Trends

The automotive industry saw mid-to-high teen production volume growth across segments. There is an increasing trend toward 100% railway electrification and rising demand for data centers. The lithium-ion sector is expanding to serve electric mobility and stationary storage applications.

Business Model and Market Situation

Exide operates a diversified portfolio serving automotive, power, telecom, and infrastructure sectors. It utilizes a nationwide network of over 100,000 dealers and distributors. The current market situation involves high raw material costs and rupee depreciation, which the company offsets through cost excellence projects.

Performance by Business Vertical and Key Segment Developments

• Auto OEM: Achieved highest ever quarterly revenue.

• Replacement: Double-digit growth on a year-over-year basis.

• Industrial Infra: Order inflow picked up in traction and railway sectors.

• Exports: Experienced a decline due to tariff-linked challenges in specific markets.

Core Growth Strategies, Strategic Expansion, and Interim Dividend

Core strategies include targeting “white spaces” in regional channels and leveraging existing technical collaborations. Strategic expansion is focused on the lithium-ion cell cylindrical line, where product validation trials have commenced. The board recently approved further investment of up to Rs. 1,400 crore in EESL to meet funding requirements for the Bengaluru facility.

Operational Scale, Market Leadership, and Robust Capital Strength

Exide maintains high market share across all business verticals. Its capital strength is supported by zero debt and high cash flow generation. The company has achieved a sales CAGR of over 10% during the last five years.

Shareholder Value and Growth Trajectory

The company has delivered PAT exceeding Rs. 1,000 crore for two successive years. Inventory levels have been optimized to 95 days, down from 110 days in the previous period. The growth trajectory is supported by new product launches, including EL Ultra premium batteries and solar grid-tie inverters.

Where Does Exide Industries Ltd Today?

The company holds a leadership position in the Indian lead-acid battery market. It is currently in the advanced stages of establishing a 12 GWh greenfield lithium-ion cell manufacturing facility in Bengaluru. Total equity investment in its subsidiary, Exide Energy Solutions Limited (EESL), reached Rs. 4,252.23 crore by January 2026.