Escorts Kubota is a leading Indian engineering conglomerate known for its manufacturing of agricultural machinery, construction and material handling equipment, and railway equipment. The company plays a vital role in supporting India’s infrastructure and agriculture sectors with robust product offerings and technological innovation. Presenting below are its Q1 FY26 Earnings Results

Q1 FY26 Earnings Results

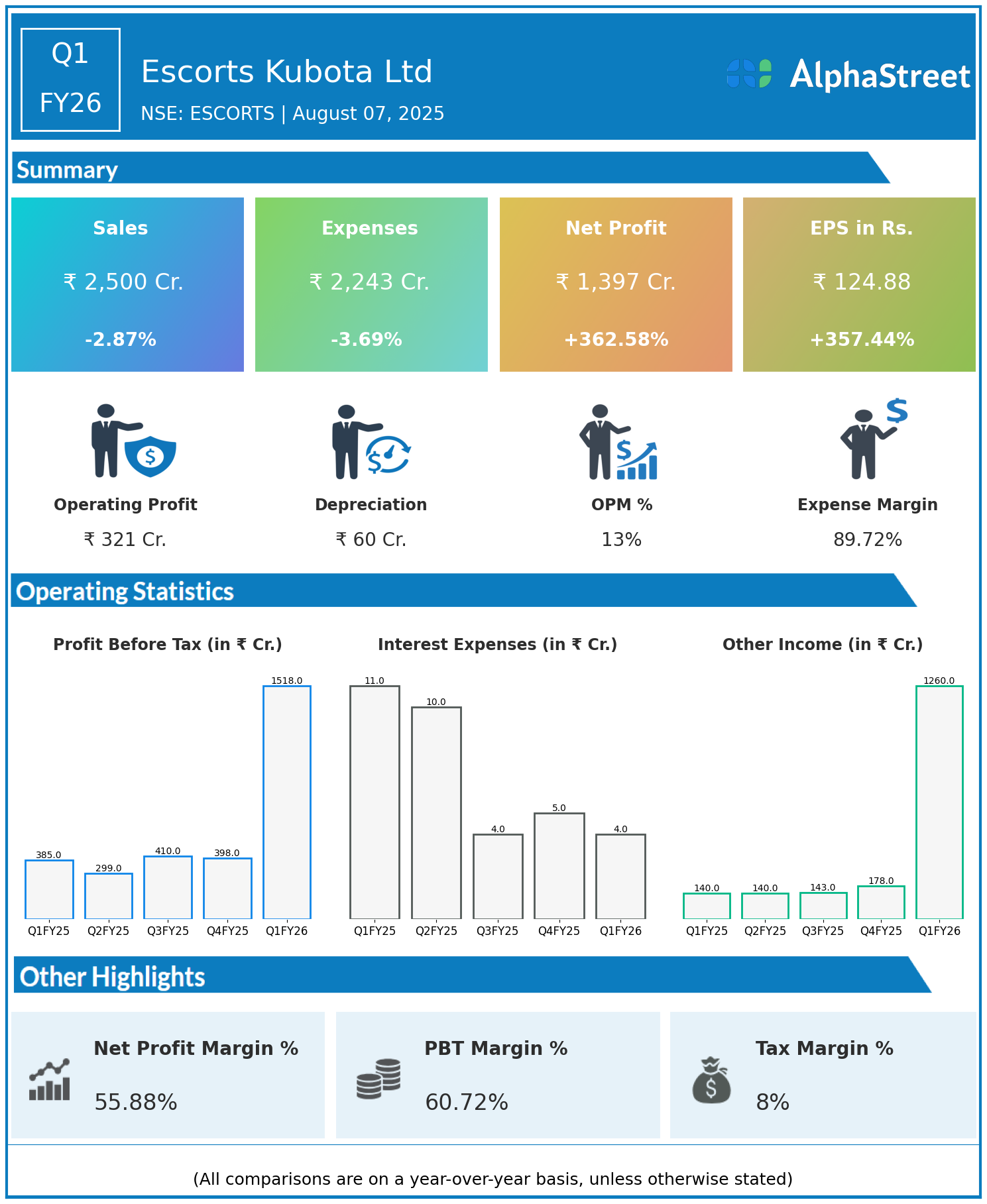

- Revenue: ₹2,500 crore, down 2.87% year-on-year (YoY) from ₹2,574 crore in Q1 FY25.

- Total Expenses: ₹2,243 crore, down 3.69% YoY from ₹2,329 crore.

- Consolidated Net Profit (PAT): ₹1,397 crore, up 362.58% from ₹302 crore in the same quarter last year.

- Earnings Per Share (EPS): ₹124.88, up 357.44% from ₹27.30 YoY.

Operational & Strategic Update

- Revenue Dynamics: The slight decline in revenue reflects softened demand or product mix shifts in the agri-machinery and construction equipment segments due to market conditions or seasonality, albeit with effective cost controls.

- Expense Management: Total expenses fell more than revenues, indicating improved operational efficiency, cost discipline, and possibly lower overheads or input costs.

- Profitability Explosion: The remarkable increase in net profit and EPS—surging over threefold—signals significant margin expansion, driven either by one-time gains, exceptional operational leverage, cost rationalization, or other extraordinary factors boosting profitability beyond the top-line variation.

- Business Segments: Escorts Kubota’s diverse portfolio across agriculture, construction, and railway equipment benefits from sustained demand in rural and infrastructure projects, while also facing cyclical industry challenges.

- Strategic Focus: The company continues to emphasize innovation, product quality, distribution expansion, and after-sales support to strengthen market share and customer loyalty in a competitive environment.

Corporate Developments in Q1 FY26 Earnings

Q1 FY26 highlights Escorts Kubota’s ability to deliver a dramatic turnaround in profitability despite modest revenue contraction. The company’s focus on cost efficiency, operational excellence, and potential one-time benefits form the core of this exceptional financial performance.

Looking Ahead

Escorts Kubota Ltd is well-positioned to leverage growth opportunities in agri-machinery modernization, infrastructure development, and freight mobility. Continued investments in technology, expanding product offerings, and capturing rural demand should support sustained profitability and value creation through FY26 and beyond.

To view ESCORTS’s previous results: Click here