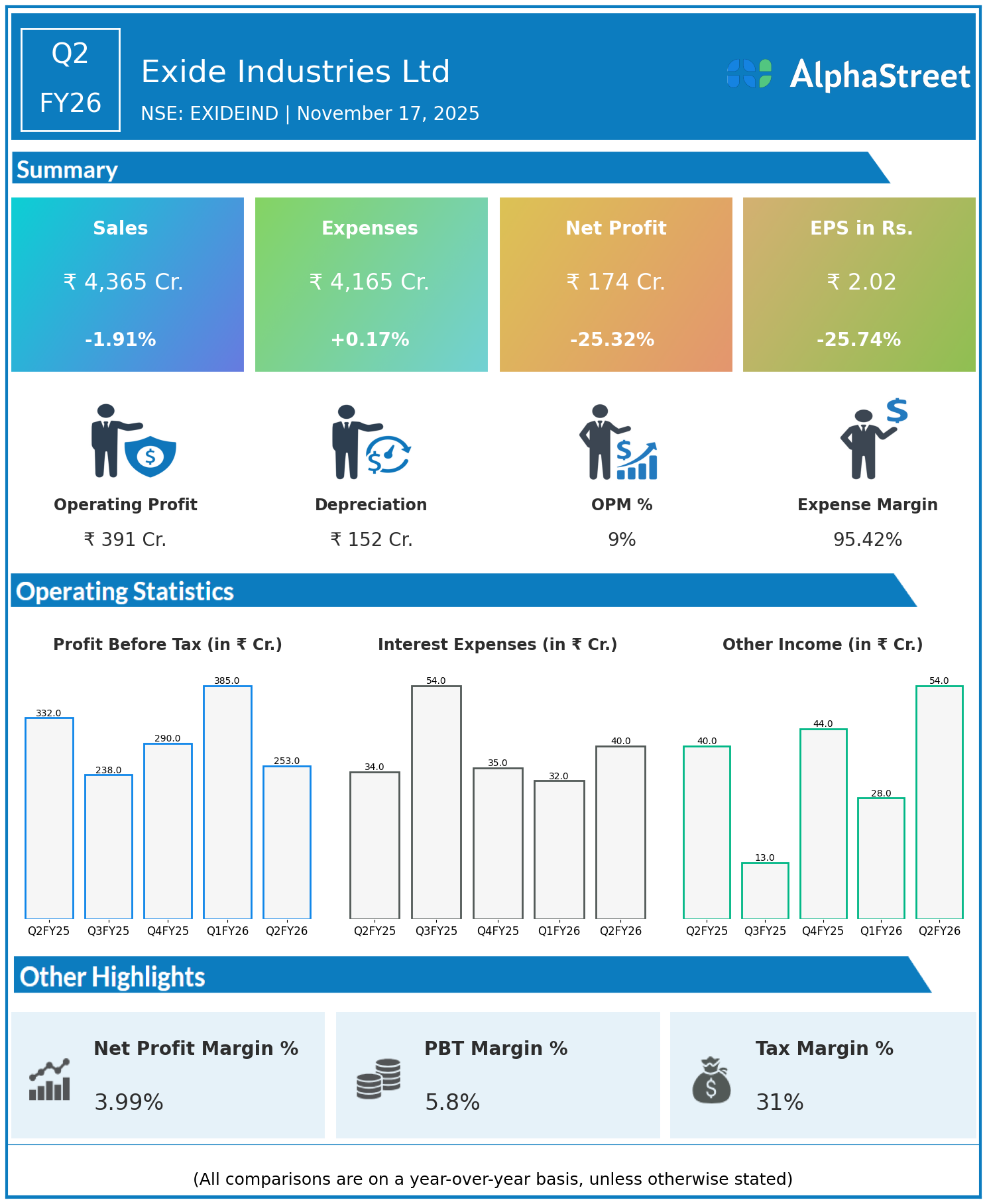

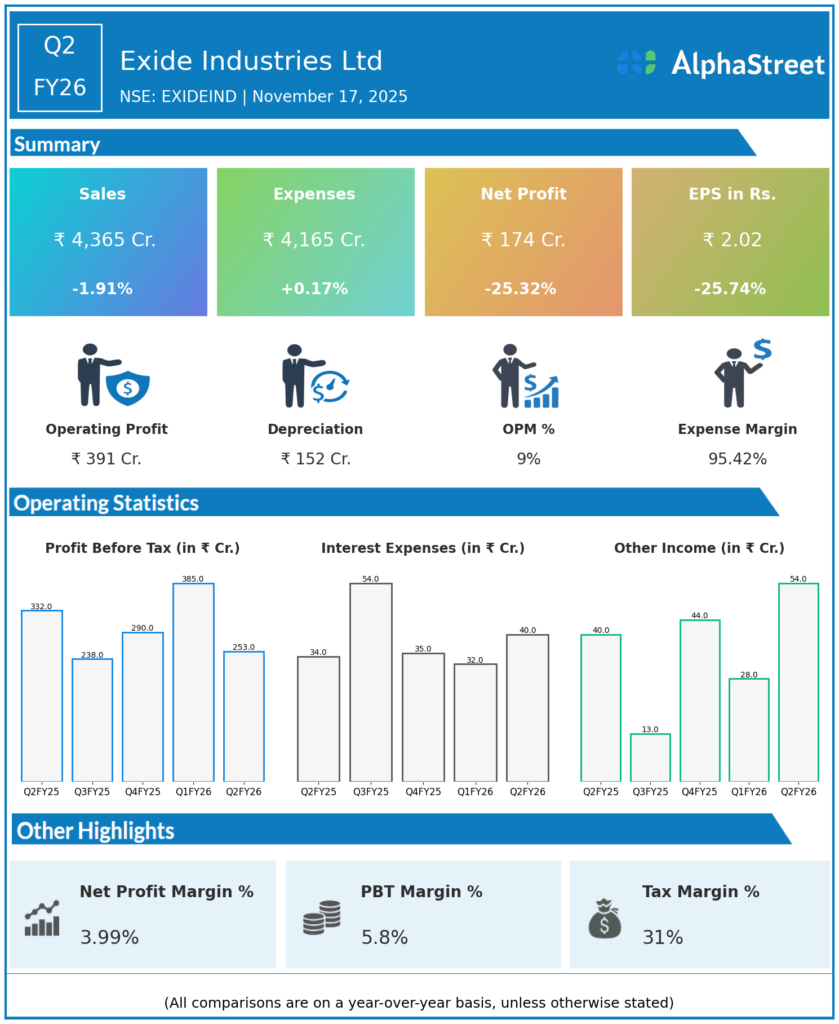

Exide Industries Ltd, a leading manufacturer of storage batteries and allied products in India, reported a challenging Q2FY26 with falling profits.

Financial Highlights:

- Revenues declined 1.91% year-on-year to ₹4,365 crore from ₹4,450 crore.

- Total expenses rose slightly by 0.17% to ₹4,165 crore from ₹4,158 crore.

- Consolidated net profit dropped 25.32% to ₹174 crore from ₹233 crore.

- Earnings per share fell 25.74% to ₹2.02 from ₹2.72.

Key Insights:

- The profit decline was primarily due to increased operational costs and margin pressures, despite relatively stable revenues.

- Input cost inflation and competitive market conditions impacted profitability.

- The company continues to focus on innovation, product quality, and efficiency improvements to combat earnings headwinds.

Outlook:

Exide Industries is investing in capacity expansion and new product development, particularly in advanced battery technologies, to regain earnings momentum and strengthen its market position in both automotive and industrial battery segments.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel.