Brooks Laboratories Limited(NSE:BROOKS) has an industry presence of nearly two decades now, leading to established relationships with the customers as well as suppliers. The company is engaged in the manufacturing of pharmaceutical formulations and is supplying to various reputed players.

Brooks Laboratories Limited(NSE:BROOKS) has floated a Joint Venture (JV) named Brooks Steriscience Ltd, with another India based pharmaceutical player, Steriscience Specialties Private Limited. Brooks Laboratories Limited(NSE:BROOKS) has sold its Vadodara facility under the slump exchange to this JV.

The JV will focus on making the plant (Vadodara) U.S. Food and Drug Administration (USFDA) compliant, attaining additional regulatory approvals along with adding some new products. Turnaround of the Vadodara unit and requirement of funding support from Brooks Laboratories Limited(NSE:BROOKS) to this JV, in the future, will remain a monitorable.

Brooks Laboratories Limited(NSE:BROOKS) has also floated another JV (with Brooks Laboratories Limited(NSE:BROOKS)’s share at ~45%) named SteriBrooks Penems Pvt. Ltd, also with Steriscience Specialties Private Limited, for marketing the products of the JV Brooks Steriscience Ltd, in the export markets.

The company was initially incorporated as Brooks Pharmaceuticals in 2000. Brooks Laboratories Limited(NSE:BROOKS) is engaged in the contract manufacturing of pharmaceutical formulations at its sole manufacturing facility located in Baddi (Himachal Pradesh).

It is operating at a combined installed capacity of 2.30 crore units per annum for liquid injection vials, 13.82 crore units per annum for tablets, 2.01 crore units per annum for dry syrup, 5.76 crore units per annum for liquid injection ampoules, 2.30 crore units per annum for eye/ear drops and 5.19 crore units per annum for dry powder injection from Baddi Plant as on March 31, 2022.

The products manufactured by the company find application in various therapeutic segments including antibacterial, antibiotics, antigastric, anti-malarial, life-saving drugs etc. Brooks Laboratories Limited(NSE:BROOKS) also supplies generic formulations on a tender basis in states like Gujarat, Jammu & Kashmir, Mumbai and West Bengal. The company also engages in export sales to Yemen, Afghanistan etc. while some domestic sales are also being made under self-owned brands.

Brooks Laboratories Limited(NSE:BROOKS) is currently being managed by all the directors collectively. Mr Atul Ranchal, Mr Rajesh Mahajan, Mr Rajnish Kumar Bedi, Mr Deepak Mahajan and Mr. Manpreet Singh Naroo have an industry experience of around two decades each whereas Ms. Sonia Gupta, has an industry experience of around one and a half decade.

Furthermore, directors are supported by a team of well versed professionals having rich experience in their respective fields. The company was earlier (prior to slump exchange) incurring high operational expenses like those for obtaining regulatory approvals, selling in new geographies etc. at the Vadodara unit while sales from the unit have not yet picked up to cover these.

This has led to continued losses at the PBILDT level in FY21 and FY20. Consequently, the company also remained in losses at the Net level. Owing to the transfer of loss-making units in subsidiaries, the company is expected to remain profitable in the current financial year.

The pharmaceutical industry is a closely monitored and regulated industry and as such there are inherent risks and liabilities associated with the products and their manufacturing. Regular compliance with product and manufacturing quality standards of regulatory authorities is critical for selling products across various geographies.

Brooks Laboratories Limited(NSE:BROOKS) is engaged in the manufacturing of pharmaceutical formulations. The industry is characterised by a high level of competition having presence of a large number of small and big players.

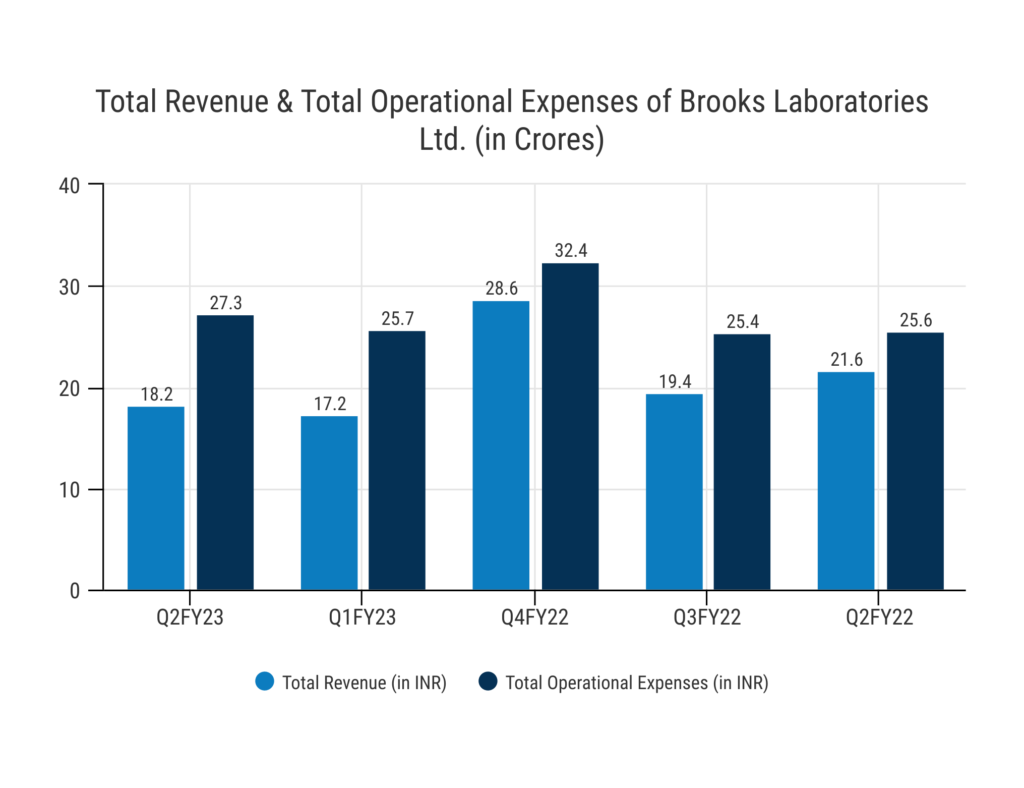

The scale of operations of the company remains small and at a similar level marked by revenue from operations of Rs.18.2 Cr. in FY23 (refers to the period July 01 to August 31) against Rs. 21.6 crores in FY21 (refers to the period July 01, 2022 to September 30, 2022).

Company was incurring cash losses till Q2FY23 due to loss making unit located at Vadodara, Gujrat which was transferred in Brooks Steriscience Limited (BSL) on slump exchange basis including assets and liabilities of the unit which was concluded in March 2021 subsequently Brooks Laboratories Limited(NSE:BROOKS) becomes profitable in FY22 and has reported GCA and PAT of Rs 2.15 crores and Rs 0.67 crores respectively.

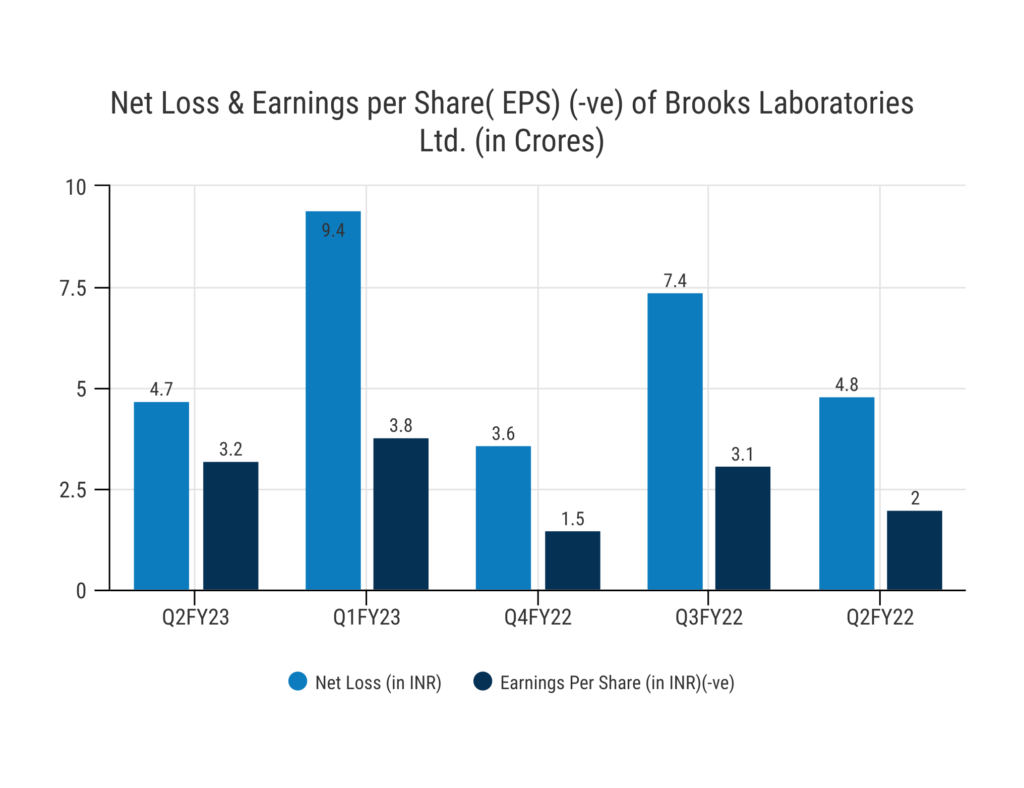

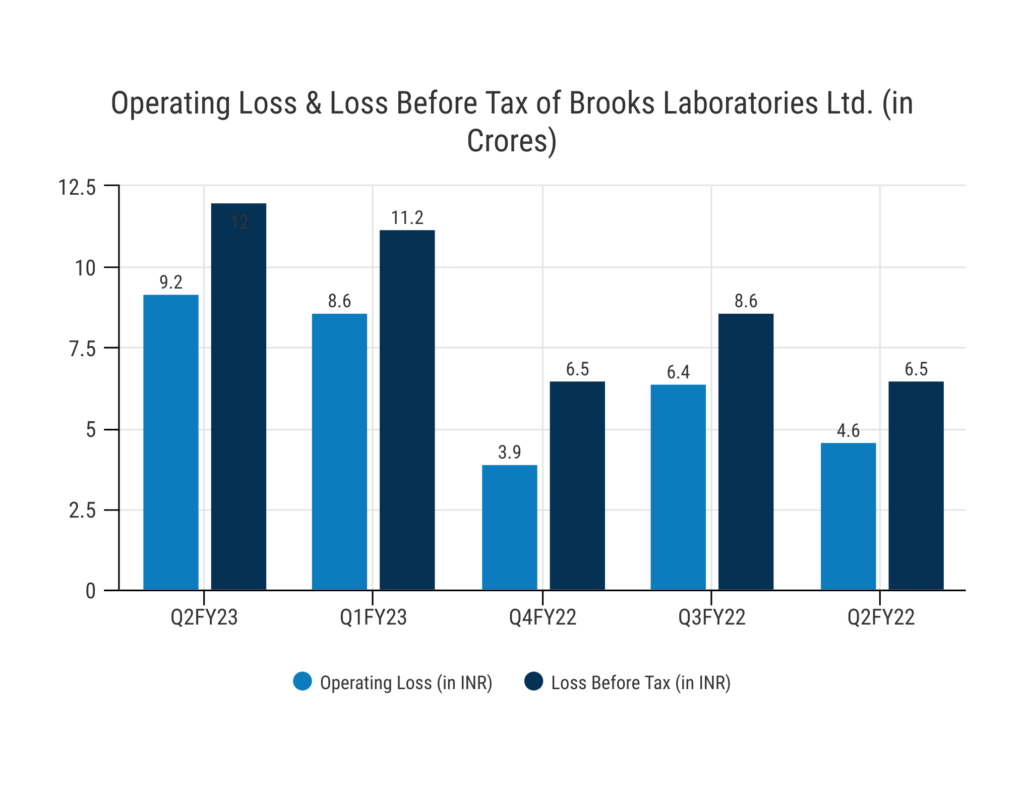

However, during current financial quarter company has booked revenue of Rs 18.2 crores and has incurred PBILDT loss and Net loss of Rs 9.2 crores & Rs 4.7 crores respectively in Q2FY23 since company is the process of launching new products and diversified their business in B2C segment which requires comparatively higher marketing cost whereas revenue is yet to be picked up resulting in operating losses.

The capital structure of the company continued to remain at a comfortable level marked by debt to equity and overall gearing ratios of 0.02x and 0.09x, as on March 31, 2022, as compared to 0.02x and 0.13x respectively as at March 31,2021. Further, interest coverage has improved during FY22 to 3.16x as compared to 0.27x during FY21.

The liquidity position of the company remains stretched as reflected by current ratio and quick ratio of 1.02x and 0.55x respectively as on March 31, 2022, as against 0.95x and 0.47x as on March 31,2021.

The company had unencumbered cash & cash equivalent of Rs. 0.08 crore only as on March 31, 2022. Working capital utilisation of fund-based limits of Rs 5.80 crores also remains comparatively high marked by average utilisation of 86.46% during the last 12 months ending September 2022.

However, position is likely to improve going forward since revenue from newly introduced products is gradually picking up.