Gland Pharma Limited (NSE: GLAND) is an Indian pharmaceutical company that specialises in producing high-quality, low-cost generic medications. The company has a broad range of products and is expanding its presence in both domestic and foreign markets.

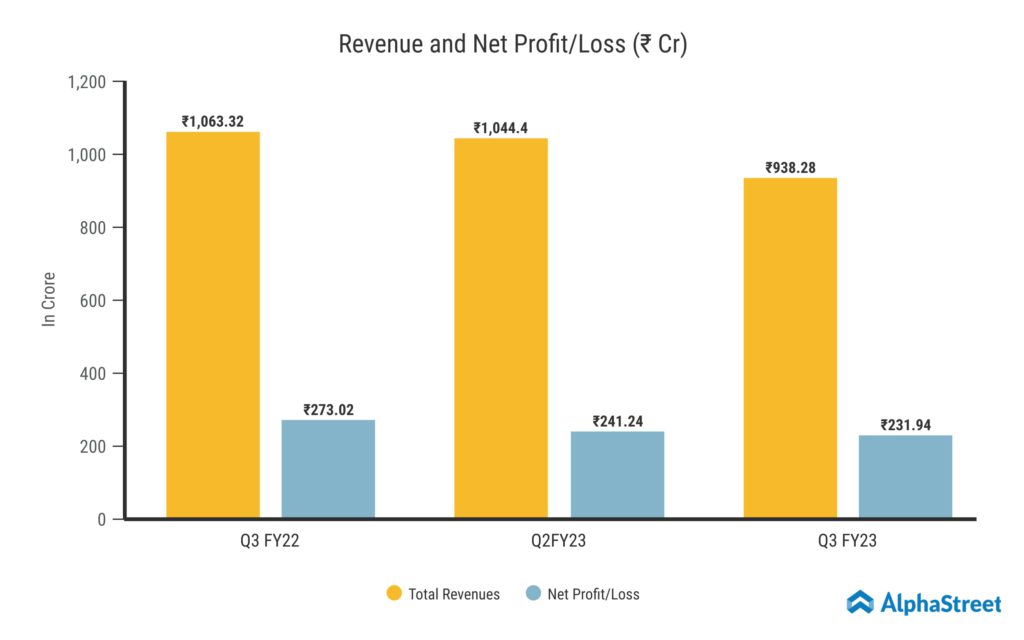

In terms of earnings, Revenue from Operations for Q3 FY23 was ₹938.28 crore, a 12% decrease from ₹1,063.32 crore in the same period last year. The core markets of the company – the US, Canada, Europe, Australia, and New Zealand, generated a total of 662.6 Crore in revenue, or 70% of the total. The core market segment fell by 11% from the previous year down to ₹740.6 Crore. The supply chain issues had an effect on this market. The management is making an effort to increase material accessibility and address any production delays.

The India market accounts for 9% of revenue in Q3 FY23. A total of ₹81.4 Crore were contributed by the domestic market, a sharp decline of 32% from the same quarter last year. Sales and margins for the India business have been impacted by both the recent publication of the NLEM list and the significant price reductions announced for key products like Heparin. The Rest of the World market, which reported revenue of ₹194.3 Crore, accounted for the remaining 21% of the overall Revenue.

The Consolidated Net Profit was ₹231.94 crore, down 15% from ₹273.02 crore in the same quarter last year. A higher depreciation expense on the company’s newly capitalised assets had an effect on profit. This quarter’s earnings per share was ₹14.08.

The third quarter’s other income, which came from operating gains and interest on fixed deposits, totalled ₹61.5 Crore. In the same time period, the company’s EBITDA margin was 35% and its net profit margin was 23%. As of December 31, 2022, it had a Cash & Bank balance of $3,829 Crore, demonstrating its ability to maintain a strong cash position. This should give the business the financial freedom to invest in potential areas of future expansion. Additionally, in Q3 FY23, the company produced cash flow from operations of ₹39.8 Crore.