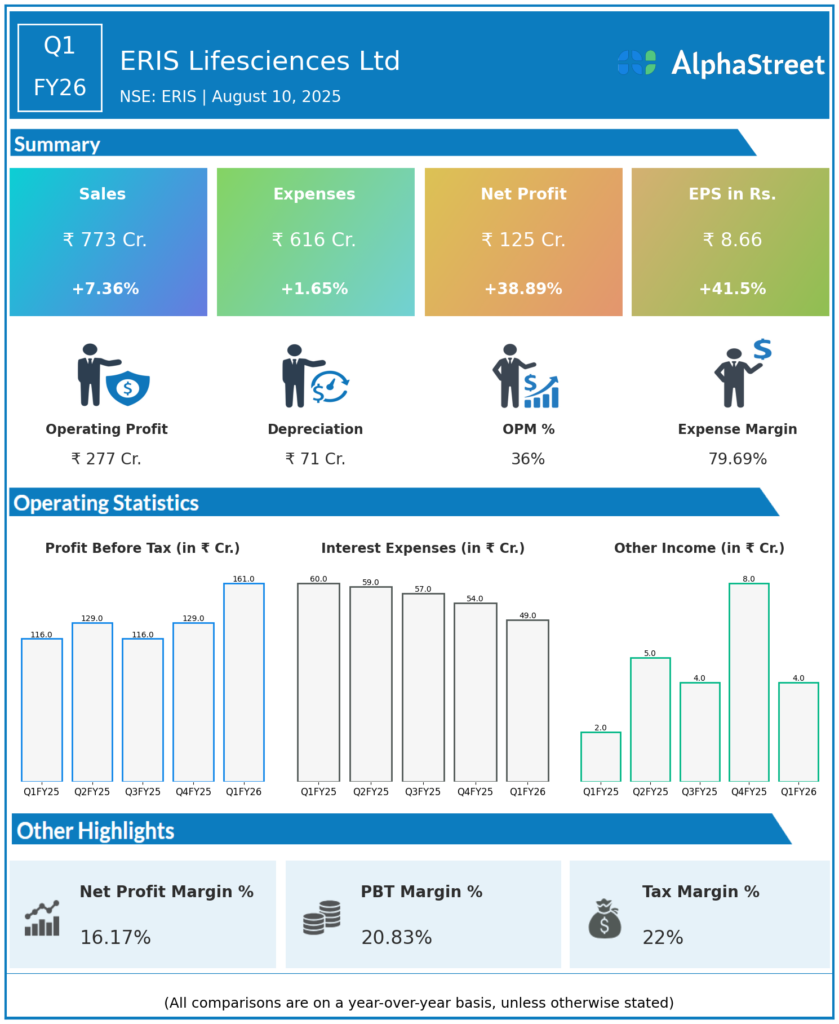

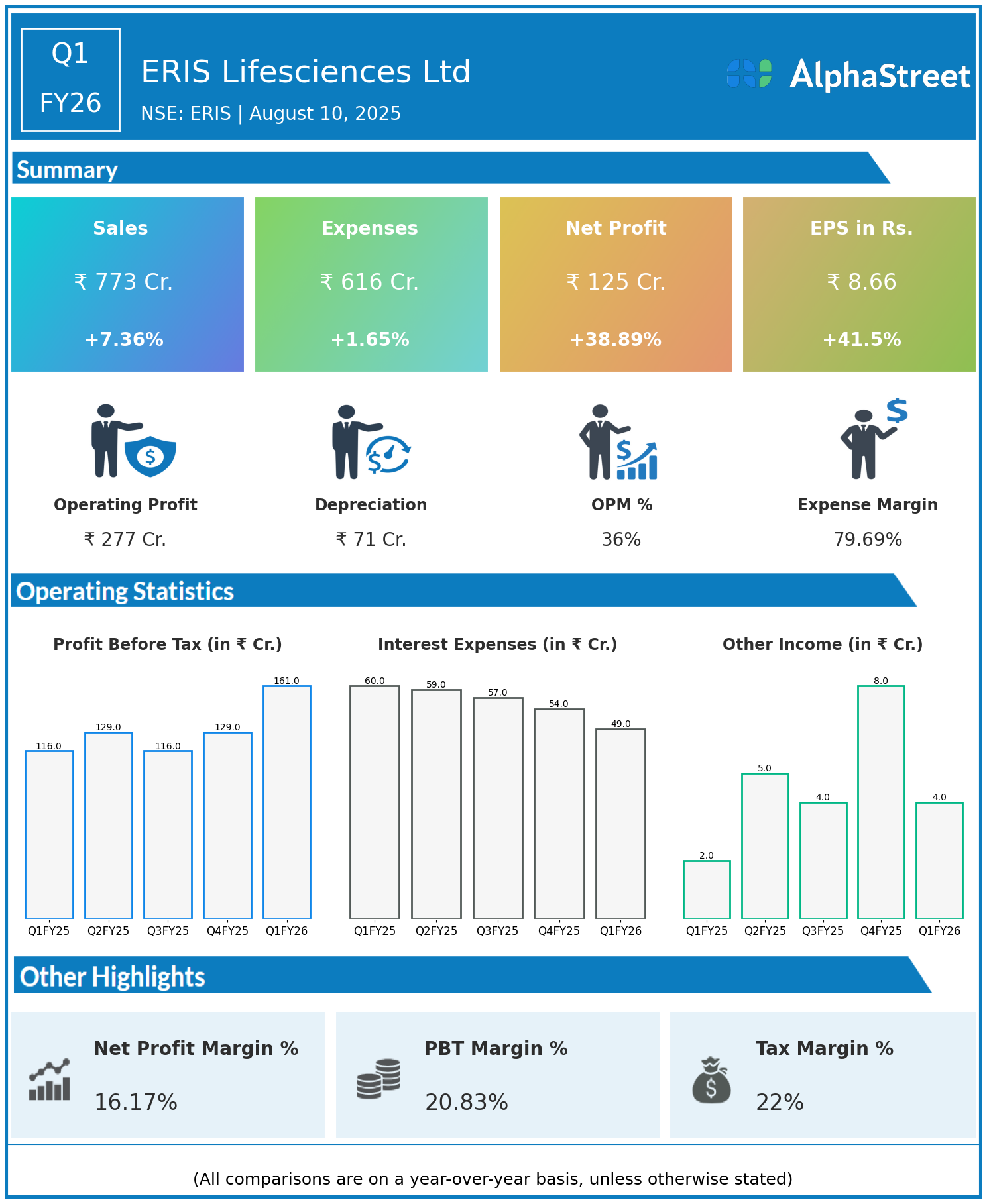

ERIS Lifesciences Limited is engaged in the manufacture and marketing of pharmaceutical products. Presenting below are its Q1 FY26 Earnings Results.

Q1 FY26 Earnings Results

- Revenue: ₹773 crore, up 7.36% year-on-year (YoY) from ₹720 crore in Q1 FY25.

- Total Expenses: ₹616 crore, up 1.65% YoY from ₹606 crore.

- Consolidated Net Profit (PAT): ₹125 crore, up 38.89% from ₹90 crore in the same quarter last year.

- Earnings Per Share (EPS): ₹8.66, up 41.50% from ₹6.12 YoY.

Operational & Strategic Update

- Moderate Revenue Growth: The 7.36% increase in revenue reflects steady market demand and effective execution in product sales across key therapeutic segments.

- Controlled Expense Growth: Total expenses increased marginally by 1.65%, indicating strong cost discipline and operational efficiency gains.

- Significant Profitability Expansion: Net profit and EPS surged nearly 39% and 42% respectively, indicating improved margins driven by cost control, better product mix, and operational leverage.

- Market & Product Focus: ERIS Lifesciences continues to strengthen its position in the pharmaceutical market with a focus on specialty and chronic therapies, supported by a robust and diversified product portfolio.

- Strategic Initiatives: The company remains committed to innovation, expanding its therapeutic reach, and enhancing distribution networks to sustain growth and improve profitability.

Corporate Developments in Q1 FY26 Earnings

Q1 FY26 results highlight ERIS Lifesciences Ltd’s ability to deliver strong profit growth despite moderate revenue increase, underscoring effective cost management and favorable operational dynamics. The company’s focus on high-value segments and geographic expansion has bolstered its financial performance.

Looking Ahead

ERIS Lifesciences Ltd is well-positioned to capitalize on growing demand in specialty pharmaceuticals and chronic care segments. Continued investments in R&D, product innovation, and market expansion are expected to drive sustained revenue growth, margin enhancement, and shareholder value creation through FY26 and beyond.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel.