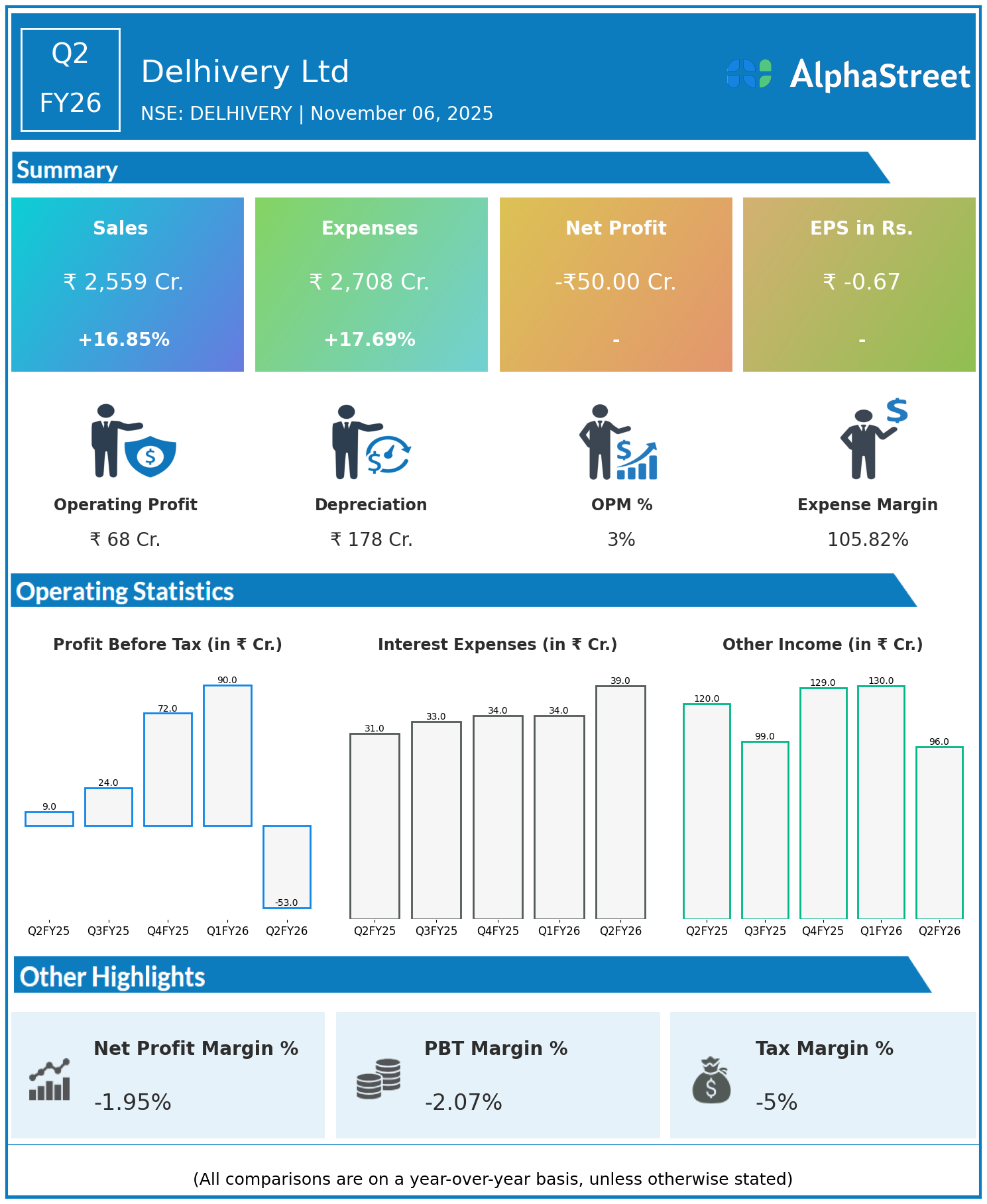

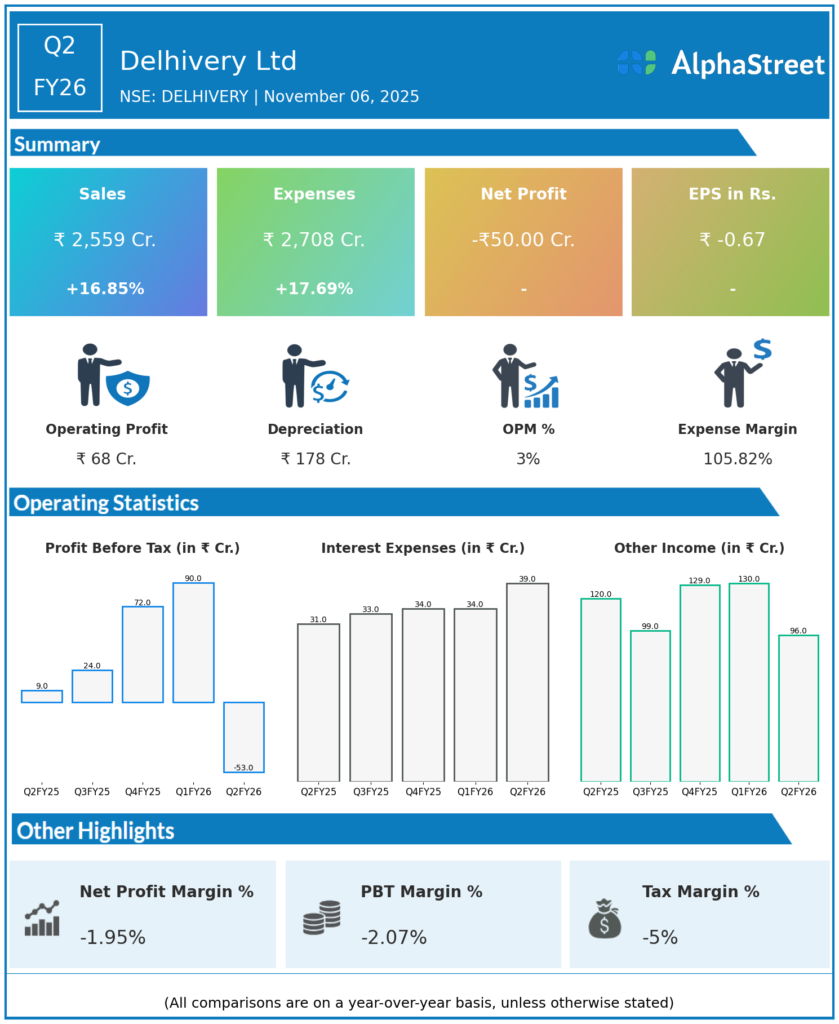

Delhivery Ltd, a comprehensive logistics service provider covering express parcels, heavy goods, freight, warehousing, cross-border express, and supply chain software, announced its Q2 FY26 financials reflecting robust top-line growth alongside a net loss.

Financial Highlights:

- Revenue surged 16.85% year-on-year to ₹2,559 crore from ₹2,190 crore.

- Total expenses rose 17.69% to ₹2,708 crore from ₹2,301 crore.

- Consolidated net loss stood at ₹50 crore versus a net profit of ₹10 crore in the prior-year quarter.

- Earnings per share reported a negative ₹0.67 as compared to ₹0.14 previously.

The reported loss includes one-time integration costs related to recent acquisitions, impacting short-term profitability despite healthy operational momentum. The company continues to expand its service portfolio and geographic footprint, underpinning revenue growth.

Outlook:

Delhivery is pursuing strategic investments aimed at long-term value creation, including new subsidiary setups and leadership transitions. Despite near-term losses, the company remains focused on consolidating its logistics ecosystem and enhancing operational efficiencies.

This quarter’s results underscore Delhivery’s growth trajectory with a clear emphasis on strengthening market position and scale through technology-led service innovations and strategic expansion efforts.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel.