“We are progressing well on our pipeline products. The number of filings in several of our key markets have been improving. The ANDA and DMF filings are expected to significantly improve during Q4. We are evaluating several inorganic opportunities across businesses in line with our strategy. We believe, all of these will lead to several growth opportunities for us both in the short term and long term. I am confident that we will be able to continue the growth momentum supported by our strong cash position, focused management team and robust governance and processes.”

-Erez Israeli, CEO

Stock Data

| Ticker | DRREDDY |

| Exchange | NSE & BSE |

| Industry | Pharma |

Share Price

| Last 1 Month | 8.9% |

| Last 6 Months | 12.3% |

| Last 12 Months | 9% |

Business Basics

Dr. Reddy’s Laboratories is an Indian multinational pharmaceutical company that specializes in the manufacture and marketing of generic medicines, active pharmaceutical ingredients (APIs), and proprietary products. The company operates in over 25 countries across the world and has a strong presence in the US, Europe, India, and other emerging markets. Dr. Reddy’s Laboratories has a strong research and development (R&D) team and invests heavily in R&D to develop new products and formulations. The company has several R&D centres located in India and other countries. The company has a global presence and is committed to providing affordable and high-quality medicines to patients across the world. The company’s strong focus on innovation, R&D, and quality has helped it to build a strong reputation in the pharmaceutical industry. With a talented and experienced management team and a focus on sustainable growth, Dr. Reddy’s Laboratories is well-positioned to continue its success in the pharmaceutical industry.

Dr. Reddy’s Laboratories’ product portfolio includes a wide range of generics and active pharmaceutical ingredients (APIs). The global generics segment is responsible for the manufacture and sale of generic pharmaceuticals across several therapeutic areas such as oncology, cardiovascular, and dermatology. Dr. Reddy’s Laboratories has a significant presence in the global generics market and offers a broad range of high-quality, affordable medicines to patients across the world. The company’s global generics portfolio includes several popular brands such as Omeprazole, Simvastatin, and Gabapentin.

The APIs segment is responsible for the manufacture and sale of active pharmaceutical ingredients (APIs), which are the essential components used in the production of pharmaceutical products. The segment offers a wide range of APIs across several therapeutic areas such as oncology, cardiology, and gastroenterology. Dr. Reddy’s Laboratories has a significant market share in the global APIs market and is known for its high-quality products.

Q3 FY23 Financial Performance

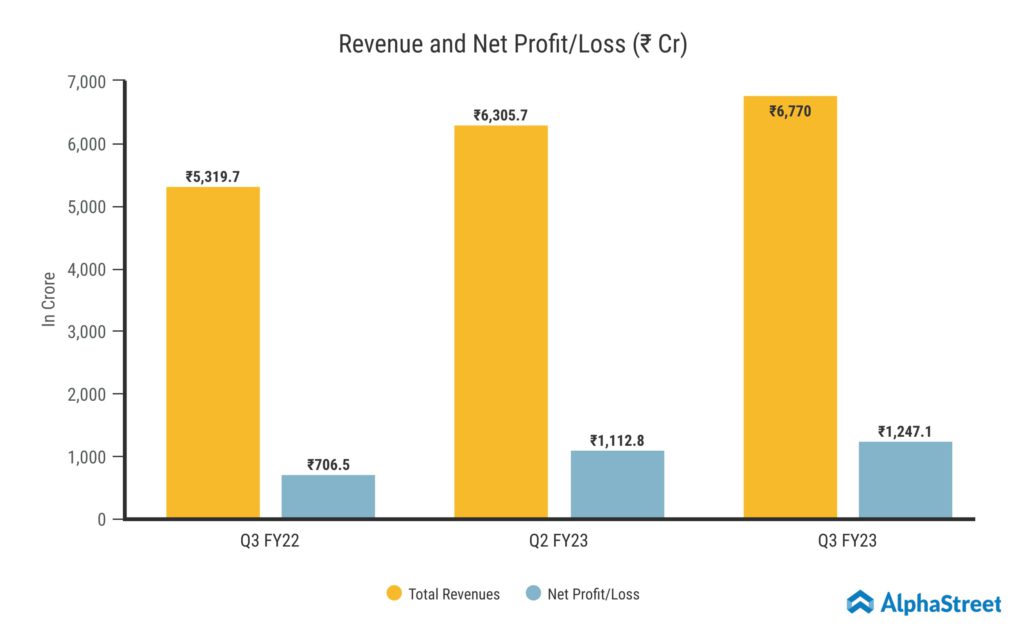

Dr. Reddy’s Laboratories Limited reported Revenue from Operations for Q3 FY23 of ₹6,770 Crore up from ₹5,319.7 Crore year on year, a growth of 27%. The Revenue was driven by Global generics segment which surged by 33% up to ₹5,924.1 Crore. Healthy growth across all of our businesses, including both base business and new product launches, contributed to the performance. Consolidated Net Profit of ₹1,247.1 Crore, up 76.5% from ₹706.5 Crore in the same quarter of the previous year. The Earnings per Share is ₹74.95 for this quarter.

Key Business Highlights

The company’s North America generics division saw strong year-over-year growth of 51% and quarterly sales of $375 million. Sequentially, the market for Sorafenib, Sapropterin hydrochloride, and Lenalidomide capsules saw sales increase in the US. Dr. Reddy’s launched five new products in this quarter, and they anticipate that momentum to continue throughout the rest of the year. The Europe business did, however, report sales of €51 million this quarter, an 8% year-over-year growth. The company also introduced eleven new products during the quarter in various European nations. The management anticipates maintaining the growth rate throughout the remainder of FY23.

Sales for the Emerging Markets division reached ₹1,310 crores, up 14% year over year and 7% sequentially. The Russia business expanded by 29% year over year and 8% quarter over quarter in constant currency within the emerging market category. An increase in the sales of biosimilar products in Russia contributed to this robust growth. The company introduced 29 new products during the quarter in a number of emerging market nations.

The India division reported sales of ₹1,127 crores, an increase of 10% from the previous year. The business introduced two new products to the Indian market during the quarter.

As per the management, “We are creating several growth engines for India business for both Horizon 1 and Horizon 2, which includes ramping up internal portfolio, collaborations, innovation and inorganic opportunities.”

Analysis of India’s Pharma Industry

In terms of both volume and value, India is the third-largest producer of pharmaceuticals in the world. A 20% share of the global supply of generic medications is provided by this nation, which is also the world’s top producer of vaccines. Over 50% of the world’s demand for various vaccines is met by the Indian pharmaceutical industry, as is 40% of US demand for generic drugs and 25% of UK demand for all medications. The domestic market is anticipated to increase three times over the following ten years, according to the Indian Economic Survey 2021. The domestic pharmaceutical market in India was valued at $42 billion in 2021 and is projected to rise to $65 billion by 2024 and $120–130 billion by 2030. Formulations and biologicals continue to make up the majority of India’s total exports, accounting for 73.31% of those exports. Bulk drugs and drug intermediates came in second with exports of ₹4.43 billion. USA, UK, South Africa, Russia, and Nigeria are India’s top 5 international markets for pharmaceutical exports.

A Production Linked Incentive (PLI) Scheme for Pharmaceuticals has been introduced by the Indian government, with a provision for the payment of $2 billion or ₹15,000 crore in government incentives. This will decrease reliance on imports, benefit domestic producers, and increase product innovation for the creation of complex and high-tech products.