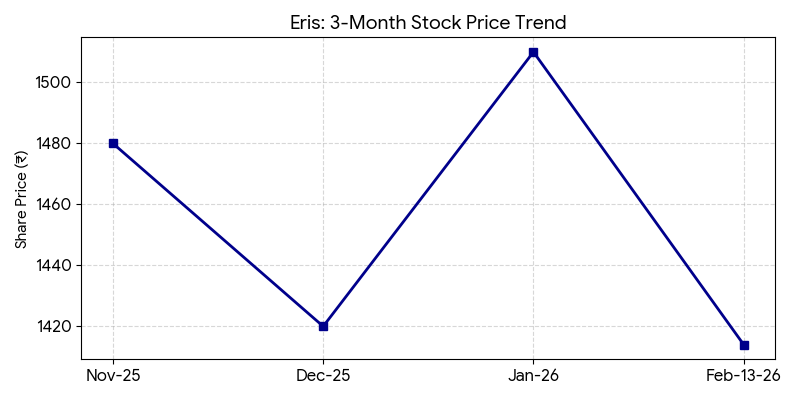

Eris Lifesciences Limited (NSE: ERIS; BSE: 540596) shares closed 6.36% lower at ₹1,414.65 on Friday despite reporting record quarterly revenues for the period ended December 31, 2025.

Market Capitalization

The market capitalization for Eris Lifesciences stands at approximately ₹19,584 crores as of the latest close.

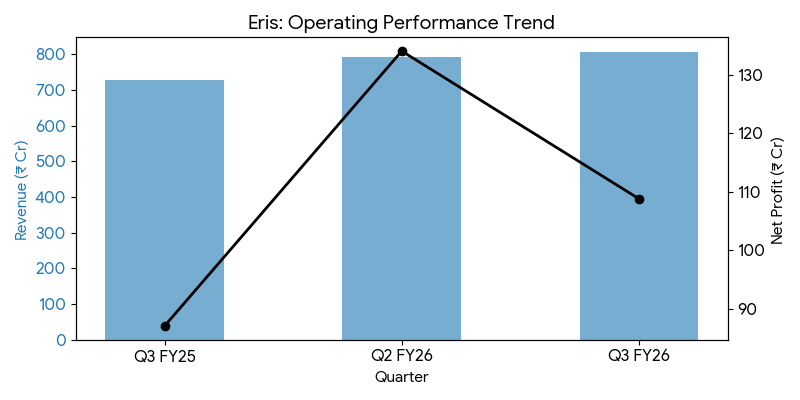

Latest Quarterly Results

The company reported consolidated revenue of ₹807.45 crores, up 11% year-on-year. Net profit for the quarter rose 25% to ₹108.83 crores compared to ₹87.06 crores in Q3 FY25.

Segment Highlights:

- Branded Formulations: Revenue grew 10% YoY to ₹696 crores with 36.5% EBITDA margins.

- International: Revenue surged 45% to ₹111 crores, marking the strongest quarter for the segment.

- Insulin: Market share in Recombinant Human Insulin reached 25%.

Full Year Results Context

For the nine months ended December 31, 2025, revenue increased to ₹2,372.86 crores. Net profit grew 35% year-on-year to ₹368.40 crores.

Financial Trends

Business & Operations Update

Eris recorded an exceptional item of ₹17.24 crores due to new labor code implementations. Net debt as of December 31, 2025, was reported at ₹2,270 crores.

M&A or Strategic Moves

On January 16, 2026, Eris completed the acquisition of the remaining 30% stake in Swiss Parenterals Limited, making it a wholly owned subsidiary.

Equity Analyst Commentary

Motilal Oswal and PL Capital track the stock. Analysts noted the insulin market share gains but expressed concerns regarding the pace of debt reduction.

Guidance & Outlook

Management projects FY26 revenue of ₹3,200 crores; breakout performance is expected from the international business in FY27.

Performance Summary

Eris shares closed at ₹1,414.65. Revenue grew 11% to a record ₹807.45 crores, while 9M profit rose 35%. Exceptional items impacted the quarterly bottom line.