Recently, Dilip Piramal, the man who built India’s biggest luggage empire, has decided it’s time to let someone else carry VIP Industries forward. Well, if you are an Indian, its highly unlikely that you have not heard about VIP Industries. But the most puzzling part is why such a successful company is being sold? Lets dive deeper with AlphaStreet Research.

The Story

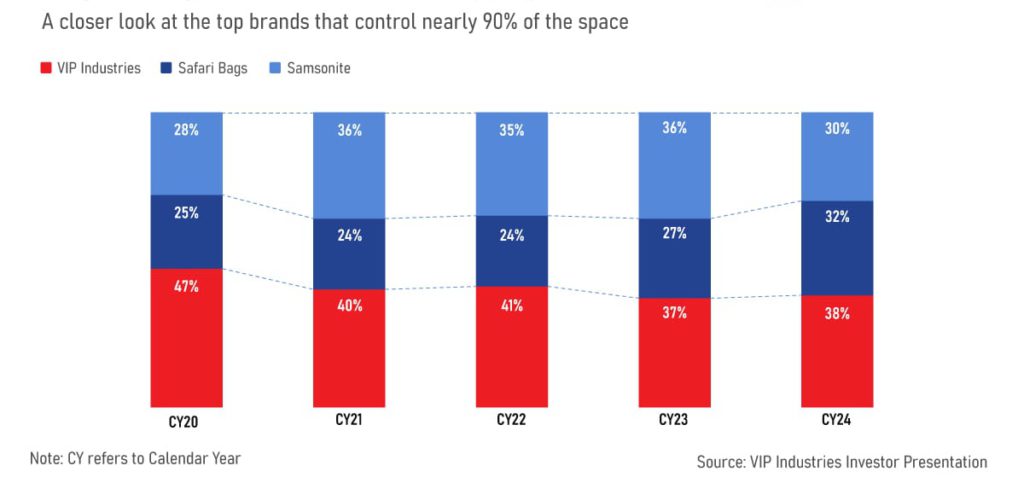

When it comes to luggage in India, there are three big names that dominate every airport carousel: Samsonite, Safari, and VIP. Between them, they control nearly 90% of the country’s branded luggage market.

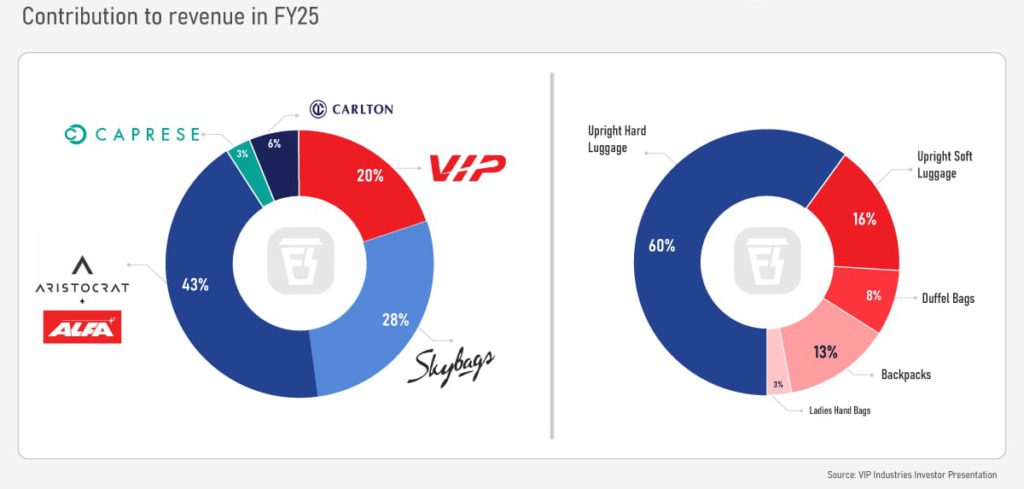

And of the three, VIP Industries, yes, the one behind brands like Skybags, Aristocrat, and Carlton is still India’s largest luggage maker. But last week, something big happened. Dilip Piramal, VIP’s long time chairperson and part of its founding family, decided to sell control of the company.

He’s offloading a 32% stake to a consortium led by Multiples Alternate Asset Management, along with Samvibhag Securities and Mithun Sacheti’s family (the folks who founded CaratLane).

And that’s not all, the group will also make an open offer for another 26% of the shares from public investors. If that goes through, the total deal valued at about ₹3,200 crore will hand them a 58% majority stake in VIP.

Now, that’s a big move for a company that’s been in the Piramal family for over five decades.

So the question is: why now?

The Changing of the Guard

See, VIP has always been a family run business. Founded in 1968 as Aristoplast Pvt. Ltd., it eventually became a household name under Dilip Piramal, who took charge in 1980 after his father’s passing.

For years, VIP ruled the skies and trains, its sturdy suitcases became a status symbol of the middle class.

But in 2025, Dilip Piramal decided to call it a day. Part of that is personal since the next generation isn’t interested in the luggage business. But there’s also a tinge of regret. In interviews, Piramal admitted that he probably should’ve exited earlier because holding on too long has cost him dearly.

So what went wrong for a company that once symbolized reliability and travel aspirations?

Hard vs Soft Luggage – The Missed Turn

To understand VIP’s struggles, you need to know the two sides of the luggage world: hard luggage and soft luggage.

- Hard luggage: the tough, polycarbonate shells that protect your stuff when baggage handlers throw your suitcase around.

- Soft luggage: lighter, flexible polyester bags that can squeeze into overhead bins.

For years, VIP leaned heavily into soft luggage. Travellers wanted lighter bags, and the company retooled its supply chain and inventory to chase that demand.

But post-pandemic, the trend flipped. Travellers rediscovered the appeal of hard luggage, durable, sleek, and “Instagram-ready.” Today, nearly 80% of all luggage sales come from hard cases.

The irony? VIP actually started as a hard-luggage company. Its iconic cases were once so strong that, as Piramal famously said “someone even used one as a shield during militancy in Punjab.”

Yet somehow, the company missed the comeback of its own original product.

The result? Warehouses filled with unsold soft luggage, and a manufacturing setup that couldn’t pivot fast enough to meet new demand.

Indian Luggage Market

A Price War That Went Too Far

But that’s not the only problem.

The luggage market in India is a tale of two halves:

- On one side, organized brands like VIP, Safari, and Samsonite.

- On the other, unorganized players, smaller factories and counterfeit sellers offering much cheaper alternatives.

The problem? Even the big brands started fighting each other on discounts.

Online sales and new D2C brands like Mokobara, Uppercase, and Nasher Miles flooded the market, forcing legacy players to slash prices just to stay visible.

It became a race to the bottom. Even Samsonite’s CFO publicly complained that rivals like VIP and Safari were ruining margins with deep discounting.

VIP denied it saying the discounts were limited to soft luggage. But the numbers tell a story of pain. In FY25, VIP posted a ₹69 crore loss, with EBITDA margins collapsing to just 3% (down from 9% earlier). It even booked losses in three out of four quarters that year.

Meanwhile, competitor Safari was flying high: ₹1,772 crore in revenue, ₹143 crore in net profit, and 12% EBITDA margins. The message was clear: VIP wasn’t just losing luggage. It was losing ground.

VIP’s Portfolio of Products

When a Legacy Meets a Limit

Insiders say VIP’s professional management had hit a wall. The company was slow to adapt, burdened with old inventory, and struggling with what Piramal called an “internal management crisis.”

And with no family successors waiting in the wings, a private equity sale began to look like the best option.

Enter Multiples PE, known for its sharp turnarounds (they’ve previously backed companies like PVR, Delhivery, and Dream11). Along with the CaratLane founders, they could bring both capital and fresh digital thinking to an old brand.

There’s also a twist, the open offer to shareholders is at ₹388 per share, around 17% below the market price. That may look like a bad deal, but it’s not about a quick payout. It’s about long-term renewal.

The Bigger Picture

The entire luggage sector has been cooling off since the “revenge travel” boom of 2022 faded. People have returned to normal travel patterns, and the wave that lifted all brands has receded.

That makes this the perfect time for a shake-up. And VIP might just be the first of the legacy brands to reset under new ownership. If the new investors can streamline manufacturing, focus on the fast-growing hard luggage segment, and inject some design and digital flair, there’s still plenty of value to unlock.

After all, VIP is still a trusted name with vast distribution, a brand recall that startups would kill for, and a balance sheet that’s far from broken.

The Bottom Line

For five decades, Dilip Piramal built VIP into a household name. But markets evolve and even the most iconic brands sometimes need a reboot. By passing the baton now, he may finally give VIP the professional edge it needs to compete in a brutal, post-pandemic market.

Sure, the short term might be bumpy. But with the right strategy, this could be less of a sell-off and more of a handover for a comeback. Until then, investors will be watching closely to see if VIP’s next chapter will travel as far as its legacy once did.