Executive Summary

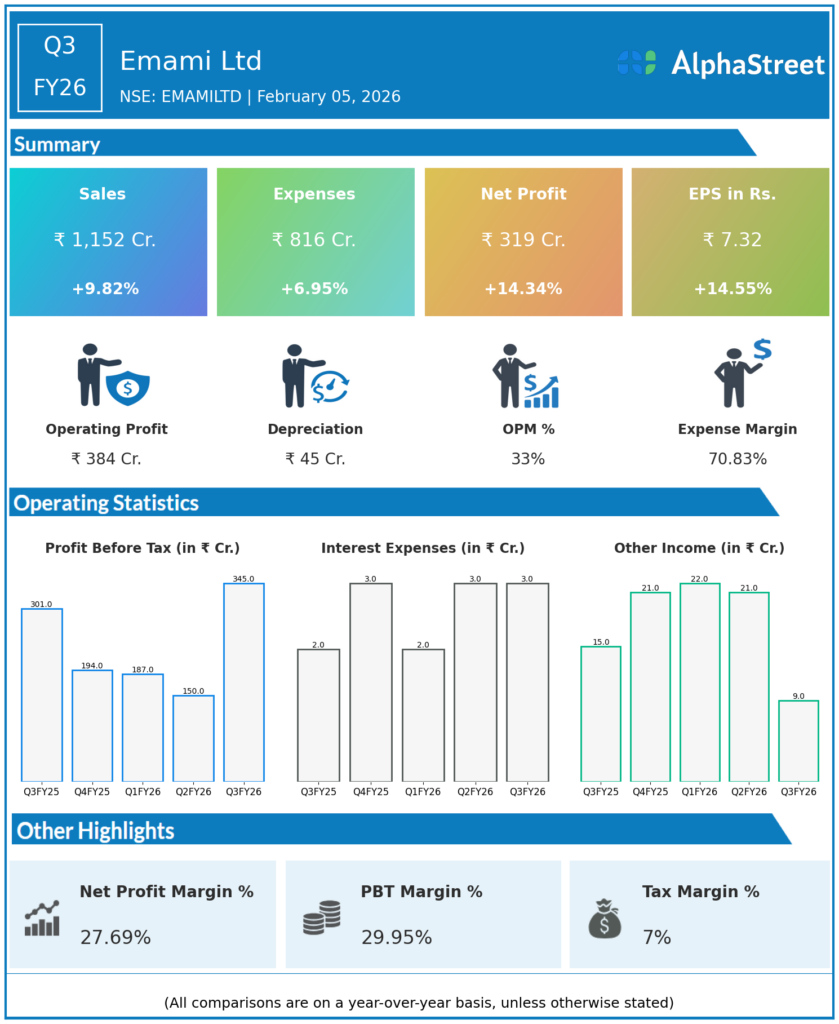

Emami Ltd reported Q3FY26 revenues of ₹1,152 crore, up 9.82% YoY, with consolidated net profit increasing 14.34% to ₹319 crore. Strong volume growth of 9% across domestic FMCG brands like BoroPlus, Navratna, and Zandu, combined with margin expansion, drove resilient performance amid favorable winter demand.

Revenue & Growth

Revenues grew to ₹1,152 crore from ₹1,049 crore YoY, reflecting 9.8% expansion led by 11% domestic sales growth and 9% volume increase across power brands. Total expenses rose 6.95% YoY to ₹816 crore, significantly trailing revenue growth through operational efficiencies.

Profitability & Margins

Consolidated net profit rose 14.5% YoY to ₹319 crore from ₹279 crore, with EBITDA increasing 13% to ₹384 crore at expanded 33.4% margins (up 110 bps YoY). Basic EPS increased 14.55% to ₹7.32 from ₹6.39; board declared second interim dividend of ₹6/share.

Balance-Sheet Highlights

The dataset lacks detailed balance sheet items such as assets, liabilities, equity, net debt, or current ratio for Q3FY26.

Cash Flow / Liquidity

Operating cash flow, free cash flow, and liquidity metrics are not specified in the Q3FY26 dataset.

Key Ratios / Metrics

Gross margins improved 30 bps to 70.6%; 7 Oils in One grew 41%, Kesh King 10%. Organised channels contributed 32% YTD revenues with quick commerce doubling to 20% of e-commerce sales.