Dynamic Cables Ltd (NSE: DYCL), a leading manufacturer of power and industrial cables in India, delivered robust financial results for the third quarter of the financial year 2025–26 (Q3 FY26), reflecting continued operational strength and steady demand across its product portfolio.

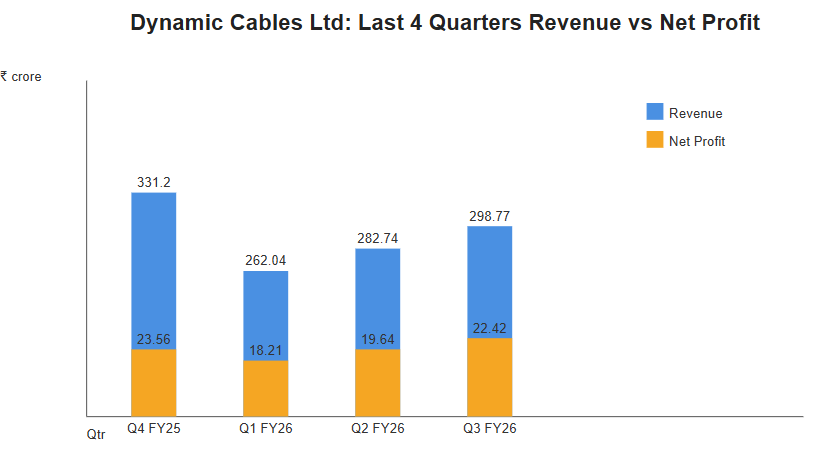

For the quarter ended December 31, 2025, the company reported revenue from operations of ₹298.77 crore, marking an 18.8% year-on-year increase compared to the corresponding period last year. This top-line growth extends the positive trend seen in earlier quarters, underpinned by higher volumes and favorable product mix dynamics.

Profitability also climbed meaningfully in the quarter. Net profit after tax rose 41.9% year-on-year to ₹22.42 crore, a significant expansion in the bottom line that signals improving operational leverage and effective cost management. The sequential trend remained positive as well, with both revenue and net profit edging up from the second quarter.

Key Financial Highlights – Q3 FY26

- Revenue: ₹298.77 crore (up ~19% YoY)

- Net Profit: ₹22.42 crore (up ~42% YoY)

- Earnings Per Share (Basic): ₹4.63 vs ₹3.26 a year ago

- Nine-Month Revenue: ₹842.37 crore (up ~21% YoY)

- Nine-Month Net Profit: ₹60.27 crore (up ~46% YoY)

The results highlight both top-line traction and improved margins driven by disciplined expense control and favourable operating conditions.

Industry observers note that Dynamic Cables’ performance comes against a backdrop of ongoing investment in capacity expansion and productivity enhancements. Management cited strong orders from power infrastructure projects and private sector demand as key drivers of growth for the period.

Over the first nine months of FY26, the company recorded sustained growth, with aggregate revenue exceeding ₹842 crore and net profit above ₹60 crore — both figures representing double-digit increases over the same period of the previous fiscal year.

Operational Drivers and Market Dynamics

Dynamic Cables’ ability to expand both sales and earnings is attributed to multiple operational levers — including a stronger mix of higher-margin products, stable raw material cost trends, and enhanced manufacturing efficiencies. These factors have helped the company preserve margin despite periodic input cost fluctuations common in the cable manufacturing sector.

The company has also pursued incremental capacity upgrades across its facilities, positioning it to meet rising demand from power distribution utilities, EPC contractors, and industrial customers. While competitive industry pressures remain, Dynamic Cables’ results suggest a solid execution environment and resilient demand conditions through Q3 FY26.

Outlook Context

Although Dynamic Cables does not provide future guidance alongside quarterly results, its nine-month performance trajectory and quarterly sequencing indicate continued momentum. Sustained demand for power infrastructure projects and electrification initiatives in India’s expanding energy and industrial sectors are expected to support further growth in coming periods. Investors and industry analysts will likely monitor how the company manages capacity, working capital, and margins in the next two quarters, particularly as the macroeconomic environment evolves. For now, the strong Q3 FY26 results underscore Dynamic Cables’ capacity to deliver consistent growth amid a competitive landscape.