EID Parry engages in sugar, nutraceuticals, and ethanol production, with a significant presence in farm inputs including bio-pesticides through its subsidiary Coromandel International Limited.

Financial Highlights:

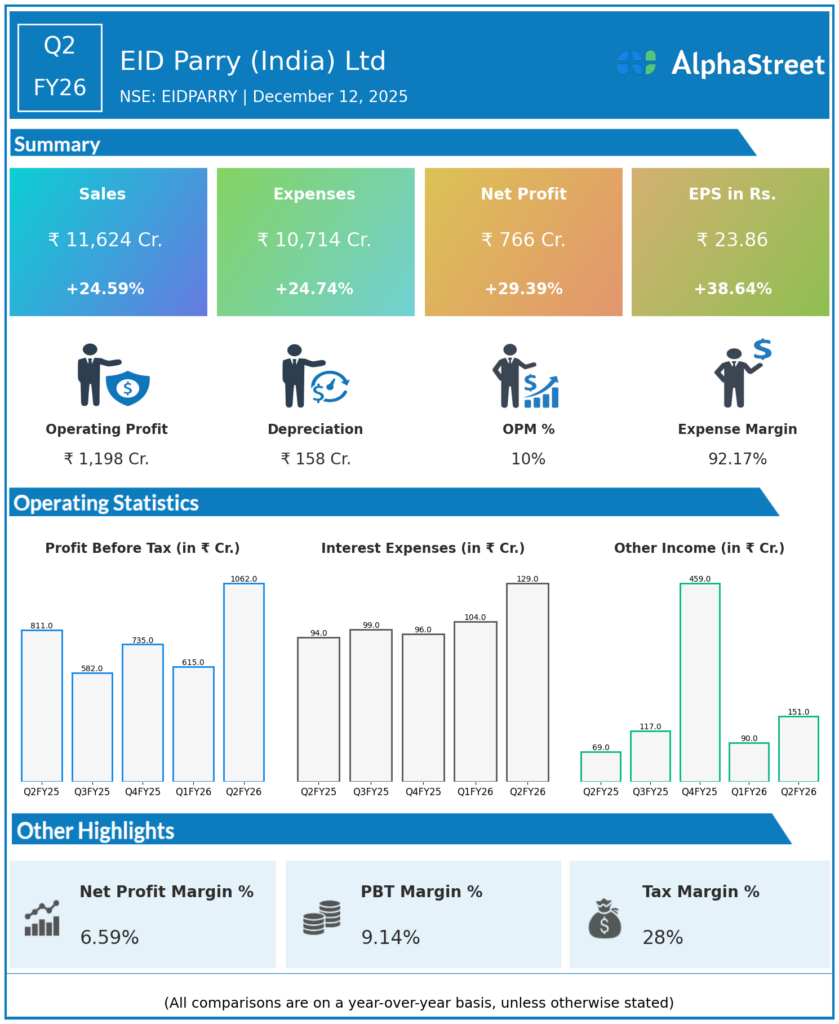

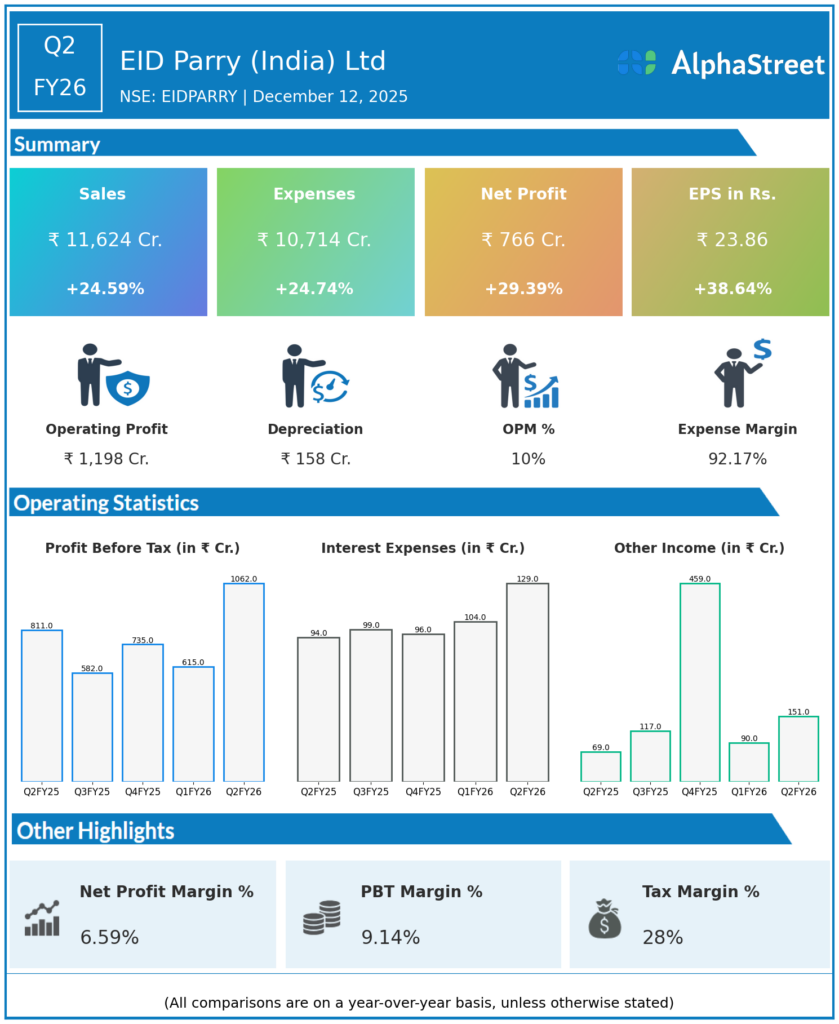

- Revenues increased 24.59% year-on-year to ₹11,624 crore from ₹9,330 crore.

- Total expenses rose 24.74% to ₹10,714 crore from ₹8,589 crore.

- Consolidated net profit grew 29.39% to ₹766 crore from ₹592 crore.

- Earnings per share improved 38.64% to ₹23.86 from ₹17.21.

Robust growth across sugar, ethanol, and farm inputs segments drove topline expansion and profitability gains despite proportional expense increases.Hemisphere-Properties-India-Ltd-Q2FY26.docx

Outlook:

EID Parry targets sustained demand in ethanol blending, nutraceuticals, and agri-inputs for continued margin expansion and growth.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel.