DCB Bank Limited is a modern private sector bank that operates with a network of 352 branches across 19 states and 3 union territories in India. As a scheduled commercial bank, it is subject to the regulations and oversight of the Reserve Bank of India. DCB Bank is known for its customer-centric approach and offers a range of banking services and products to individuals, businesses, and corporations. With a focus on innovation and technology, the bank provides convenient and efficient digital banking solutions to meet the evolving needs of its customers. DCB Bank Limited is committed to delivering excellent financial services while maintaining the highest standards of governance and compliance.

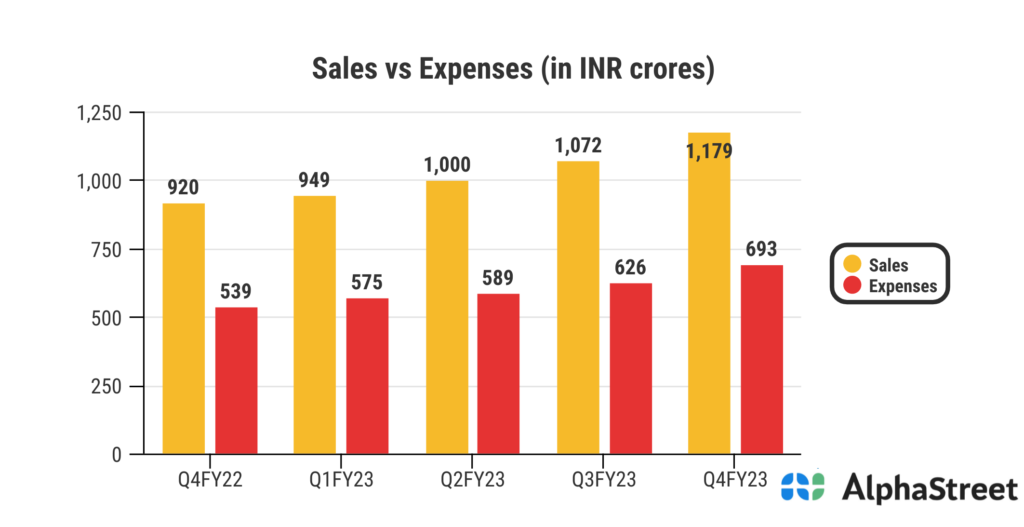

• DCB Bank Limited reported Total Income for Q4 FY23 of ₹1,301 Crore up from ₹1,034 Crore year on year, a growth of 26%.

• Total Expenses for Q4 FY23 of ₹1,057 Crore up from ₹814 Crore year on year, a growth of 30%.

• Consolidated Net Profit of ₹142 Crore, up 25% from ₹113 Crore in the same quarter of the previous year.

• The Earnings per Share is ₹4.57, up 25% from ₹3.65 in the same quarter of the previous year.