Dr. Lal PathLabs Limited is one of India’s leading consumer healthcare brand in diagnostic services. It has an integrated nationwide network, where patients and healthcare providers are offered a broad range of diagnostic and related healthcare tests and services for use in: core testing, patient diagnosis and the prevention, monitoring and treatment of disease and other health conditions. The services of DLPL are aimed at individual patients, hospitals and other healthcare providers and corporates.

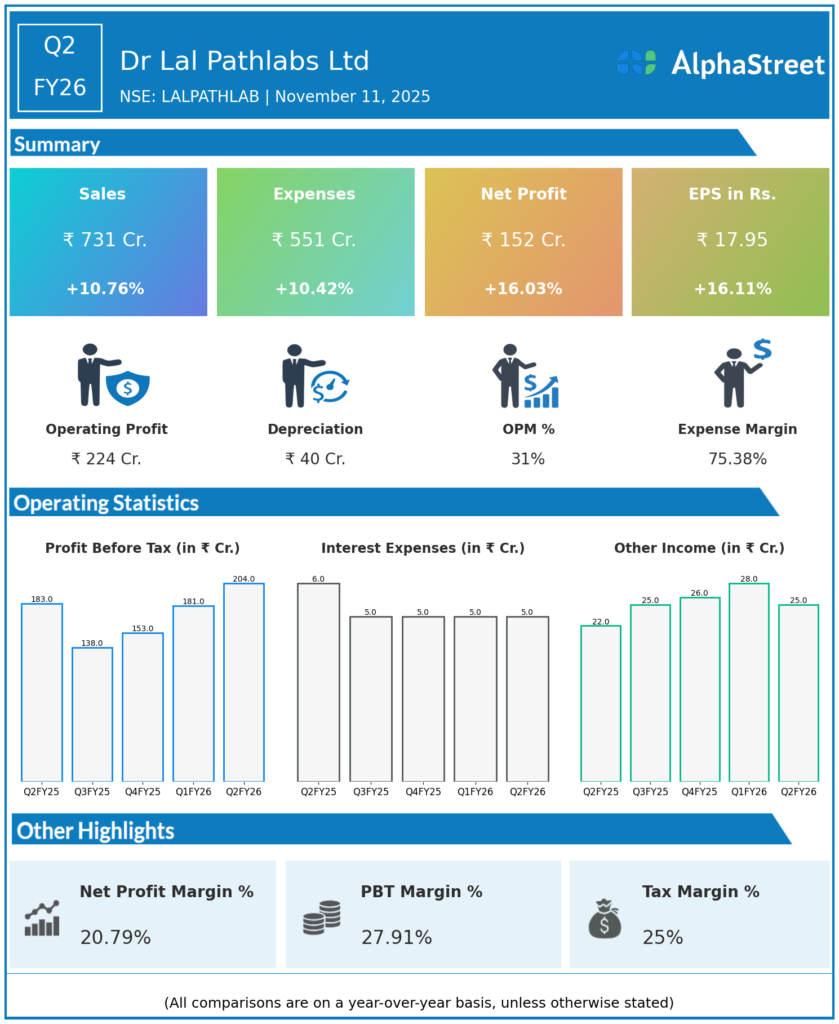

Q2 FY26 Earnings Results:

-

Revenue from Operations: ₹731 crore, up 10.7% YoY

-

EBITDA: ₹224.3 crore, up 10.8% YoY with margin at 30.7%

-

Profit Before Tax (PBT): ₹204 crore, up 11.2% YoY with margin at 27.9%

-

Profit After Tax (PAT): ₹152 crore, up 16.4% YoY with margin at 20.8%

-

Earnings Per Share (EPS): ₹18.1 compared to ₹15.5 in Q2 FY25

-

Sample volumes increased 10.3% YoY to 25.4 million; patient volumes rose 5% YoY to 8.2 million

-

Revenue per patient increased 5.4% to ₹889

-

EBITDA and PAT margins remained stable, supported by operational efficiencies and revenue mix

-

Company declared a 1:1 bonus issue and ₹7 interim dividend during the quarter

-

Strong growth in Delhi NCR and expansion into Tier 3 and Tier 4 towns contributed to results

-

Guidance maintained at 11–12% revenue growth and 27–28% EBITDA margin for FY26

Management Commentary & Strategic Insights

-

Management emphasized broad-based growth across geographies and service network expansion

-

Investments in bundled preventive testing like Swasthfit helped limit margin pressure

-

Operational discipline and efficiency gain are key contributors to sustained profitability

-

Expansion plans continue with 15–20 new labs expected in FY26

-

Management maintains positive outlook with steady growth and profitability expected to continue

Q1 FY26 Earnings Results

-

Revenue from Operations: ₹699.6 crore, up 10.8% YoY

-

PAT: ₹146 crore, up 13.2% YoY

-

EBITDA margin: ~30% with strong contribution from sample and patient volume growth

-

Continued investment in network and capacity expansion

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.