Company Overview:

Dolat Algotech Ltd is a trading and clearing member of NSE India, engaged in securities broking and securities trading. Presenting below its Q1 FY26 Earnings Results.

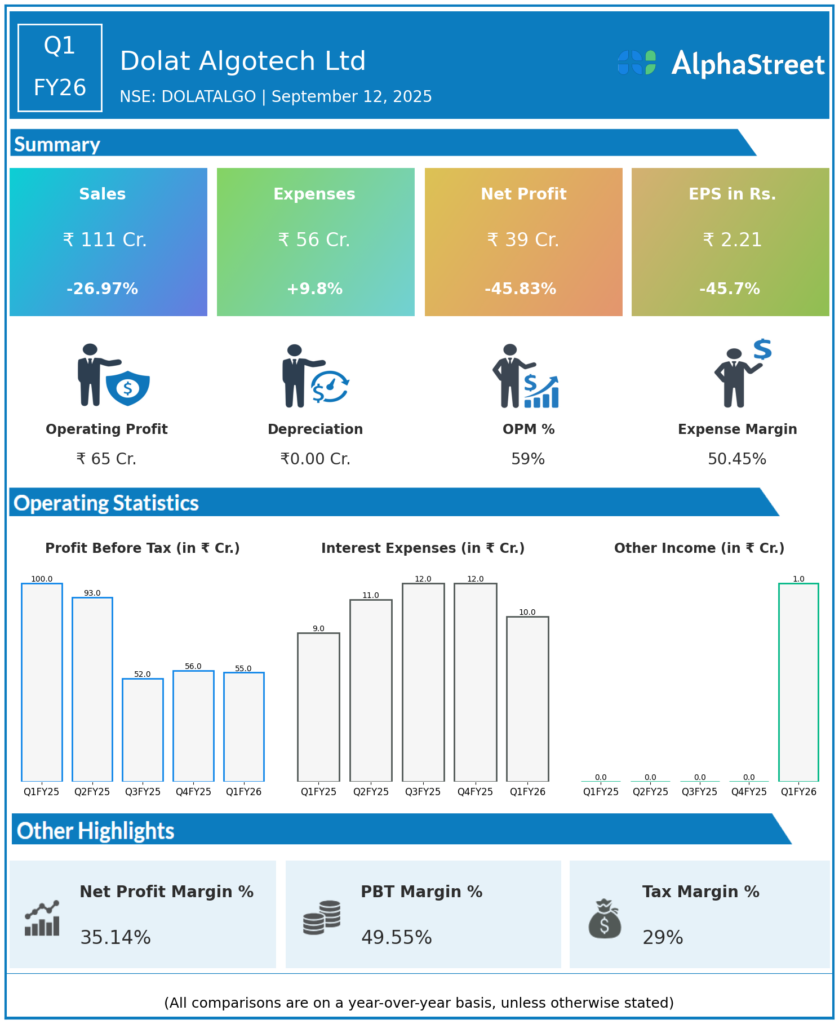

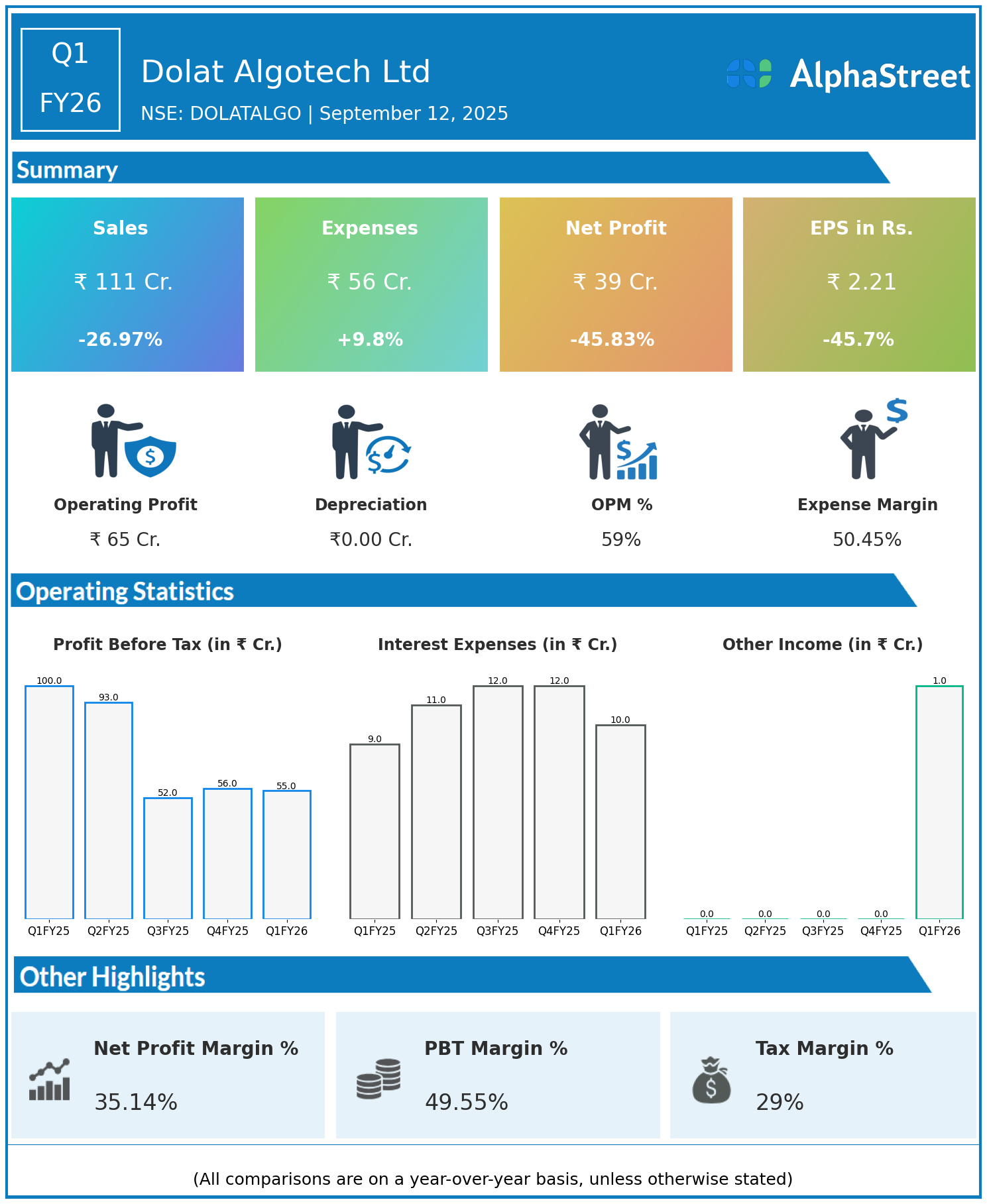

Financial Highlights for Q1 FY26:

- Revenue: ₹111 crore, down 26.97% year-on-year from ₹152 crore

- Total Expenses: ₹56 crore, up 9.8% year-on-year from ₹51 crore

- Consolidated Net Profit: ₹39 crore, down 45.83% year-on-year from ₹72 crore

- Earnings Per Share (EPS): ₹2.21, down 45.70% year-on-year from ₹4.07

Performance Insights:

- Revenues declined sharply by nearly 27%, indicating lower brokerage and trading income amid subdued market activity.

- Expenses rose by nearly 10%, potentially due to higher operating costs or investments.

- Net profit fell by around 46%, impacted by the combined effect of falling revenues and rising expenses.

- The company continues to focus on enhancing trading volumes and broadening client base to improve earnings.

Outlook:

Dolat Algotech aims to recover revenue growth through increased market participation and cost optimization in FY26 and beyond.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel.