DLF Limited, along with its subsidiaries, associates, and joint ventures, is a comprehensive real estate developer involved in the full cycle of real estate development, including land identification and acquisition, planning, execution, construction, and marketing of projects. Besides core real estate development, DLF is engaged in leasing, power generation, maintenance services, hospitality, and recreational businesses related to its real estate portfolio. Presenting below are its Q1 FY26 Earnings Results.

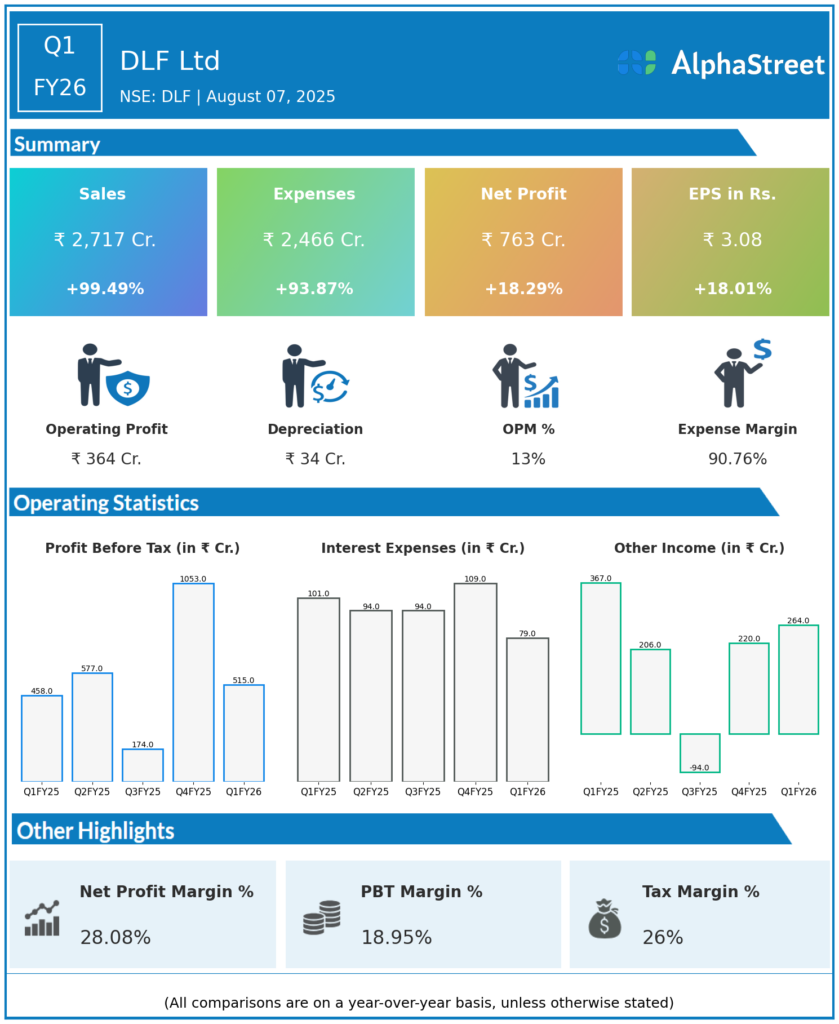

Q1 FY26 Earnings Results

- Revenue: ₹2,717 crore, up 99.49% year-on-year (YoY) from ₹1,362 crore.

- Total Expenses: ₹2,466 crore, up 93.87% YoY from ₹1,272 crore.

- Consolidated Net Profit (PAT): ₹763 crore, up 18.29% from ₹645 crore.

- Earnings Per Share (EPS): ₹3.08, up 18.01% from ₹2.61.

Operational & Strategic Insights

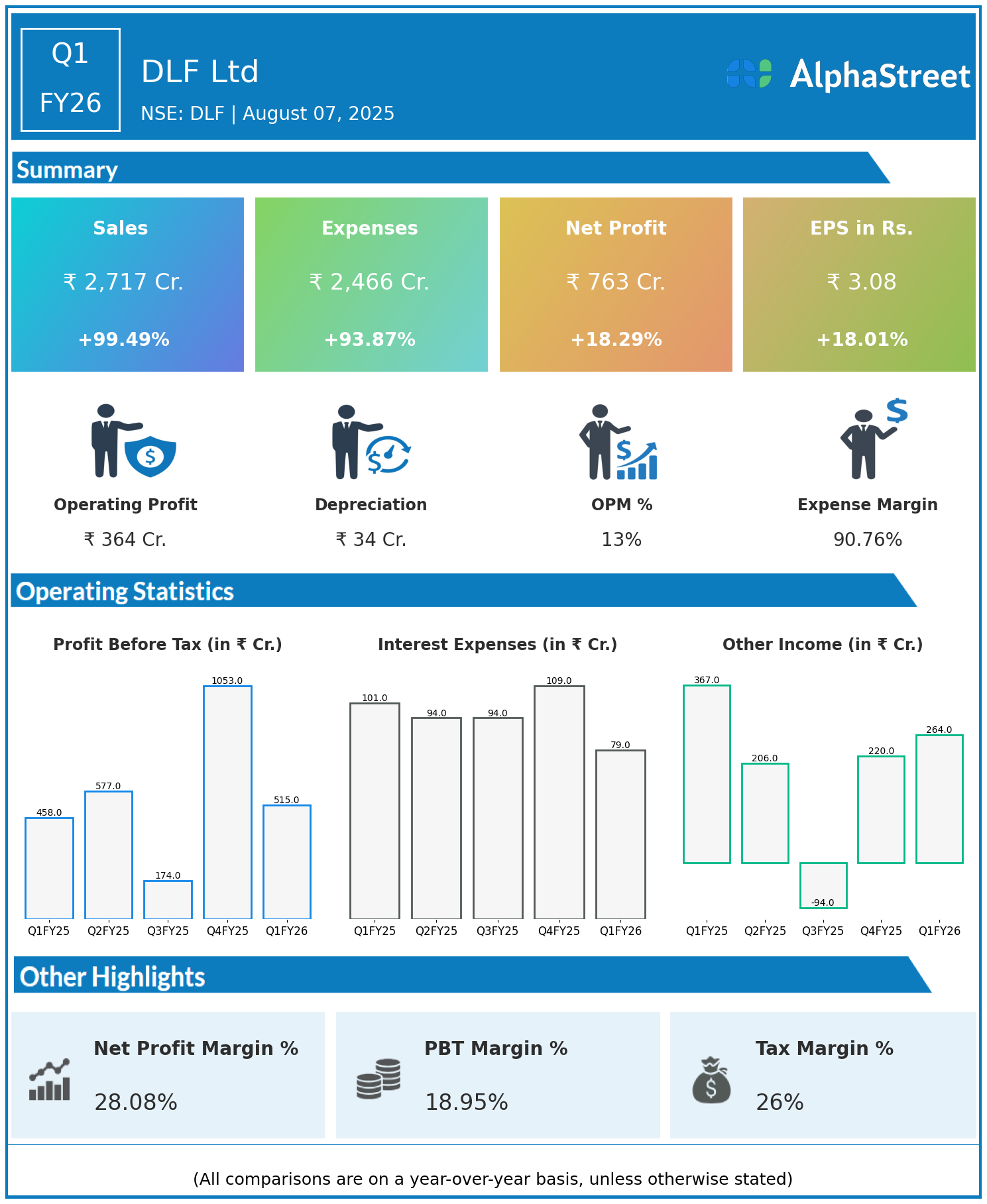

- Revenue Surge: The nearly doubling of revenue primarily reflects significant sales recognition, delivery milestones, and strong contributions across multiple real estate segments, including residential, commercial, and retail projects.

- Expense Growth: Total expenses also rose substantially, driven by heightened project execution costs and increased operational activities, but their growth rate was slightly lower than revenue’s, supporting margin expansion.

- Profit Growth: The 18% increase in net profit and EPS, while strong, was lower than revenue growth percentage, indicating that expenses and possibly other costs somewhat tempered margin gains.

- Diversified Operations: DLF’s broad portfolio includes not only development but also leasing, power generation, hospitality, and maintenance, contributing to diversified and stable cash flows.

- Market Position: The company maintains leadership in both premium and affordable housing markets, underpinned by strategic land acquisitions, strong brand equity, and solid customer trust.

- Innovation & Sustainability: Continued focus on sustainable building practices, digital sales platforms, and customer experience enhancements are key to long-term growth and stakeholder value.

Corporate Developments in Q1 FY26 Earnings

Q1 FY26 marks a strong rebound and growth phase for DLF Ltd, supported by robust sales execution across its project portfolio and operational leverage. The company’s integrated approach and strategic initiatives position it well amid a buoyant real estate market environment.

Outlook

DLF Ltd is expected to sustain growth momentum with a healthy project pipeline, expanding leasing business, and relentless focus on execution excellence. Investments in urban infrastructure, customer-centric innovations, and sustainability will be pivotal for enhancing margins and shareholder returns throughout FY26 and beyond.

To view DLF’s previous results: click here