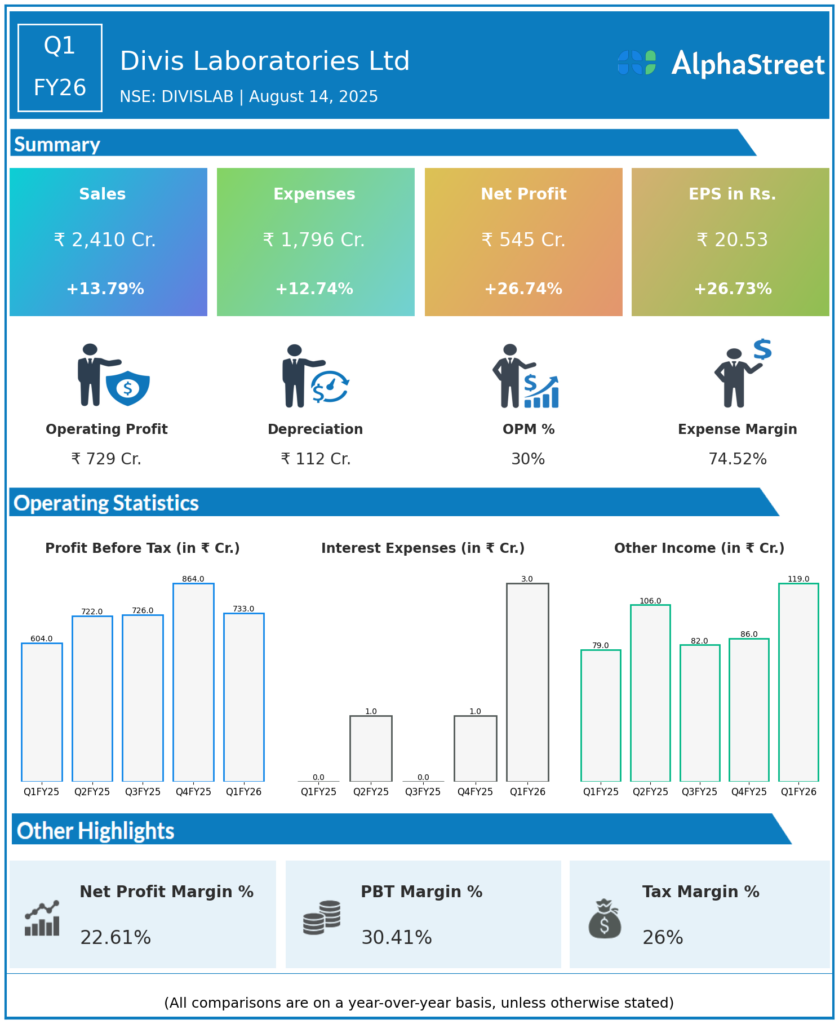

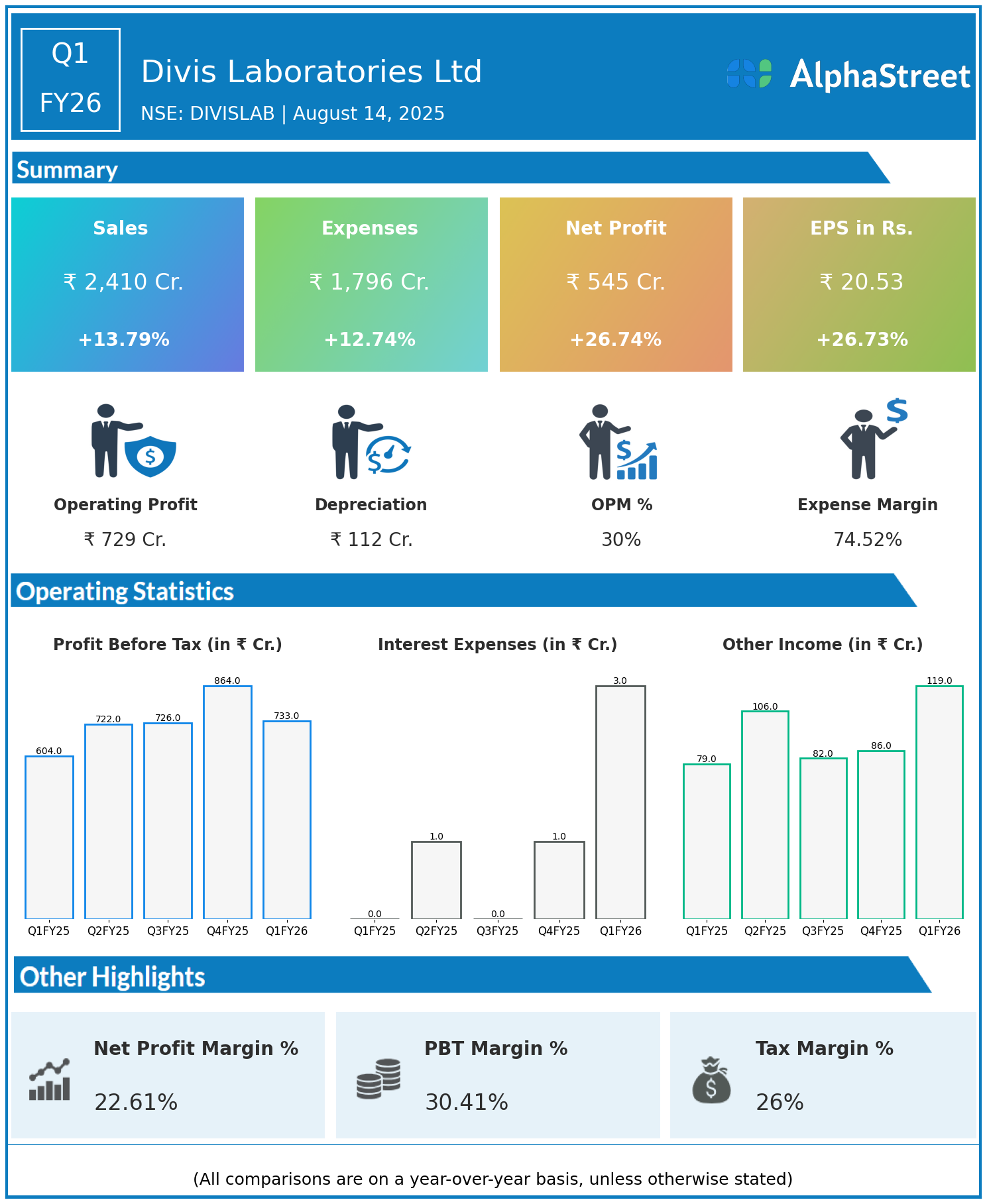

Divi’s Laboratories Limited, incorporated in 1990, is engaged in the manufacture and export of Active Pharmaceutical Ingredients (APIs), intermediates, and nutraceutical ingredients. Presenting below are its Q1 FY26 Earnings Results.

Q1 FY26 Earnings Results

- Revenue: ₹2,410 crore, up 13.79% year-on-year (YoY) from ₹2,118 crore in Q1 FY25.

- Total Expenses: ₹1,796 crore, up 12.74% YoY from ₹1,593 crore.

- Consolidated Net Profit (PAT): ₹545 crore, up 26.74% from ₹430 crore in the same quarter last year.

- Earnings Per Share (EPS): ₹20.53, up 26.73% from ₹16.20 YoY.

Operational & Strategic Update

- Healthy Revenue Growth: The near 14% YoY growth in revenues was supported by sustained demand in key export markets, a robust order book for APIs and intermediates, and increased traction in nutraceuticals.

- Disciplined Cost Management: Total expenses rose at a slightly slower pace than revenues, indicating operational efficiencies and effective input cost control.

- Strong Profitability Expansion: Net profit and EPS grew by nearly 27%, driven by margin improvement on the back of better product mix, operational leverage, and favorable currency movement.

- Global Market Presence: With a diversified customer base across regulated markets such as the US, Europe, and Japan, Divi’s continues to leverage its long-standing relationships and compliance record to secure repeat and long-term business.

- R&D and Capacity Expansion: Continued investments in research, technology upgrades, and manufacturing capacity are enhancing the company’s competitive positioning in high-value API segments.

Corporate Developments in Q1 FY26 Earnings

Q1 FY26 results reinforce Divi’s Laboratories’ ability to deliver strong earnings growth supported by demand resilience, operational excellence, and product portfolio diversification. The company’s leadership in API manufacturing positions it well to capture growth opportunities in regulated and emerging markets.

Looking Ahead

Divi’s Laboratories Ltd aims to build on its global leadership in APIs through ongoing capacity expansion, scaling of nutraceuticals, and entry into complex molecules. Focused execution in R&D, quality compliance, and cost optimization is expected to sustain growth momentum and enhance long-term shareholder value through FY26 and beyond.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel.