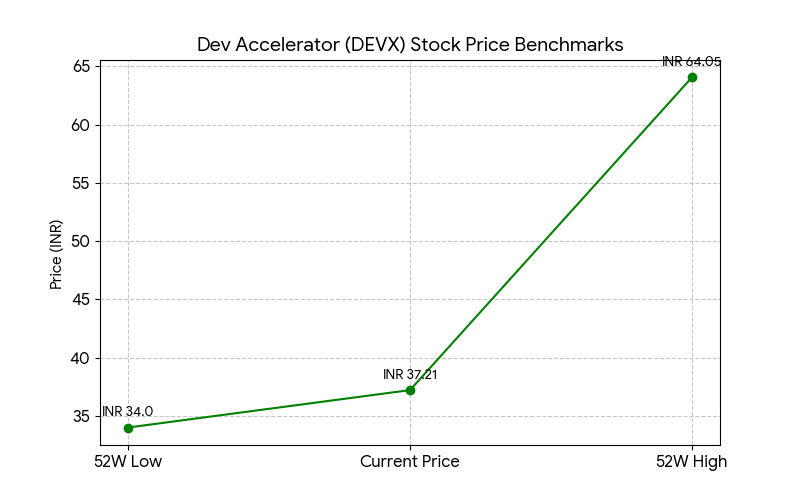

Dev Accelerator Ltd (NSE: DEVX) shares ended at INR 37.21 on Monday, February 2, 2026, representing an intraday decrease of 3.33%. The stock reached a session high of INR 39.16 and a low of INR 36.42, closing INR 1.28 lower than the previous close on the National Stock Exchange.

Market Capitalization

The market capitalization of Dev Accelerator Ltd is INR 335.84 crore as of today’s market close.

Latest Quarterly Results

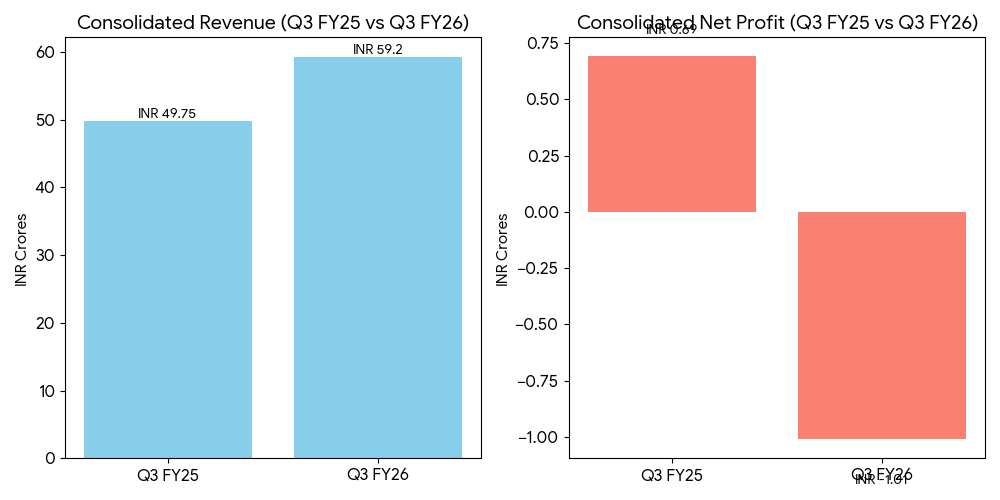

For the quarter ended December 31, 2025, Dev Accelerator Ltd reported consolidated revenue from operations of INR 59.20 crore, a 19.00% increase compared to INR 49.75 crore in the same period of the previous year. The company recorded a consolidated net loss of INR 1.01 crore for the quarter, compared to a net profit of INR 0.69 crore in the quarter ended December 31, 2024.

Segment performance for the nine-month period ending December 31, 2025, showed standalone revenue from operations reached INR 123.96 crore. The standalone EBITDA margin was reported at 61.10%. The company reported a 98.7% seat retention rate and an 88.40% occupancy rate across 28 centers.

Financial Trends

Full-Year Results Context

For the full fiscal year ended March 31, 2025, the company reported consolidated revenue of INR 177.89 crore, reflecting a growth trend in the flexible workspace sector. Total revenue for the first nine months of fiscal year 2026 reached INR 166.7 crore, representing a 53% year-over-year increase compared to the corresponding period in fiscal year 2025.

Business & Operations Update

The company announced the signing of an 8 lakh square foot managed office contract in Ahmedabad, involving an INR 100 crore investment over four years. This project is expected to create 8,500 seats. Additionally, a 3.15 lakh square foot “Mega Campus” in Ahmedabad commenced operations during the quarter with a 95% pre-leasing rate, projected to contribute INR 2.75 crore in monthly revenue.

M&A or Strategic Moves

On January 31, 2026, the Board of Directors approved the divestment of a 38% equity stake in Scaleax Advisory Private Limited. The stake will be sold to Dev Information Technology Limited and Mr. Aaryan Jaxay Shah for a total consideration of INR 3.80 lakh. Following this transaction, Scaleax Advisory will cease to be an associate company of Dev Accelerator Ltd.

Equity Analyst Commentary

Institutional research notes emphasize the company’s focus on Tier-2 markets, which currently contribute 75% of total revenue. Reports from brokerage firms have previously tracked the company’s transition to an asset-light “Development Management” model. Analysts monitor the company’s rent-to-revenue ratio, which was reported at 2.62x for the recent period.

Guidance & Outlook

Management has indicated a strategy focused on national expansion via the “Landowner First” model. Key factors for market observation include the utilization of the remaining INR 39.94 crore from IPO proceeds and the operational scaling of the newly signed Ahmedabad capacity.

Performance Summary

Dev Accelerator Ltd shares fell 3.33% to INR 37.21 today. Quarterly revenue rose 19% to INR 59.20 crore, while the company reported a net loss of INR 1.01 crore. Managed office occupancy remains at 88.40% across 12 cities.