eClerx Services Ltd, incorporated in 2000, specializes in business process management, automation and analytics. The company serves Fortune 2000 businesses, spanning industries like financial services, communications, retail, media, entertainment, technology and more.

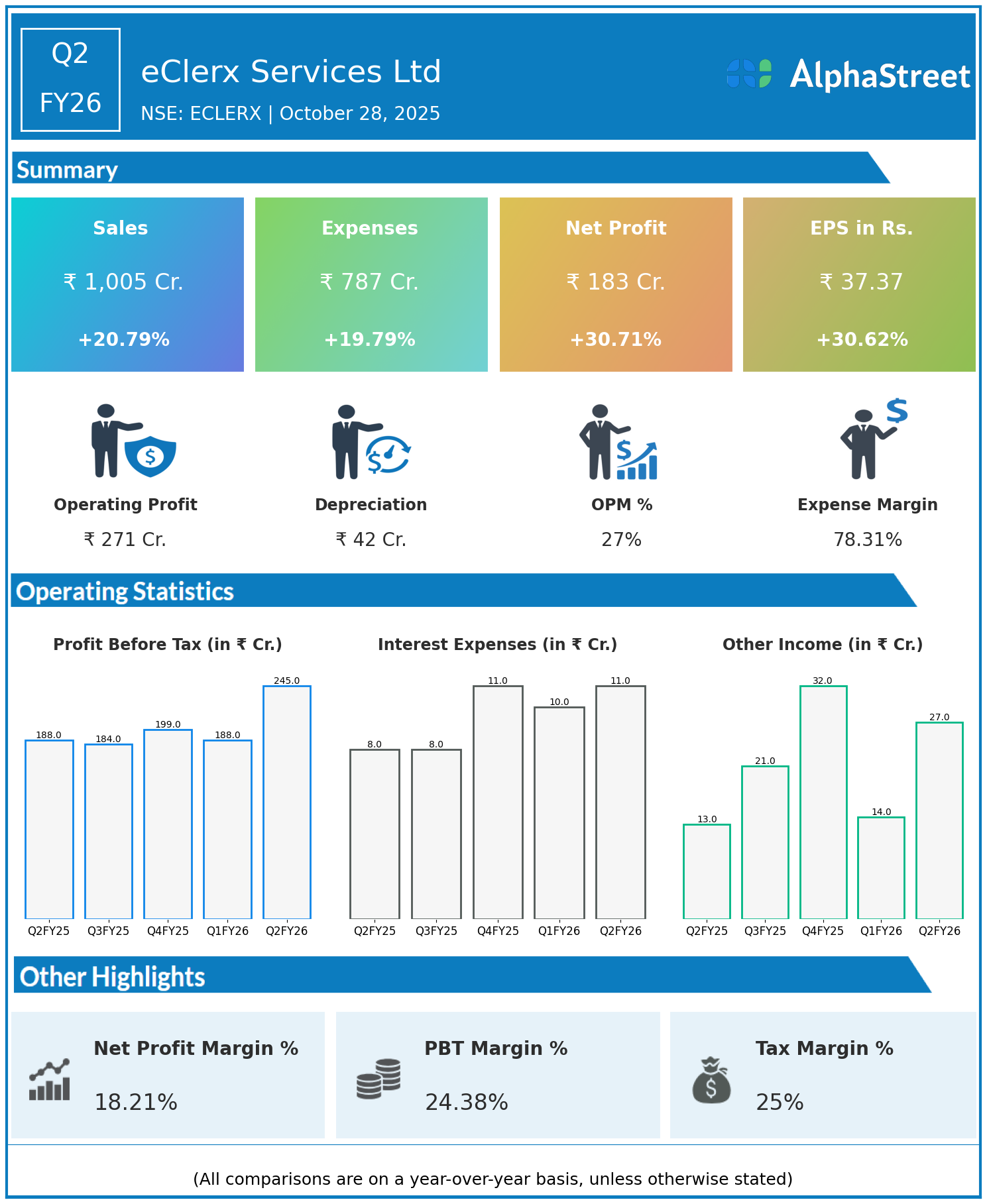

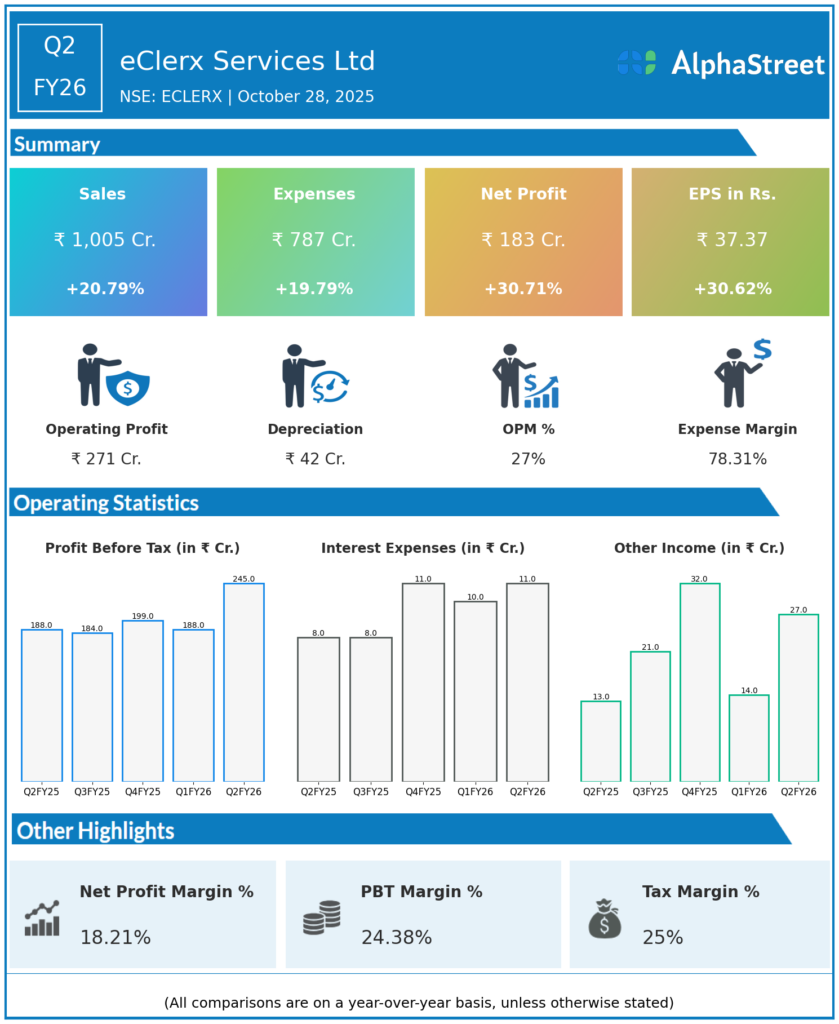

Q2 FY26 Financial Summary

- Revenues climbed 20.8% year on year to ₹1,005 crore from ₹832 crore, driven by new client wins and increased demand across automation, analytics and digital operations.

- Total expenses rose 19.8% to ₹787 crore from ₹657 crore, reflecting investments in talent and technological upgrades.

- Consolidated net profit

- jumped 30.7% to ₹183 crore from ₹140 crore, as operational leverage improved and service mix shifted towards higher-margin segments.

- Earnings per share (EPS) increased to ₹37.37 from ₹28.61, up 30.6%. The company’s delivery headcount increased 18% year on year to 21,293.

Operational and Business Highlights

- EBITDA grew strongly, with margin expanding to 28.8% from 24.8%, as profitability benefited from scale, higher utilization, and improved client mix.

- The company announced a buyback worth ₹300 crore to enhance shareholder value, targeting 6.67 lakh shares at ₹4,500 apiece via the tender offer route.

- Multiple large client wins, process automation adoption, and deeper partnerships have accelerated revenue momentum and differentiated eClerx’s service offering.

Outlook

- Management expects continued double-digit revenue growth and healthy margins, underpinned by automation demand, robust analytics, and expansion in new industry verticals.

- Focus on talent, technology investments, and operational excellence should further drive profitability, with an eye on global expansion.

eClerx Services Ltd delivered a strong Q2 FY26, combining rapid growth and margin improvement, setting the stage for sustained leadership in the digital business services sector.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel.