Ethos Limited, incorporated in 2007 and promoted by KDDL Limited, is India’s largest luxury and premium watch retail player. Presenting below are its Q1 FY26 Earnings Results.

Q1 FY26 Earnings Results

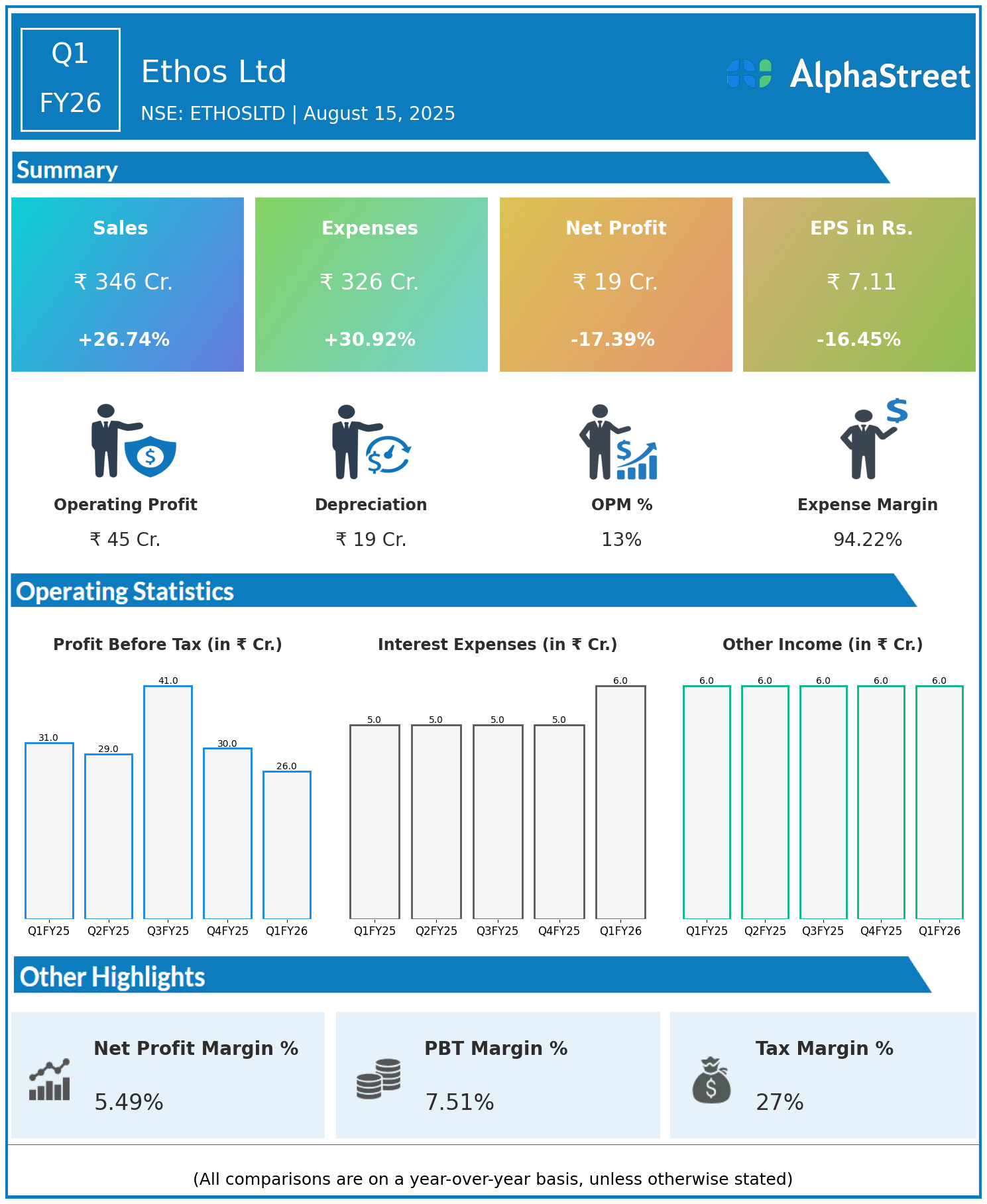

- Revenue: ₹346 crore, up 26.74% year-on-year (YoY) from ₹273 crore in Q1 FY25.

- Total Expenses: ₹326 crore, up 30.92% YoY from ₹249 crore.

- Consolidated Net Profit (PAT): ₹19 crore, down 17.39% from ₹23 crore in the same quarter last year.

- Earnings Per Share (EPS): ₹7.11, down 16.45% from ₹8.51 YoY.

Operational & Strategic Update

- Strong Revenue Growth: Revenues increased by nearly 27%, reflecting robust demand for luxury and premium watches and expansion of the retail network.

- Rising Cost Pressure: Total expenses grew almost 31%, outpacing revenue growth, mainly due to higher cost of goods sold, marketing, and operating costs associated with network expansion.

- Profitability Impacted: Net profit and EPS fell by 17% and 16%, respectively, as sharply rising expenses compressed operating margins despite strong topline performance.

- Market Leadership: Ethos continues to lead the Indian luxury watch retail sector, leveraging exclusive brand partnerships, omni-channel presence, and a strong customer base.

- Strategic Focus: The company is investing in expanding its brand portfolio, enhancing customer experience, and strengthening its omni-channel capabilities to achieve sustainable growth.

Corporate Developments in Q1 FY26 Earnings

Q1 FY26 results highlight Ethos’s ability to deliver top-line growth and reinforce its market leadership, while also underscoring the impact of cost pressures on short-term profitability. Operational efficiency and inventory management remain key focus areas.

Looking Ahead

Ethos Ltd aims to mitigate cost pressures through operational optimization, ongoing retail expansion, and deepening brand partnerships. Its focus remains on driving premium sales growth, strengthening omni-channel engagement, and creating long-term shareholder value through FY26 and beyond.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel.