Company Overview:

Easy Trip Planners Ltd offers a comprehensive range of travel-related products and services under its flagship brand, “Ease My Trip.” Presenting below its Q1 FY26 Earnings Results.

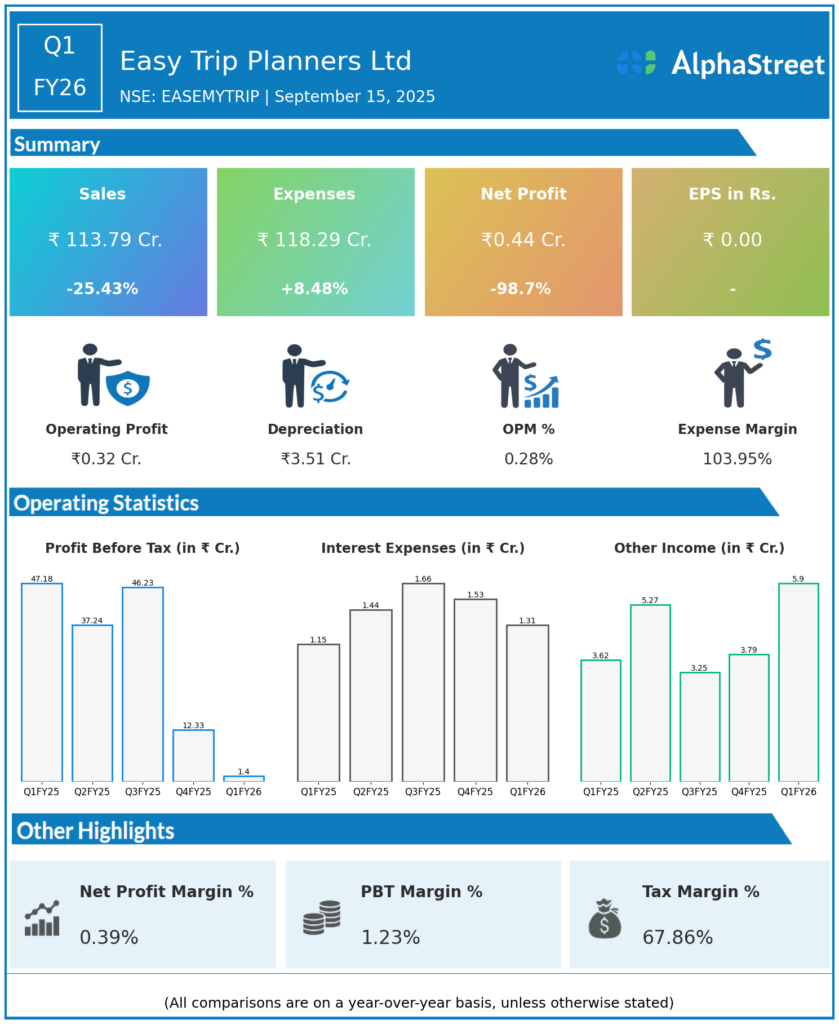

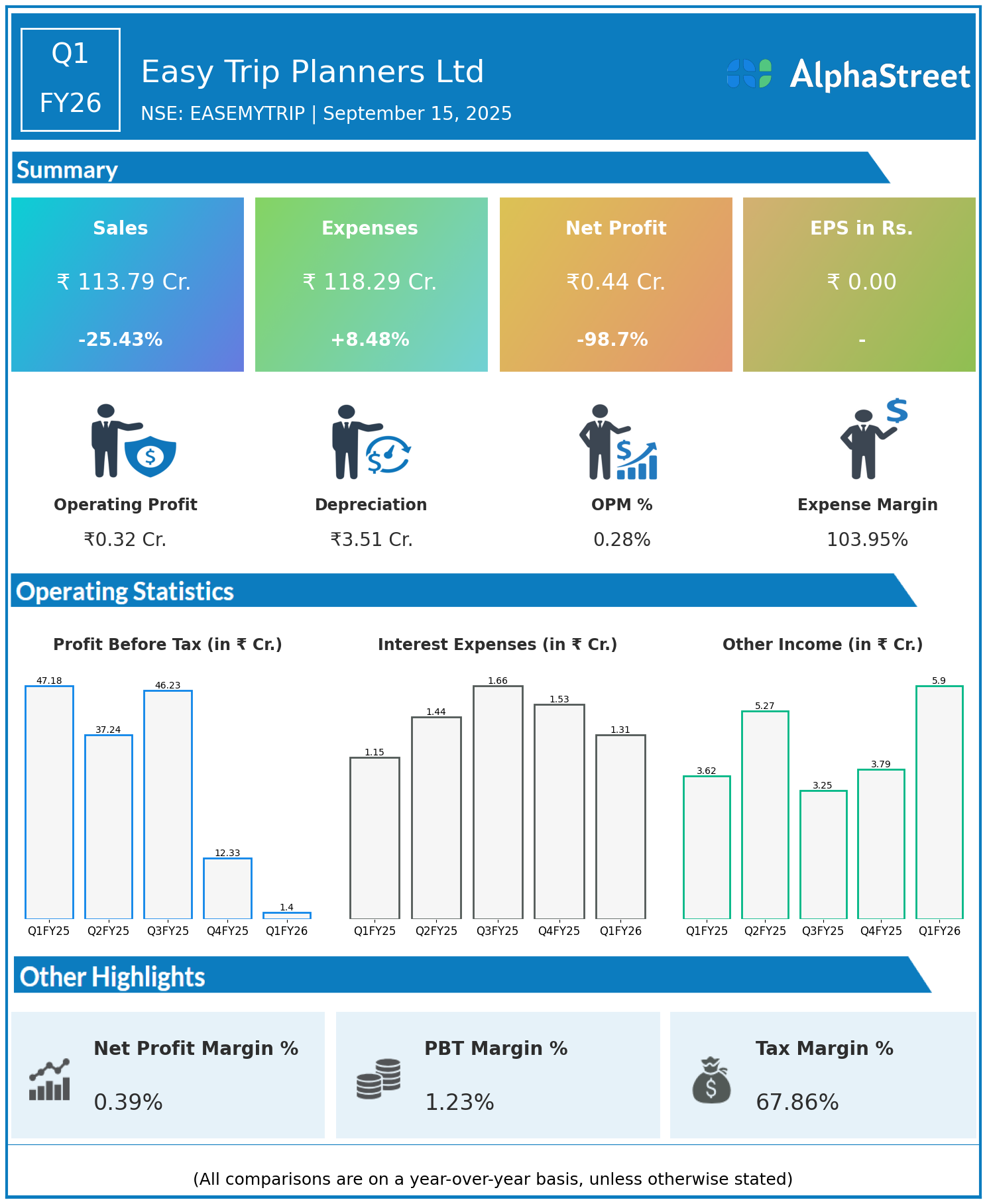

Financial Highlights for Q1 FY26:

- Revenue: ₹113.79 crore, down 25.43% year-on-year from ₹152.60 crore

- Total Expenses: ₹118.29 crore, up 8.48% year-on-year from ₹109.04 crore

- Consolidated Net Profit: ₹0.44 crore, down 98.7% year-on-year from ₹33.93 crore

- Earnings Per Share (EPS): ₹0.00, down 100% year-on-year from ₹0.09

Performance Insights:

- Revenues declined sharply by over 25%, reflecting weaker travel demand or competitive market pressures.

- Expenses increased by over 8%, impacting profitability amid falling sales.

- Net profit almost vanished with a nearly 99% decline, due to the combination of lower revenues and higher costs.

- The company is focused on expanding its digital travel services and improving operational efficiency.

Outlook:

Easy Trip Planners aims to recover revenue growth and stabilize profitability through technological enhancements, cost control, and customer acquisition efforts in FY26 and beyond.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel.