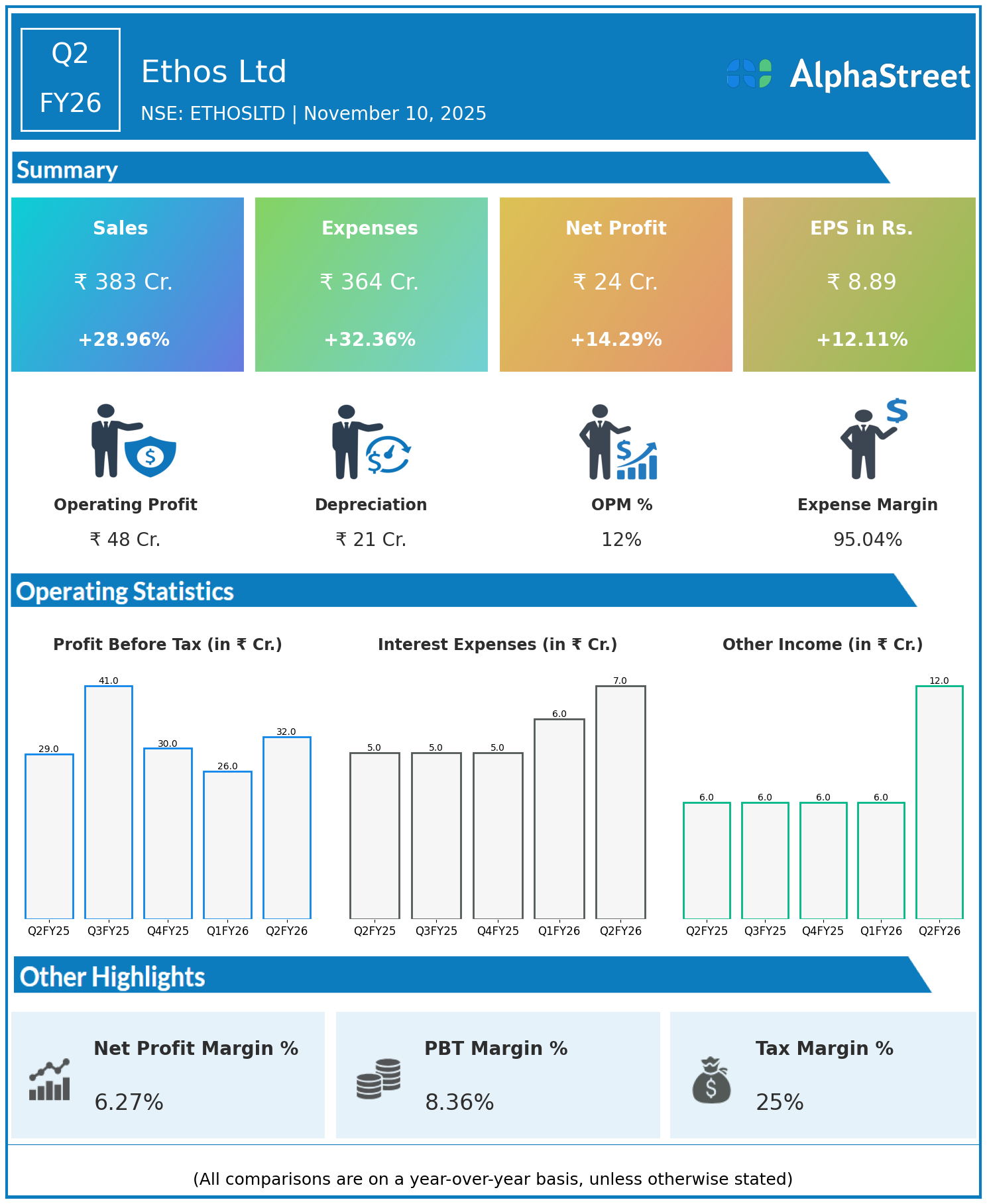

Ethos Limited, India’s largest luxury and premium watch retail player, delivered a solid financial performance in Q2FY26.

Financial Results:

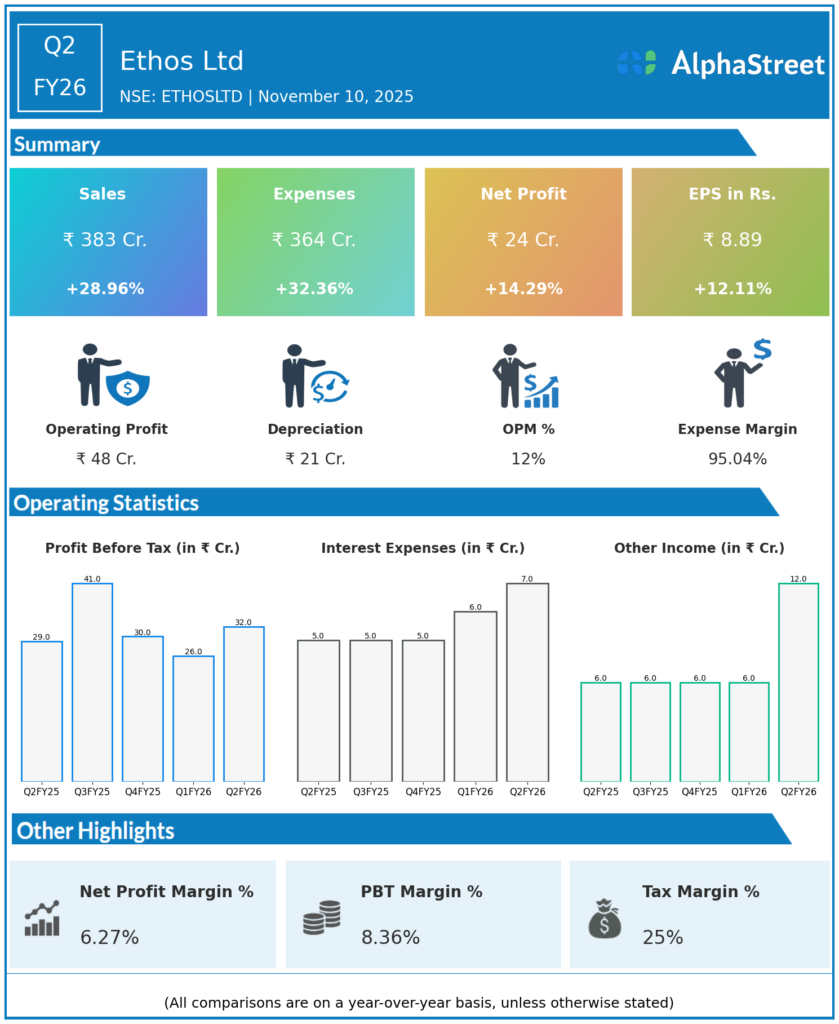

- Revenues for Q2FY26 grew 28.96% year-on-year to ₹383 crore from ₹297 crore.

- Total expenses rose 32.36% to ₹364 crore from ₹275 crore.

- Consolidated net profit increased 14.29% to ₹24 crore from ₹21 crore last year.

- Earnings per share improved 12.11% to ₹8.89 from ₹7.93.

Strong revenue growth reflects heightened demand for luxury and premium watches, while increased operating costs moderated margin improvements. Ethos continues to lead India’s premium watch retail market with its extensive brand portfolio and customer-centric strategies.

Outlook:

Ethos remains positioned for sustainable growth by expanding retail presence, enhancing inventory, and leveraging brand collaborations. The company’s robust Q2 results underpin its commitment to strengthening its industry leadership and delivering shareholder value.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel.