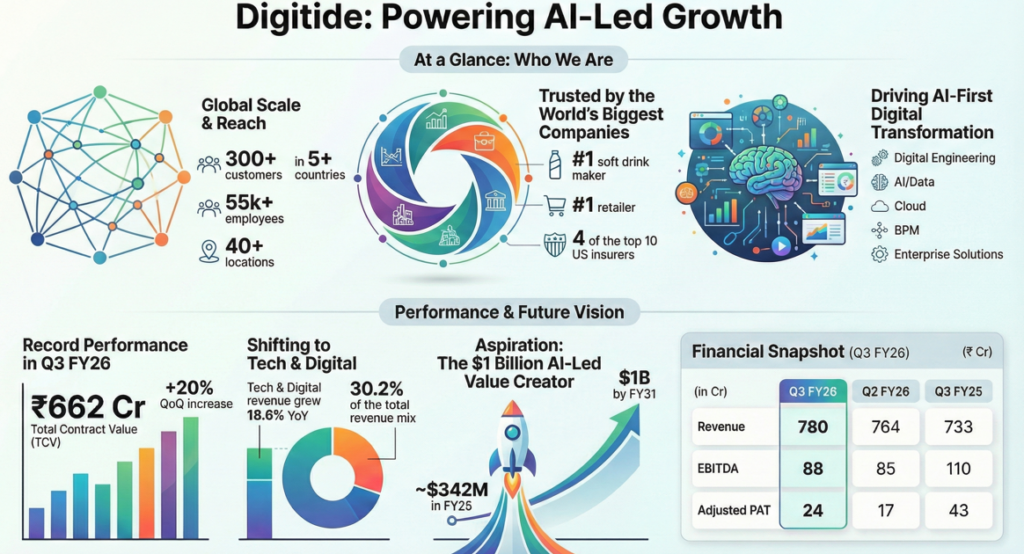

Digitide Solutions Limited (NSE:DIGITIDE), an independent AI-first technology and Business Process Management (BPM) services provider, reported a 42.5% sequential jump in adjusted net profit for the third quarter ended December 31, 2025, driven by record-high deal wins and strong momentum in its international technology services.

The company, which recently transitioned to an independently listed entity, saw its Total Contract Value (TCV) reach an all-time high as it aggressively pursues an AI-first transformation strategy. The firm continues to be backed by long-term promoters, including Chairman Ajit Isaac and the Fairfax Group.

Key Financial Trends – Q3FY26

- Revenue from operations of ₹780 crore, up 2.1% quarter-on-quarter and 6.5% year-on-year.

- Adjusted Profit After Tax (PAT) of ₹24 crore, a 42.5% increase from the previous quarter.

- EBITDA of ₹88 crore, with margins improving slightly to 11.2%.

- The company also reported improved cash flow realization, with Days Sales Outstanding (DSO) falling to 79 days from 82 in the previous quarter.

- Balance Sheet Strengthens, Cash Conversion Improves

- Operational discipline improved working capital metrics, with days sales outstanding declining to 79 days from 82 days in the previous quarter.

- Digitide ended the quarter with net cash of ₹125 crore and retained strong credit ratings, giving it headroom for selective acquisitions.

- Employee strength stood at about 55,900, broadly stable sequentially.

Geographic Presence

Digitide maintains a global delivery footprint with 40+ locations across five countries, including a strong presence in India and North America. Its U.S. headquarters is based in Morris Plains, and it operates multiple AI Centers of Excellence and delivery hubs across major Indian cities like Bengaluru, Chennai, and Mumbai.

Key Achievements – 3QFY26

- Highest ever TCV booking of ₹662 crore, representing a 20% sequential surge.

- 34 new key logos won during the quarter.

- Recognition as a “Major Contender” in six Everest Group PEAK Matrix assessments across insurance, customer experience, and payroll sectors.

- Certified as a “Great Place to Work” for the seventh consecutive year.

Market Perspective & Future Strategy

- The company is executing a “3x3x3 strategy” aimed at tripling its revenue to $1 billion by fiscal year 2031. This blueprint involves growing 2x faster than the market and expanding EBITDA margins by 200–300 basis points.

- Management is “all-in on AI,” utilizing its proprietary Pulse.AI platform to drive automation, which handled 3.6 million interactions this quarter alone.

Record Deal Wins & Client Additions

- Sales momentum accelerated sharply during the quarter.

- Management highlighted a robust pipeline supported by partnerships with hyperscalers including Amazon Web Services, Microsoft Azure and Google Cloud Platform, where Digitide recently became a services partner.

Summary

Digitide Solutions concludes the third quarter with a strengthened balance sheet, reporting a net cash position of ₹125 crore. With a high-performing leadership team and a focused pivot toward international digital services, the company remains positioned to meet its long-term goal of becoming a responsible, AI-led value creator for global enterprises. With record deal wins, rising digital mix and improving cash metrics, Digitide appears to be laying the groundwork for a gradual transition from a domestic BPM-heavy profile to a more global, AI-first technology services player.